- United States

- /

- Biotech

- /

- NasdaqGS:PGEN

Can Precigen's (PGEN) Revenue Surge Offset Concerns About Its Expanding Losses?

Reviewed by Sasha Jovanovic

- Precigen, Inc. reported financial results for the third quarter and nine months ended September 30, 2025, highlighting third-quarter revenue of US$2.92 million versus US$953,000 a year earlier, alongside a net loss of US$146.34 million compared to US$23.98 million previously.

- While revenue more than tripled year-over-year, Precigen’s net loss also increased significantly, leading to a wider basic loss per share from continuing operations.

- We’ll explore how the company’s sharp rise in revenue yet widening losses impacts its overall investment narrative and growth outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Precigen's Investment Narrative?

For shareholders in Precigen, the big picture rests on the hope that its portfolio of innovative therapies, especially PAPZIMEOS for RRP, can eventually translate scientific achievement into sustained commercial success. The latest financials show a revenue jump, driven by product launches, but the sizable net loss highlights how high development and launch costs continue to strain the company despite its strong pipeline progress. The sharp spike in losses, revealed in the recent Q3 results, immediately ramps up questions around liquidity and cash burn, given earlier concerns about Precigen’s ability to remain a going concern. Notably, catalysts such as PAPZIMEOS’s market ramp or additional product approvals still matter most in the short term, but now, financial discipline and access to capital have become even greater near-term risks. The Q3 numbers underscore that the company’s future depends not just on growth but on managing very real operational pressures.

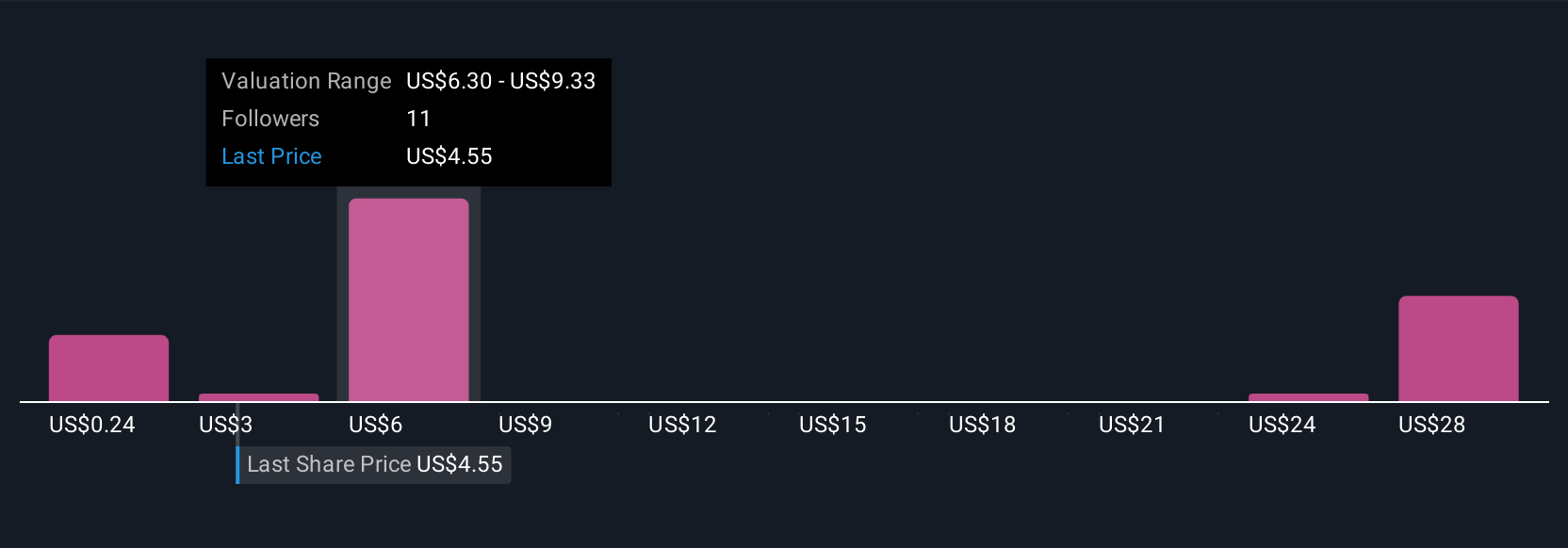

But with escalating losses, the risk around Precigen’s future funding needs has become more urgent. The valuation report we've compiled suggests that Precigen's current price could be inflated.Exploring Other Perspectives

Explore 10 other fair value estimates on Precigen - why the stock might be worth less than half the current price!

Build Your Own Precigen Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Precigen research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Precigen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Precigen's overall financial health at a glance.

No Opportunity In Precigen?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PGEN

Precigen

A discovery and clinical-stage biopharmaceutical company, develops gene and cell therapies using precision technology to target diseases in areas of immuno-oncology, autoimmune disorders, and infectious diseases.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success