- United States

- /

- Pharma

- /

- NasdaqGM:PAHC

Exploring 3 Undervalued Small Caps In United States With Insider Buying

Reviewed by Simply Wall St

The United States market has shown robust performance recently, climbing 1.2% in the last week and surging 32% over the past year, with earnings anticipated to grow by 16% annually. In this environment, identifying stocks that are potentially undervalued and have insider buying can be an intriguing strategy for investors seeking opportunities in small-cap companies.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 21.5x | 1.0x | 41.90% | ★★★★★★ |

| Hanover Bancorp | 9.5x | 2.2x | 48.63% | ★★★★★☆ |

| Citizens & Northern | 12.7x | 2.8x | 44.35% | ★★★★☆☆ |

| Franklin Financial Services | 9.8x | 1.9x | 38.58% | ★★★★☆☆ |

| HighPeak Energy | 12.2x | 1.5x | 34.09% | ★★★★☆☆ |

| German American Bancorp | 13.8x | 4.6x | 48.19% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -774.50% | ★★★☆☆☆ |

| National Vision Holdings | NA | 0.4x | -33.48% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -215.15% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

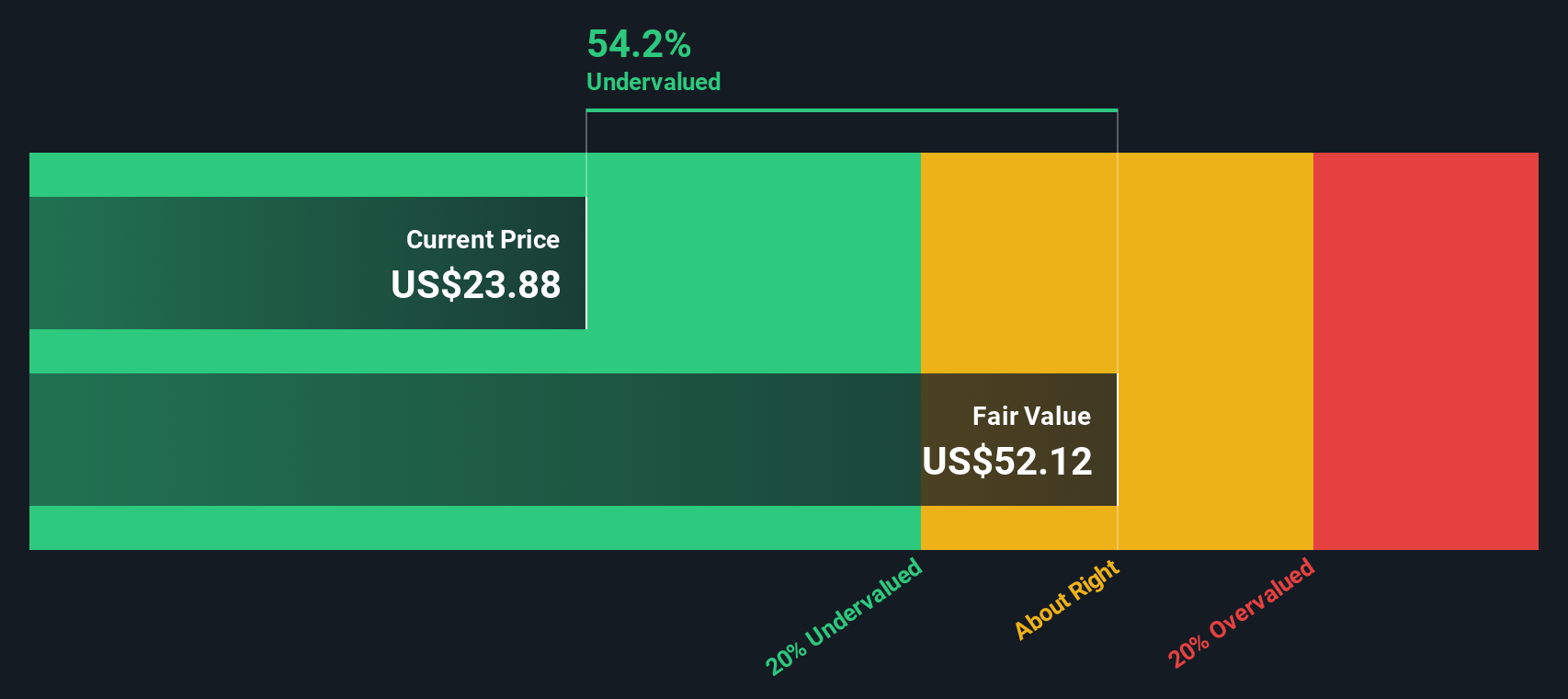

Phibro Animal Health (NasdaqGM:PAHC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Phibro Animal Health is a company engaged in the development, manufacturing, and marketing of a broad range of animal health and mineral nutrition products, with a market capitalization of approximately $0.56 billion.

Operations: The company generates revenue primarily from Animal Health, Mineral Nutrition, and Performance Products segments. Over recent periods, the gross profit margin has shown a slight upward trend, reaching 30.82% as of June 2024. Operating expenses have increased to $254.27 million in the same period, impacting net income margins which have decreased to 0.24%.

PE: 383.7x

Phibro Animal Health, a small company in the U.S., recently presented at the Morgan Stanley Global Healthcare Conference, showcasing their growth strategy. For fiscal year 2025, they project net sales between US$1.04 billion and US$1.09 billion, driven by their Animal Health segment's continued expansion and recovery in other areas. Despite lower profit margins this year compared to last (0.2% vs 3.3%), insider confidence is evident with recent share purchases from August to September 2024, suggesting belief in future prospects despite current challenges with high-risk funding sources and debt coverage issues.

- Take a closer look at Phibro Animal Health's potential here in our valuation report.

Understand Phibro Animal Health's track record by examining our Past report.

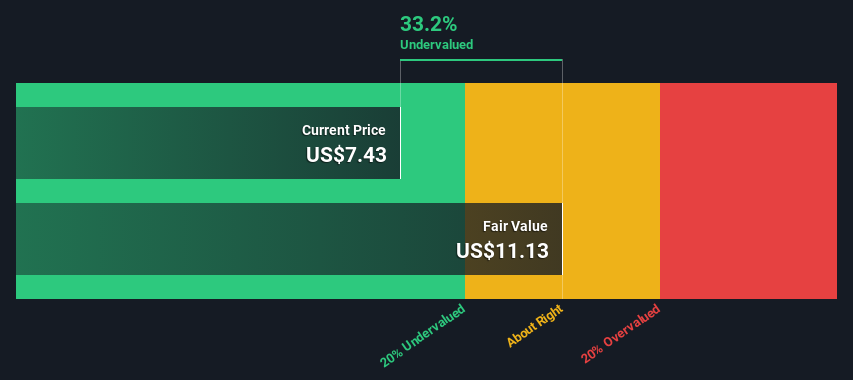

Reservoir Media (NasdaqGM:RSVR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Reservoir Media is a music rights company engaged in music publishing and recorded music operations, with a market cap of approximately $0.45 billion.

Operations: Reservoir Media generates revenue primarily from music publishing and recorded music, with a notable gross profit margin trend reaching 62.48% as of June 2024. The company's cost structure includes significant operating expenses and non-operating expenses, impacting net income margins which have shown fluctuations over recent periods.

PE: 26685.2x

Reservoir Media, a smaller player in the U.S. market, is seen as undervalued by Irenic Capital Management LP, which urged a strategic review to boost shareholder value. Despite earnings projections of 104% growth annually, profit margins have dipped from 2.1% to 0.01%, and interest payments strain earnings. Recent quarterly results showed increased sales at US$34 million but a net loss of US$0.35 million compared to last year's profit.

- Unlock comprehensive insights into our analysis of Reservoir Media stock in this valuation report.

Assess Reservoir Media's past performance with our detailed historical performance reports.

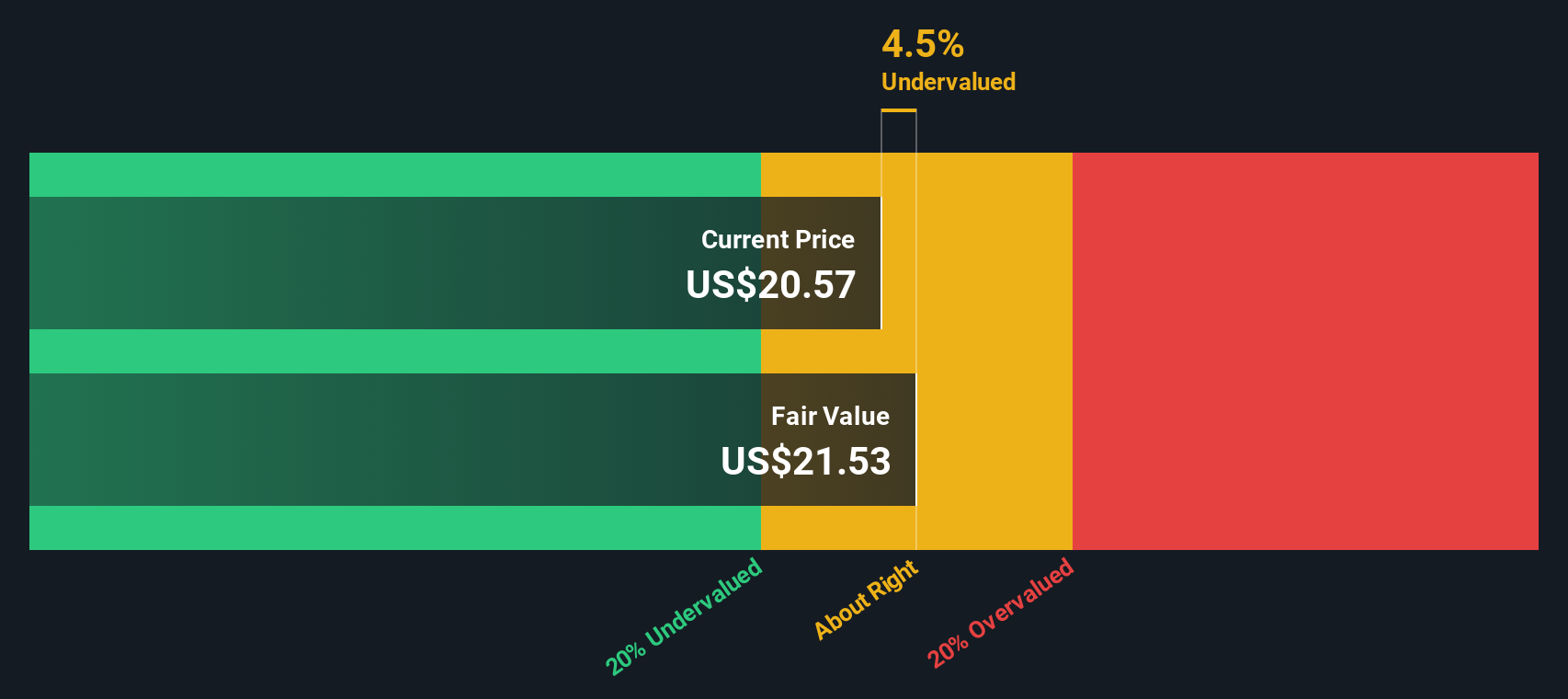

Victoria's Secret (NYSE:VSCO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Victoria's Secret is a specialty retailer focused on lingerie, beauty products, and intimate apparel with operations primarily in retail stores and a market capitalization of approximately $2.33 billion.

Operations: The company generates revenue primarily from its retail specialty segment, with recent figures showing $6.13 billion. Its cost of goods sold (COGS) significantly impacts gross profit, which has shown a gross profit margin trend reaching 44.67% in the latest period. Operating expenses are notable, with general and administrative costs being a major component, alongside sales and marketing expenditures. Net income margins have fluctuated over recent periods but were recorded at 2.25% in the latest data point provided.

PE: 14.3x

Victoria's Secret, a smaller player in the U.S. market, is navigating a transformative phase with recent leadership changes and strategic initiatives. The company reported improved financials for Q2 2024, with net income reaching US$31.8 million compared to a loss last year, reflecting potential growth in profitability. Although no shares were repurchased recently, insider confidence remains noteworthy due to management restructuring efforts aimed at streamlining operations and enhancing brand appeal through new product launches like the Victoria's Secret Dream collection.

- Dive into the specifics of Victoria's Secret here with our thorough valuation report.

Examine Victoria's Secret's past performance report to understand how it has performed in the past.

Key Takeaways

- Unlock more gems! Our Undervalued US Small Caps With Insider Buying screener has unearthed 52 more companies for you to explore.Click here to unveil our expertly curated list of 55 Undervalued US Small Caps With Insider Buying.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PAHC

Phibro Animal Health

Operates as an animal health and mineral nutrition company in the United States, Israel, Brazil, Ireland, and internationally.

Undervalued with reasonable growth potential and pays a dividend.