David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that ProQR Therapeutics N.V. (NASDAQ:PRQR) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for ProQR Therapeutics

How Much Debt Does ProQR Therapeutics Carry?

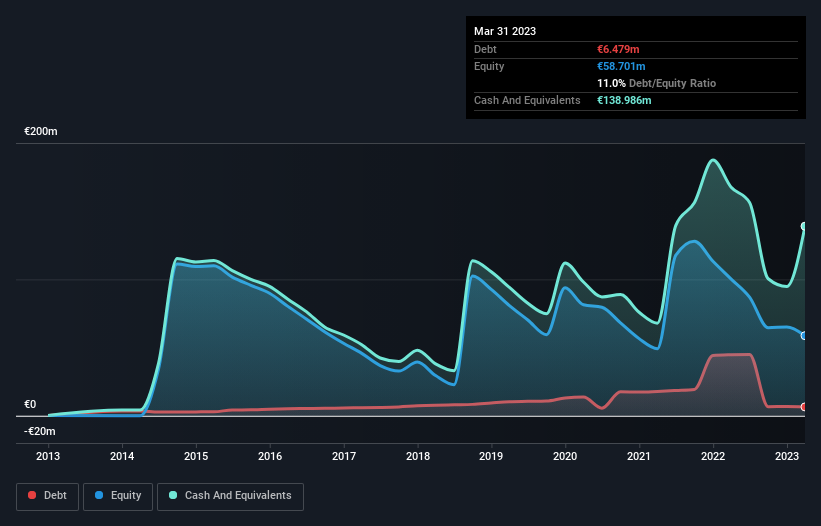

As you can see below, ProQR Therapeutics had €6.48m of debt at March 2023, down from €44.8m a year prior. However, it does have €139.0m in cash offsetting this, leading to net cash of €132.5m.

How Healthy Is ProQR Therapeutics' Balance Sheet?

The latest balance sheet data shows that ProQR Therapeutics had liabilities of €17.2m due within a year, and liabilities of €82.2m falling due after that. On the other hand, it had cash of €139.0m and €457.0k worth of receivables due within a year. So it actually has €40.1m more liquid assets than total liabilities.

This luscious liquidity implies that ProQR Therapeutics' balance sheet is sturdy like a giant sequoia tree. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Succinctly put, ProQR Therapeutics boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine ProQR Therapeutics's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year ProQR Therapeutics wasn't profitable at an EBIT level, but managed to grow its revenue by 22%, to €4.3m. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is ProQR Therapeutics?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year ProQR Therapeutics had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through €3.9m of cash and made a loss of €60m. But at least it has €132.5m on the balance sheet to spend on growth, near-term. ProQR Therapeutics's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that ProQR Therapeutics is showing 4 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PRQR

ProQR Therapeutics

A biotechnology company, focuses on the discovery and development of novel therapeutic medicines.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026