- United States

- /

- Pharma

- /

- NasdaqGS:PHVS

Why Pharvaris (PHVS) Is Up 13.3% After RAPIDe-3 Success And 2026 Deucrictibant Filing Plans

Reviewed by Sasha Jovanovic

- Earlier this week, Pharvaris reported positive top-line results from its pivotal RAPIDe-3 trial of deucrictibant for on-demand treatment of hereditary angioedema attacks, meeting the primary endpoint with significantly faster symptom relief versus placebo.

- The company also confirmed plans to begin filing marketing authorization applications for deucrictibant in the first half of 2026, signaling a transition from late-stage development toward potential commercialization in this rare disease area.

- Next, we’ll examine how deucrictibant’s pivotal success and upcoming regulatory filings could reshape Pharvaris’s investment narrative and risk profile.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Pharvaris' Investment Narrative?

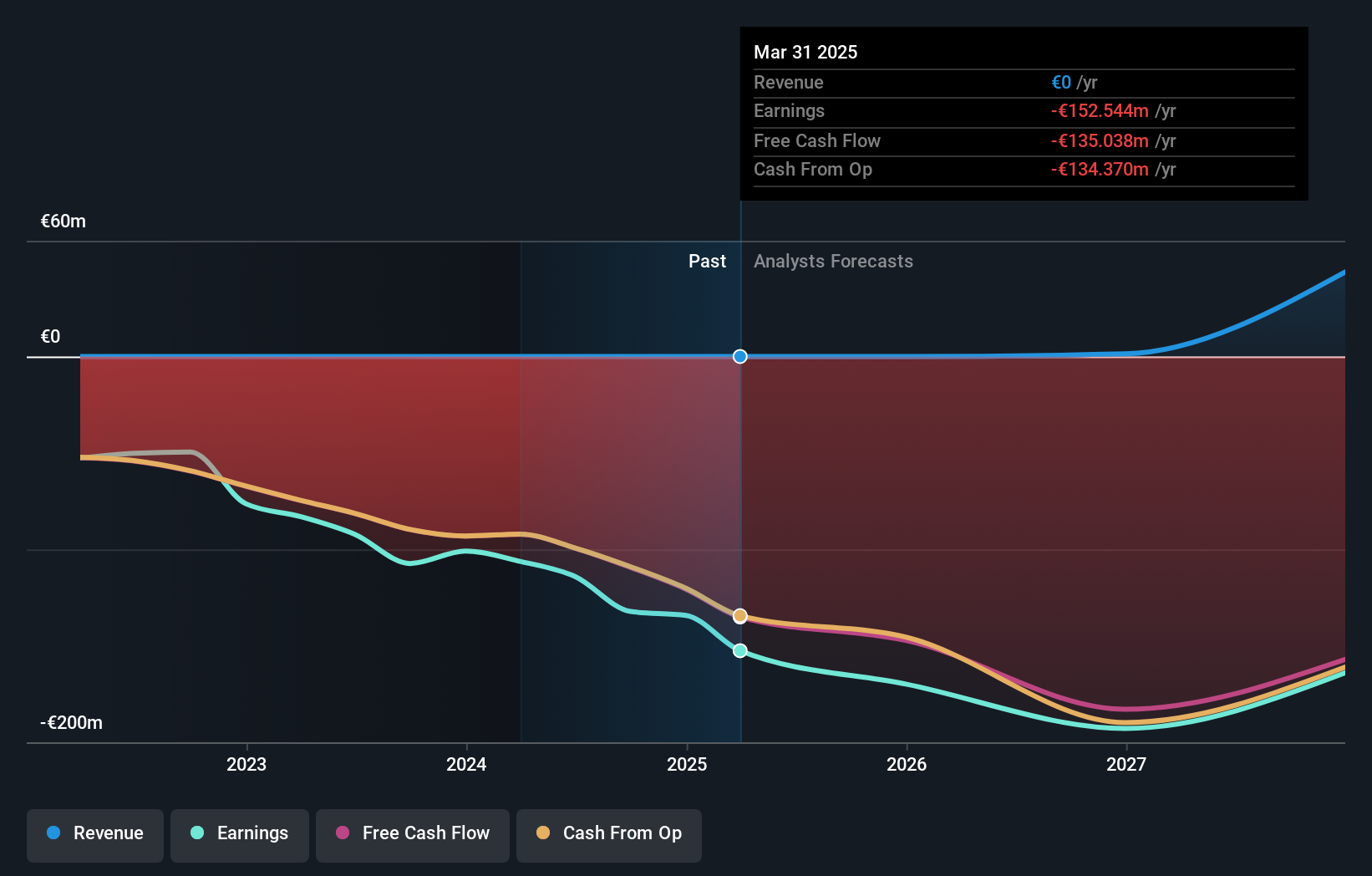

To own Pharvaris today, you have to believe that deucrictibant can move from a promising clinical asset to a commercial product in hereditary angioedema, without the balance sheet buckling under the weight of ongoing losses. The RAPIDe-3 success and the plan to start marketing filings in 2026 sharpen the near-term story: regulatory feedback, filing quality and any safety questions around deucrictibant now matter more than incremental trial updates. At the same time, the business is still pre-revenue, burning over €100 million a year and not expected to turn profitable soon, so financing risk and future dilution remain front and center. The recent share price strength suggests the market sees the pivotal readout as material, but execution from here is what really counts.

But the biggest concern now is how Pharvaris funds itself through to potential approval. Our expertly prepared valuation report on Pharvaris implies its share price may be too high.Exploring Other Perspectives

Explore another fair value estimate on Pharvaris - why the stock might be worth just $45.92!

Build Your Own Pharvaris Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pharvaris research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Pharvaris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pharvaris' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PHVS

Pharvaris

A late-stage biopharmaceutical company, focuses on the development and commercialization of therapies for rare diseases with unmet needs covering angioedema and other bradykinin-mediated diseases.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion