- United States

- /

- Pharma

- /

- NasdaqGS:PHVS

Pharvaris (PHVS) Is Up 9.1% After Deucrictibant Shows 92% HAE Attack Reduction and Phase 3 Update

Reviewed by Sasha Jovanovic

- Pharvaris recently announced third-quarter 2025 earnings, reporting a net loss of €37.14 million and outlined clinical progress for its hereditary angioedema (HAE) candidate deucrictibant, including long-term safety data and an anticipated pivotal Phase 3 study readout in 2026.

- The new data presented showed an average 92.4% reduction in HAE attacks over 34 months and highlighted a plasma kinin biomarker assay that may help further characterize bradykinin-mediated angioedema.

- We’ll explore how the promising efficacy data for deucrictibant could strengthen Pharvaris’s investment narrative in the HAE treatment landscape.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Pharvaris' Investment Narrative?

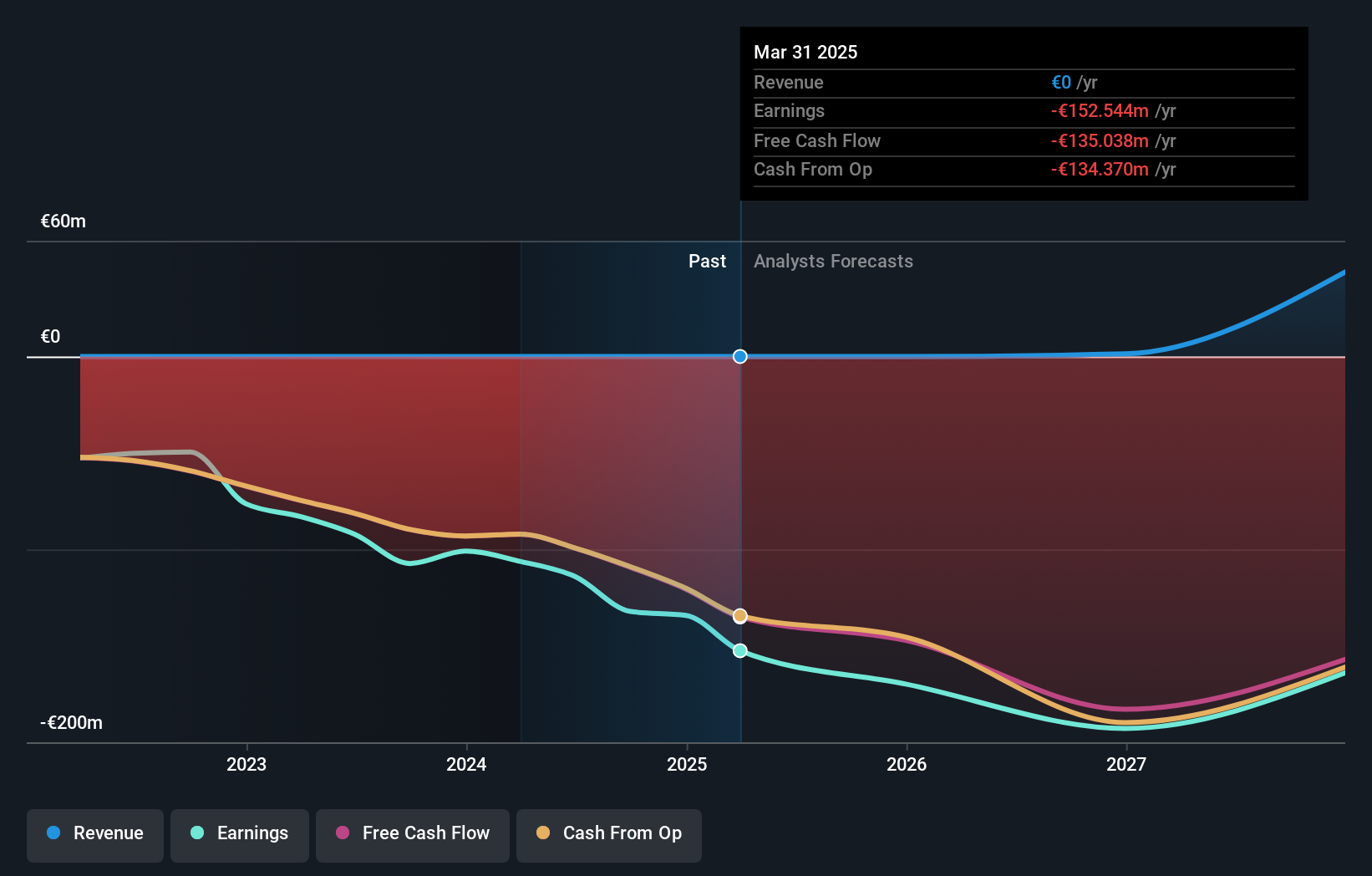

For anyone considering Pharvaris as part of their portfolio, the big picture rests on a straightforward but high-stakes thesis: success in developing deucrictibant for hereditary angioedema (HAE). The recent third-quarter update and new clinical data inject a boost of confidence, showcasing a substantial reduction in HAE attack frequency and reinforcing anticipation for the Phase 3 study readout. While Pharvaris remains pre-revenue, the potential for regulatory progress has been a key short-term catalyst, and the positive safety and efficacy signals may help mitigate near-term uncertainty about pipeline viability. However, the company continues to post heavy net losses and has needed ongoing shareholder dilution to fund its ambitions, risks that haven’t disappeared, despite the strong clinical news. The immediate impact of the recent announcement appears material for sentiment, but financial fundamentals and the timeline to commercialization will keep risk elevated for now. But there’s an important risk here that many overlook: ongoing dilution matters more than you might expect.

Pharvaris' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Pharvaris - why the stock might be worth just $37.45!

Build Your Own Pharvaris Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pharvaris research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Pharvaris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pharvaris' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PHVS

Pharvaris

A late-stage biopharmaceutical company, focuses on the development and commercialization of therapies for rare diseases with unmet needs covering angioedema and other bradykinin-mediated diseases.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives