- United States

- /

- Pharma

- /

- NasdaqGS:PHAT

Could Expanding VOQUEZNA’s Pipeline Mark a New Strategic Phase for Phathom Pharmaceuticals (PHAT)?

Reviewed by Sasha Jovanovic

- Phathom Pharmaceuticals recently announced that the first patient has been dosed in its Phase 2 pHalcon-EoE-201 clinical trial of VOQUEZNA tablets for treating eosinophilic esophagitis (EoE) in adults, with topline results expected in 2027.

- This development highlights the company’s commitment to expanding VOQUEZNA’s potential indications, targeting a condition with significant unmet medical need and complex diagnosis challenges.

- We'll explore how advancing VOQUEZNA into Phase 2 for EoE may reshape Phathom Pharmaceuticals' long-term outlook and pipeline narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Phathom Pharmaceuticals Investment Narrative Recap

Phathom Pharmaceuticals’ long-term appeal largely rests on the potential for VOQUEZNA to secure multiple indications and drive rapid commercial growth in gastrointestinal diseases. The initiation of the Phase 2 EoE trial signals a step toward expanding VOQUEZNA’s footprint, but topline results are not expected until 2027, so current investor focus likely remains on near-term U.S. commercial performance and persistent reimbursement challenges, which this news does not materially impact in the short term.

One particularly relevant recent announcement is Phathom’s Q3 2025 earnings, which reported a narrowed net loss amidst continued commercial progress for VOQUEZNA. This financial update may have immediate implications for confidence in the company’s ability to fund ongoing pipeline developments like the EoE trial, especially given high discount rates and cash flow pressures.

In contrast, investors should be keenly aware that dependence on a single product puts Phathom at risk if...

Read the full narrative on Phathom Pharmaceuticals (it's free!)

Phathom Pharmaceuticals is projected to reach $612.6 million in revenue and $155.5 million in earnings by 2028. Achieving this would require annual revenue growth of 75.1% and an earnings increase of $485.7 million from the current earnings of -$330.2 million.

Uncover how Phathom Pharmaceuticals' forecasts yield a $23.12 fair value, a 59% upside to its current price.

Exploring Other Perspectives

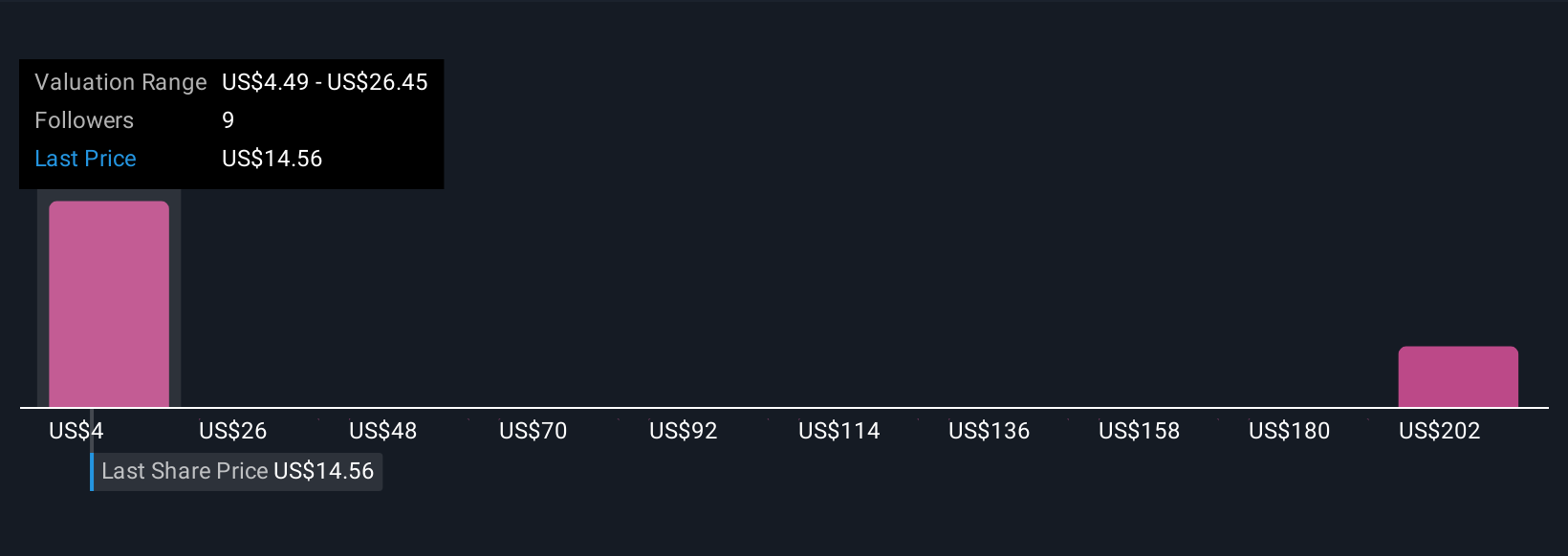

Fair value estimates from the Simply Wall St Community span from US$4.49 to US$224.09, based on three distinct viewpoints. While market optimism centers on pipeline expansion, concentrated revenue streams mean any adverse VOQUEZNA developments could rapidly shift sentiment, explore what others are projecting and why their opinions differ.

Explore 3 other fair value estimates on Phathom Pharmaceuticals - why the stock might be worth less than half the current price!

Build Your Own Phathom Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Phathom Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Phathom Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Phathom Pharmaceuticals' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PHAT

Phathom Pharmaceuticals

A biopharmaceutical company, focuses on developing and commercializing treatments for gastrointestinal diseases.

High growth potential and good value.

Market Insights

Community Narratives