- United States

- /

- Biotech

- /

- NasdaqGS:PRAX

Is Praxis Precision Medicines Fairly Priced After 223% Surge and Clinical Trial Update?

Reviewed by Bailey Pemberton

- Curious about whether Praxis Precision Medicines is undervalued, overvalued, or has hidden potential? You are not alone. With all the recent buzz, this is the perfect time to dig in.

- The stock's price has been on a wild ride lately. It has surged 223% over the past month and climbed 129.1% in the last year, despite a recent 15.9% pullback in the last week.

- Much of this action has followed encouraging updates from the company's clinical programs and positive momentum in the biotech sector. Headlines about new trial results and strategic partnerships have also played a role, possibly shifting the risk calculus for investors.

- When we break down Praxis Precision Medicines using our six key valuation checks, the company scores a 2 out of 6 for being undervalued. We will look at what this means through several standard valuation approaches, and at the end, introduce an even clearer way to grasp whether the stock actually offers value.

Praxis Precision Medicines scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Praxis Precision Medicines Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model tries to estimate the fair value of a company today by projecting its future cash flows and discounting them back to the present. This gives a snapshot of what the business could be worth, based on what it is expected to actually generate in cash over time.

For Praxis Precision Medicines, the most recent Free Cash Flow stands at about -$191 million, reflecting significant investment and early-stage operations. Analyst estimates extend out five years and point to a dramatic turnaround. For example, projected Free Cash Flow in 2029 reaches approximately $749 million, with further growth extrapolated beyond that. These future numbers are based on a combination of analyst estimates and extended forecasts by Simply Wall St, with substantial jumps anticipated as the company moves through its clinical milestones.

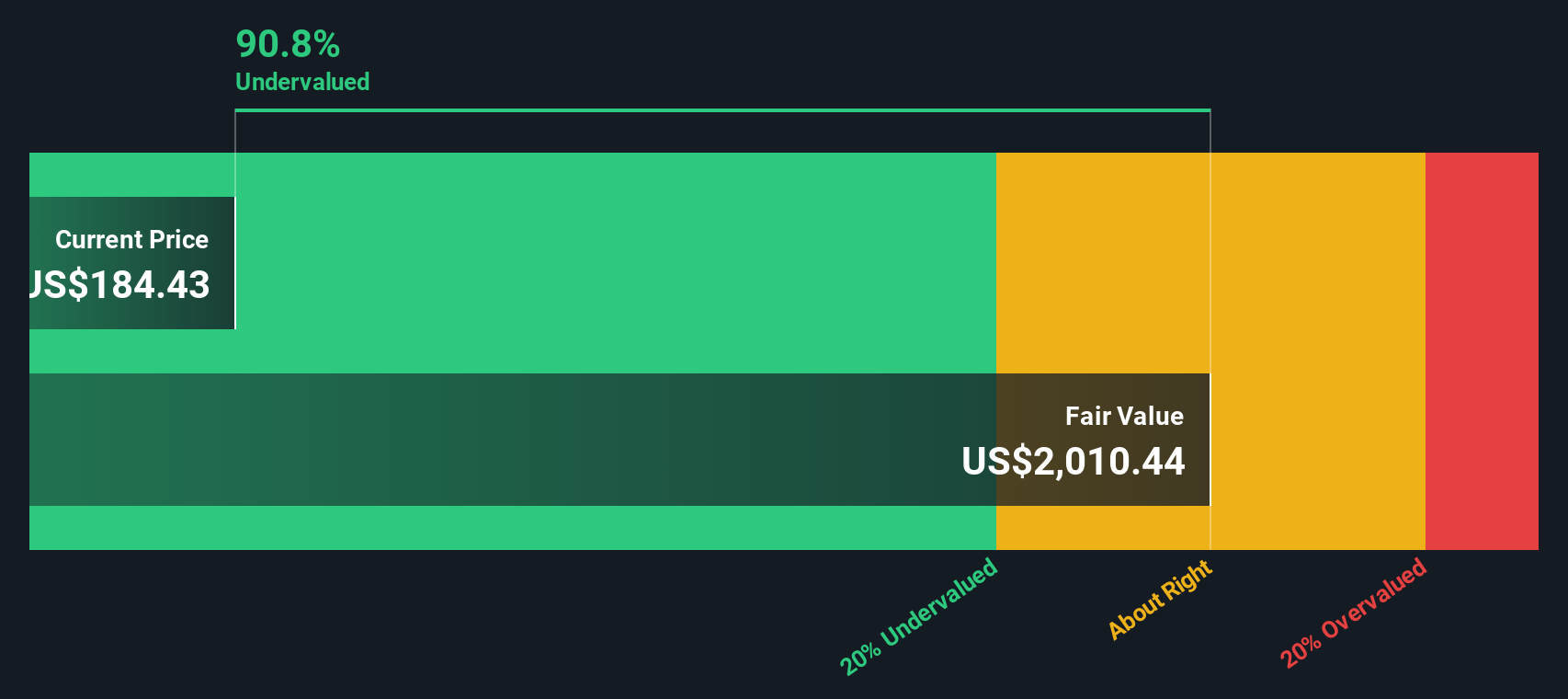

All future cash flows are discounted to reflect their value in today's dollars, using a 2 Stage Free Cash Flow to Equity approach. Plugging in all the numbers, the DCF model calculates an intrinsic value of $1,925.51 per share. This suggests the stock is currently trading at a 91.4% discount to its estimated worth.

This dramatic gap means that, at least by DCF standards, Praxis Precision Medicines appears strongly undervalued given current projections and assumptions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Praxis Precision Medicines is undervalued by 91.4%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Praxis Precision Medicines Price vs Book

The Price-to-Book (PB) ratio is often used as a valuation tool for companies that may not yet be consistently profitable, which is common in the biotech space. This metric is especially relevant for firms like Praxis Precision Medicines, where tangible assets and early-stage research drive much of the value, rather than steady earnings.

Growth potential and risk both influence what investors consider a "normal" or "fair" PB ratio. Companies with high growth prospects and low risks can justify a higher PB ratio. Firms with uncertain futures or industry headwinds typically see their valuations constrained.

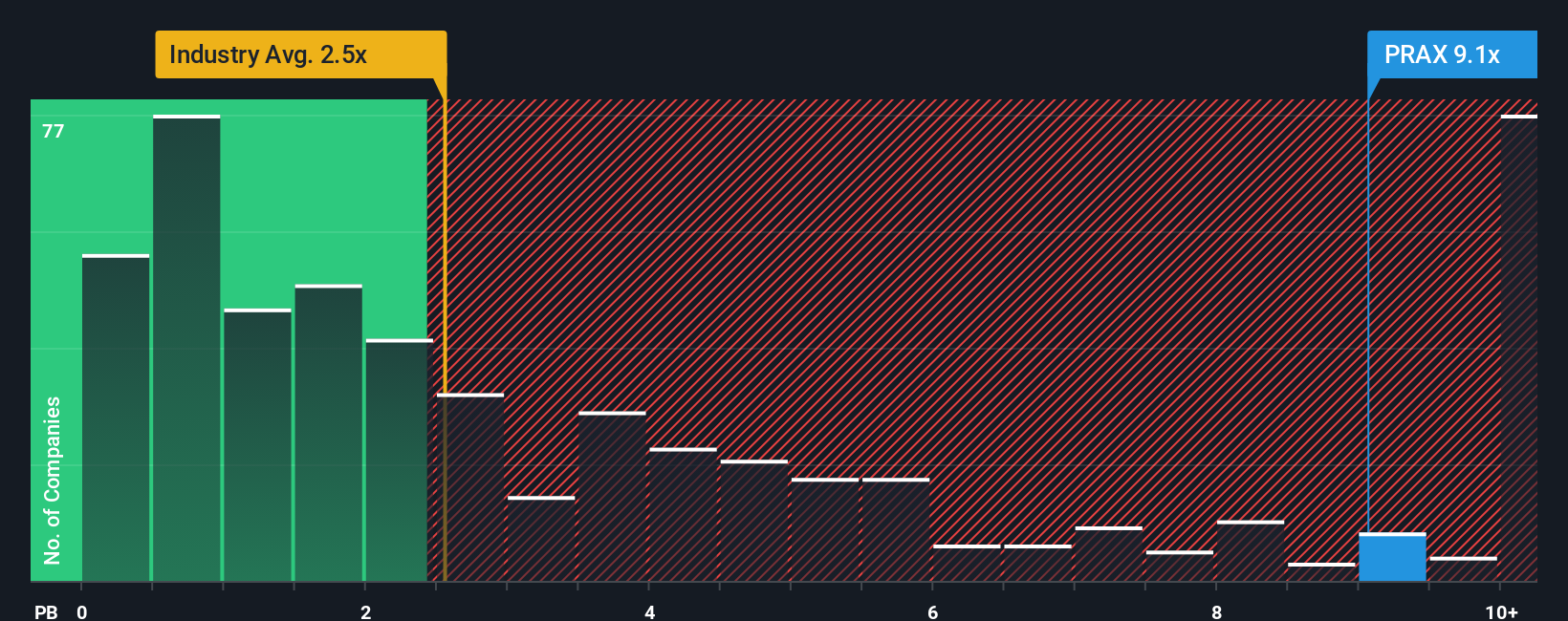

Right now, Praxis Precision Medicines trades at a PB ratio of 10.06x. By contrast, the average PB ratio for other biotech companies is 2.39x, and the peer group average comes in at 9.77x. These benchmarks suggest Praxis is priced above the sector overall, but closely in line with its most comparable peers.

Simply Wall St’s “Fair Ratio” goes further than traditional benchmarks by calculating the PB multiple a company deserves while accounting for factors such as future earnings growth, profit margins, overall industry trends, company size, and specific company risks. This makes the Fair Ratio a more targeted measure because it adapts to the unique qualities and potential of Praxis, rather than relying only on broad market comparisons.

Comparing Praxis's current PB ratio to its Fair Ratio, the difference is less than 0.10. This means the stock is valued about right by this method. Investors looking for value should weigh this against strong growth forecasts and sector volatility before making decisions.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Praxis Precision Medicines Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, dynamic story you create about a company, connecting your own perspective, including your estimates of future revenue, earnings, and margins, to a forecast and an assumed fair value.

With Narratives, you are not just looking at numbers on a page. You are tying Praxis Precision Medicines’ unique journey to your financial outlook and turning it into an actionable fair value. Narratives make this process clear and approachable and are available in the Community page on Simply Wall St, trusted by millions of investors.

Investors use Narratives to decide whether to buy or sell a stock by comparing their own Fair Value, based on their story, with the current share price. As news, earnings, or clinical updates emerge, your Narrative auto-updates, helping you stay current and make informed decisions fast.

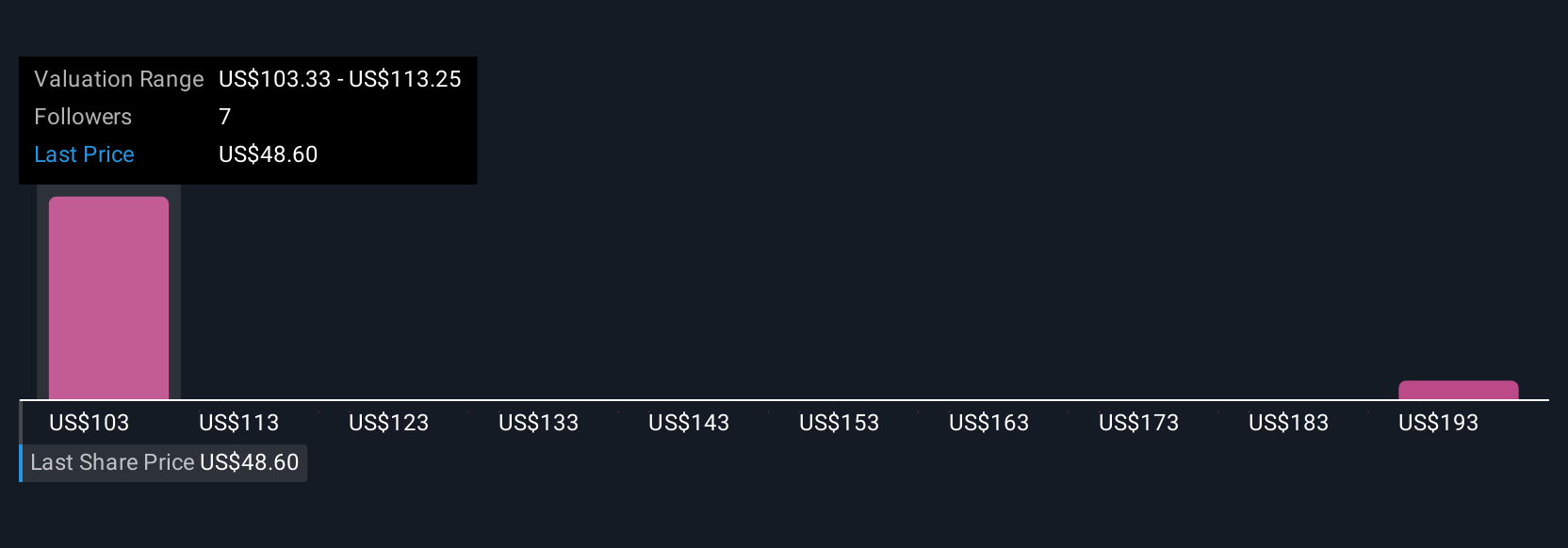

For example, some investors see Praxis Precision Medicines as a future outperformer and set their Fair Value above $1,900, while others remain cautious and estimate it to be well below $200. Narratives make these perspectives easy to track, compare, and act on.

Do you think there's more to the story for Praxis Precision Medicines? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRAX

Praxis Precision Medicines

A clinical-stage biopharmaceutical company, engages in the development of therapies for central nervous system (CNS) disorders characterized by neuronal excitation-inhibition imbalance.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives