- United States

- /

- Pharma

- /

- NasdaqGM:PAHC

Phibro Animal Health (PAHC): Is the Company’s Recent Share Price Surge Justified by Its Valuation?

Reviewed by Simply Wall St

Phibro Animal Health (PAHC) shares have gained nearly 8% over the past month, prompting some investors to revisit the company’s recent performance and outlook. The steady climb has caught the market’s attention for good reason.

See our latest analysis for Phibro Animal Health.

With shares now trading at $41.68, Phibro Animal Health has not only soared in the short term with a 7.4% 1-month share price return, but momentum has truly built over the longer run, as reflected in a remarkable 101% year-to-date share price gain and a 3-year total shareholder return of 205%. That kind of sustained performance suggests investors are re-evaluating the company’s prospects and growth potential as sentiment shifts decisively positive.

If this kind of momentum has you interested, you might want to see what’s happening elsewhere in the healthcare space. See the full list for free.

The sharp rally raises a key question: are investors buying into Phibro's actual value, or is the recent surge simply pricing in all the upside that future growth could bring, leaving little room for new buyers?

Most Popular Narrative: 16.6% Overvalued

Phibro Animal Health’s last close of $41.68 sits notably above the narrative’s consensus fair value of $35.75, highlighting a sharp divide between recent market enthusiasm and what underlying business fundamentals may support in the long term.

Favorable industry trends, strategic acquisitions, operational improvements, and diversification into higher-margin products position Phibro Animal Health for sustained growth and financial resilience.

Curious about the ambitious earnings, revenue growth, and margin forecasts backing this view? There is a bold story beneath this price. Find out what surprising assumptions drive these calculations. Do not miss the key catalysts hidden in the details.

Result: Fair Value of $35.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong global protein demand or breakthrough results from recent acquisitions could quickly reshape current expectations and strengthen Phibro's long-term outlook.

Find out about the key risks to this Phibro Animal Health narrative.

Another View: Discounted Cash Flow Paints a Different Picture

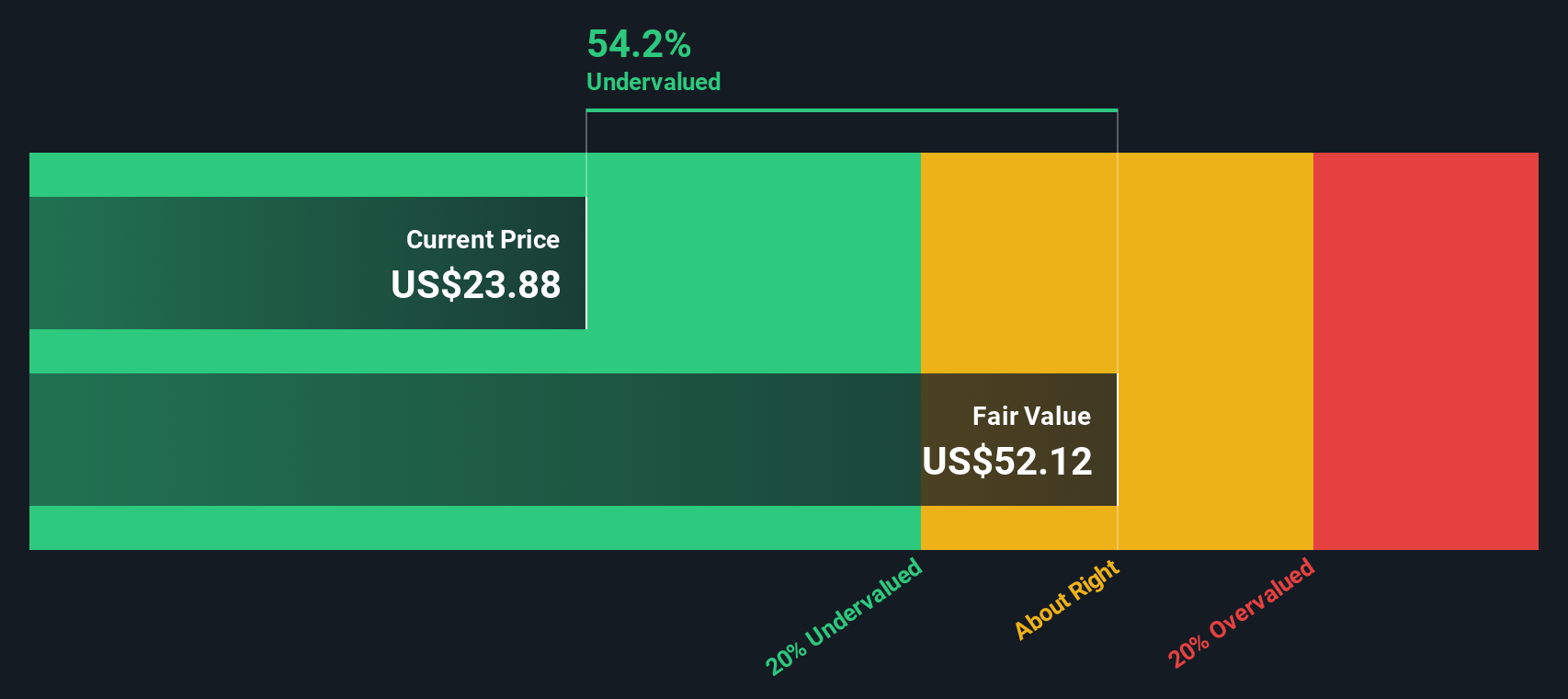

While the price-to-earnings approach signals Phibro Animal Health is overvalued, our DCF model arrives at a very different conclusion. The SWS DCF model estimates fair value at $77.67, which is almost double the current stock price. This suggests significant undervaluation if future cash flows materialize.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Phibro Animal Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Phibro Animal Health Narrative

If you want to see how the numbers stack up in your own way, crafting a narrative that reflects your perspective takes just a few minutes. Do it your way

A great starting point for your Phibro Animal Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t leave your next opportunity on the table. Broaden your search with these handpicked strategies designed to spot smart moves before the crowd catches on.

- Capitalize on market inefficiencies by scanning for value among these 866 undervalued stocks based on cash flows poised for upside based on future cash flows and robust fundamentals.

- Boost your income potential by targeting these 21 dividend stocks with yields > 3% offering yields above 3% and a track record of steady payouts.

- Tap into the future of innovation with these 28 quantum computing stocks as the race for breakthroughs in quantum computing accelerates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PAHC

Phibro Animal Health

Operates as an animal health and mineral nutrition company in the United States, Latin America and Canada, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives