In 2012 Daniel de Boer was appointed CEO of ProQR Therapeutics N.V. (NASDAQ:PRQR). First, this article will compare CEO compensation with compensation at similar sized companies. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for ProQR Therapeutics

How Does Daniel de Boer's Compensation Compare With Similar Sized Companies?

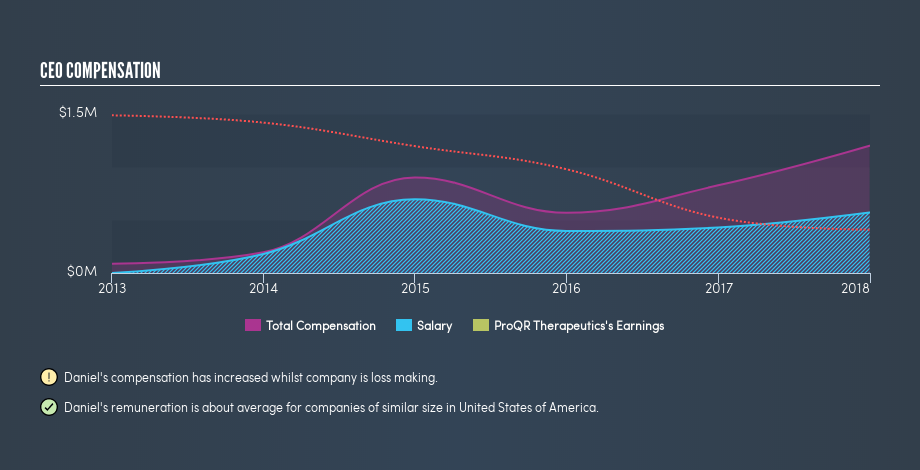

Our data indicates that ProQR Therapeutics N.V. is worth US$555m, and total annual CEO compensation is €1.2m. (This number is for the twelve months until December 2017). While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at €570k. We examined companies with market caps from €178m to €713m, and discovered that the median CEO total compensation of that group was €1.4m.

So Daniel de Boer is paid around the average of the companies we looked at. While this data point isn't particularly informative alone, it gains more meaning when considered with business performance.

The graphic below shows how CEO compensation at ProQR Therapeutics has changed from year to year.

Is ProQR Therapeutics N.V. Growing?

Earnings per share at ProQR Therapeutics N.V. are much the same as they were three years ago, albeit slightly lower, based on the trend. It achieved revenue growth of 542% over the last year.

As investors, we are a bit wary of companies that have lower earnings per share, over three years. On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Shareholders might be interested in this free visualization of analyst forecasts.

Has ProQR Therapeutics N.V. Been A Good Investment?

Boasting a total shareholder return of 177% over three years, ProQR Therapeutics N.V. has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Daniel de Boer is paid around the same as most CEOs of similar size companies.

The company isn't showing particularly great growth, but shareholder returns have been pleasing. So considering most shareholders would be happy, we'd say the CEO pay is appropriate. Whatever your view on compensation, you might want to check if insiders are buying or selling ProQR Therapeutics shares (free trial).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:PRQR

ProQR Therapeutics

A biotechnology company, focuses on the discovery and development of novel therapeutic medicines.

Flawless balance sheet low.

Market Insights

Community Narratives