- United States

- /

- Biotech

- /

- NasdaqGS:PGEN

Precigen (PGEN) Is Up 21.8% After Durable PAPZIMEOS Data Highlights Sustained RRP Treatment Outcomes

Reviewed by Sasha Jovanovic

- Precigen, Inc. recently presented long-term follow-up data at the AAO-HNSF 2025 Annual Meeting showing that PAPZIMEOS™ (zopapogene imadenovec-drba) led to sustained responses and ongoing safety in adults with recurrent respiratory papillomatosis (RRP) following its full FDA approval in August 2025.

- This therapy is the first and only FDA-approved treatment targeting the root cause of RRP, with over 80% of complete responders remaining surgery-free for up to three years post-treatment.

- With these durable clinical results now in focus, we'll examine how the first-in-class approval of PAPZIMEOS shapes Precigen's investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Precigen's Investment Narrative?

For an investor considering Precigen, the crux of the story is the company’s bold approach to gene therapies and its pursuit of treatments that address underserved diseases like recurrent respiratory papillomatosis (RRP). The latest long-term follow-up data for PAPZIMEOS, presented after the therapy’s full FDA approval, is a meaningful positive as it highlights sustained safety and responses out to three years. This update could support one of the main short-term catalysts: increased commercial traction and broader adoption, especially since PAPZIMEOS is the only FDA-approved option targeting the root cause of RRP. Yet, this is set against ongoing risks such as the company’s low revenue, negative equity, and prior auditor concerns about going concern status. The therapy’s market uptake and payer access could materially affect these risks, meaning the path ahead could shift as new revenue flows in and clinical credibility grows. However, execution risk remains high, with the company still unprofitable and share price volatility suggesting investor sentiment can turn quickly. On the other hand, investors should keep a close eye on cash burn and regulatory progress.

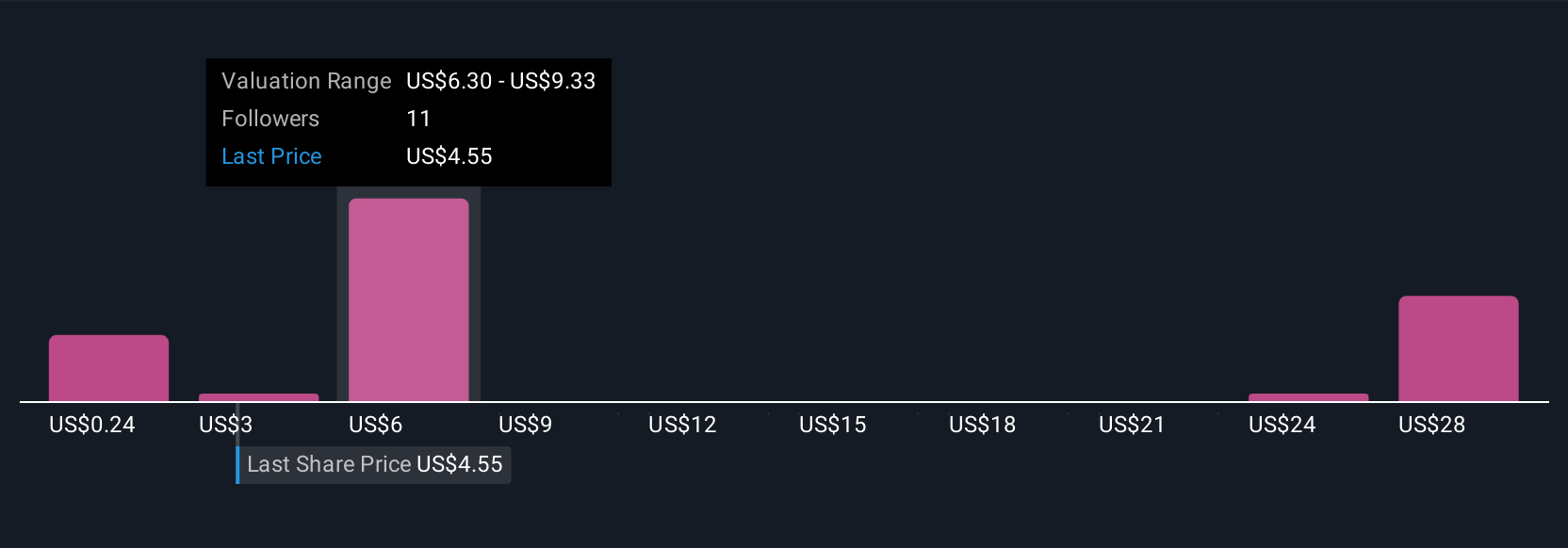

Upon reviewing our latest valuation report, Precigen's share price might be too optimistic.Exploring Other Perspectives

Explore 10 other fair value estimates on Precigen - why the stock might be worth less than half the current price!

Build Your Own Precigen Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Precigen research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Precigen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Precigen's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PGEN

Precigen

A discovery and clinical-stage biopharmaceutical company, develops gene and cell therapies using precision technology to target diseases in areas of immuno-oncology, autoimmune disorders, and infectious diseases.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives