- United States

- /

- Biotech

- /

- NasdaqGS:PGEN

Some Shareholders Feeling Restless Over Precigen, Inc.'s (NASDAQ:PGEN) P/S Ratio

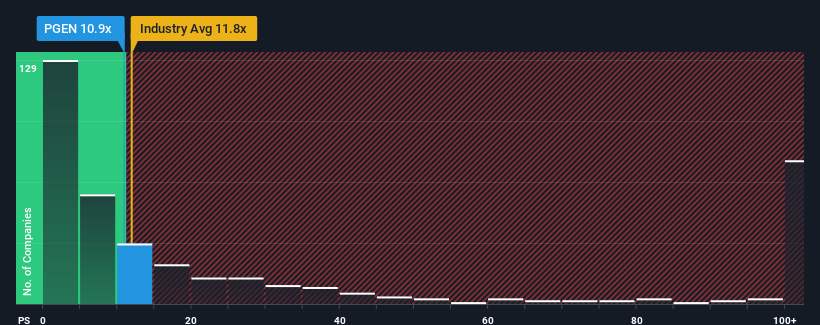

With a median price-to-sales (or "P/S") ratio of close to 11.8x in the Biotechs industry in the United States, you could be forgiven for feeling indifferent about Precigen, Inc.'s (NASDAQ:PGEN) P/S ratio of 10.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Precigen

What Does Precigen's Recent Performance Look Like?

Precigen certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Precigen.Is There Some Revenue Growth Forecasted For Precigen?

Precigen's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 89%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 70% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 24% per annum over the next three years. That's shaping up to be materially lower than the 95% each year growth forecast for the broader industry.

With this in mind, we find it intriguing that Precigen's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Precigen's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Precigen's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You should always think about risks. Case in point, we've spotted 4 warning signs for Precigen you should be aware of, and 1 of them is concerning.

If these risks are making you reconsider your opinion on Precigen, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PGEN

Precigen

A discovery and clinical-stage biopharmaceutical company, develops gene and cell therapies using precision technology to target diseases in areas of immuno-oncology, autoimmune disorders, and infectious diseases.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives