- United States

- /

- Biotech

- /

- NasdaqGS:ONC

How Positive Phase 3 Lung Cancer Results at BeOne Medicines (ONC) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- At the European Society of Medical Oncology (ESMO) 2025 Congress in Berlin, BeOne Medicines announced new data from two pivotal Phase 3 trials of its PD-1 inhibitor TEVIMBRA, showing enduring efficacy across multiple lung cancer subtypes, and unveiled the first clinical results of its investigational HPK1 inhibitor in advanced solid tumors.

- An especially significant outcome was the reported overall survival benefit of TEVIMBRA plus chemotherapy for squamous non-small cell lung cancer patients, even when accounting for high rates of treatment crossover, supporting its differentiated clinical value.

- We'll examine how these new clinical results for TEVIMBRA strengthen BeOne Medicines' investment case through expanded therapeutic potential.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

BeOne Medicines Investment Narrative Recap

To believe in BeOne Medicines as a shareholder, you need confidence in its ability to deliver innovative oncology therapies and successfully expand the reach of its clinical assets. The positive Phase 3 trial results for TEVIMBRA strengthen the case for leadership in the immunotherapy space and offer upside to the near-term catalyst of regulatory approvals and commercial expansion. However, this does little to address the concentrated revenue risk centered on BRUKINSA and the need for pipeline diversification in case of future setbacks.

Among recent announcements, the October 2025 FDA Breakthrough Therapy Designation for sonrotoclax in mantle cell lymphoma is highly relevant. It shows BeOne's ongoing momentum in broadening its late-stage portfolio beyond BRUKINSA, aligning with market expectations for pipeline progress as a key driver of future growth.

By contrast, any shortfall in clinical milestones or loss of exclusivity remains a risk that investors should be acutely aware of...

Read the full narrative on BeOne Medicines (it's free!)

BeOne Medicines' outlook forecasts $7.6 billion in revenue and $1.3 billion in earnings by 2028. Achieving these figures would require 18.6% annual revenue growth and a $1.48 billion increase in earnings from the current level of -$177.6 million.

Uncover how BeOne Medicines' forecasts yield a $381.09 fair value, a 21% upside to its current price.

Exploring Other Perspectives

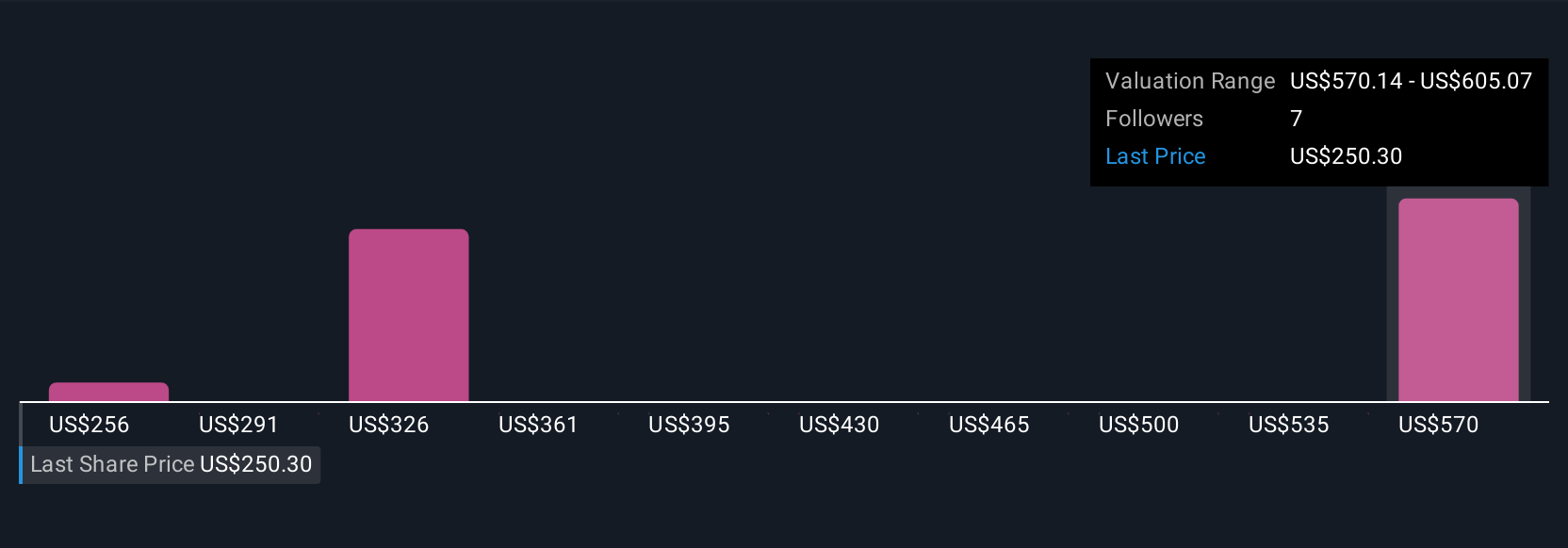

Fair value estimates from four Simply Wall St Community members span US$255.78 to US$734.81 per share. These views reflect sharp differences in future prospects, especially given the company’s reliance on a few key assets for growth.

Explore 4 other fair value estimates on BeOne Medicines - why the stock might be worth over 2x more than the current price!

Build Your Own BeOne Medicines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BeOne Medicines research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free BeOne Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BeOne Medicines' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeOne Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONC

BeOne Medicines

An oncology company, engages in discovering and developing various treatments for cancer patients in the United States, China, Europe, and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives