- United States

- /

- Biotech

- /

- NasdaqGS:ONC

Assessing BeOne Medicines (ONC) Valuation Following Promising Sonrotoclax Trial Results and Regulatory Progress

Reviewed by Simply Wall St

If you have been tracking BeOne Medicines (ONC), this week’s announcement about their investigational drug sonrotoclax might be the kind of news that makes you pause and rethink your playbook. The company revealed that its Phase 1/2 trial in relapsed or refractory mantle cell lymphoma not only hit its primary goal but also delivered meaningful clinical responses, even in patients who had already tried several treatment options. With regulatory submissions planned and full data coming soon, many investors are now taking a fresh look at the potential upside of BeOne’s pipeline and what this could mean for future growth.

This latest win is just the most recent headline from an eventful year for BeOne Medicines. Since January, the stock’s momentum has been building, with a return of 66 percent and a strong 60 percent boost over the past three months alone. The persistent pattern of product advancements and approvals, from the rollout of new therapies in Europe to lucrative royalty deals, has coincided with these gains. In short, confidence in BeOne’s ability to deliver value both clinically and financially appears to be on the rise.

After such an impressive run, the big question emerges: Is BeOne Medicines undervalued after this string of progress, or has the market already priced in much of its future growth?

Most Popular Narrative: 14.1% Undervalued

According to the community narrative, BeOne Medicines is considered undervalued based on robust growth assumptions and upcoming catalysts in its pipeline.

BeOne’s strong revenue growth (41% year-over-year in Q2; updated full-year guidance of $5 to $5.3 billion) is supported by rapid demand expansion for differentiated, best-in-class oncology therapies like BRUKINSA. This is further driven by a growing, aging population and increased global healthcare spending, both of which suggest a sustainably expanding addressable market and potential future revenue growth.

Curious why analysts see significant potential upside for BeOne? Key factors include ambitious revenue forecasts, margin improvements, and promising blockbuster therapies. These considerations are all included in the current valuation outlook. Interested in the details behind these optimistic financial targets? Review the full narrative to see the pivotal projections supporting this fair value assessment.

Result: Fair Value of $356.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition and BeOne’s dependence on just a few key products could quickly alter these growth assumptions if market dynamics shift.

Find out about the key risks to this BeOne Medicines narrative.Another View: What Does the DCF Model Say?

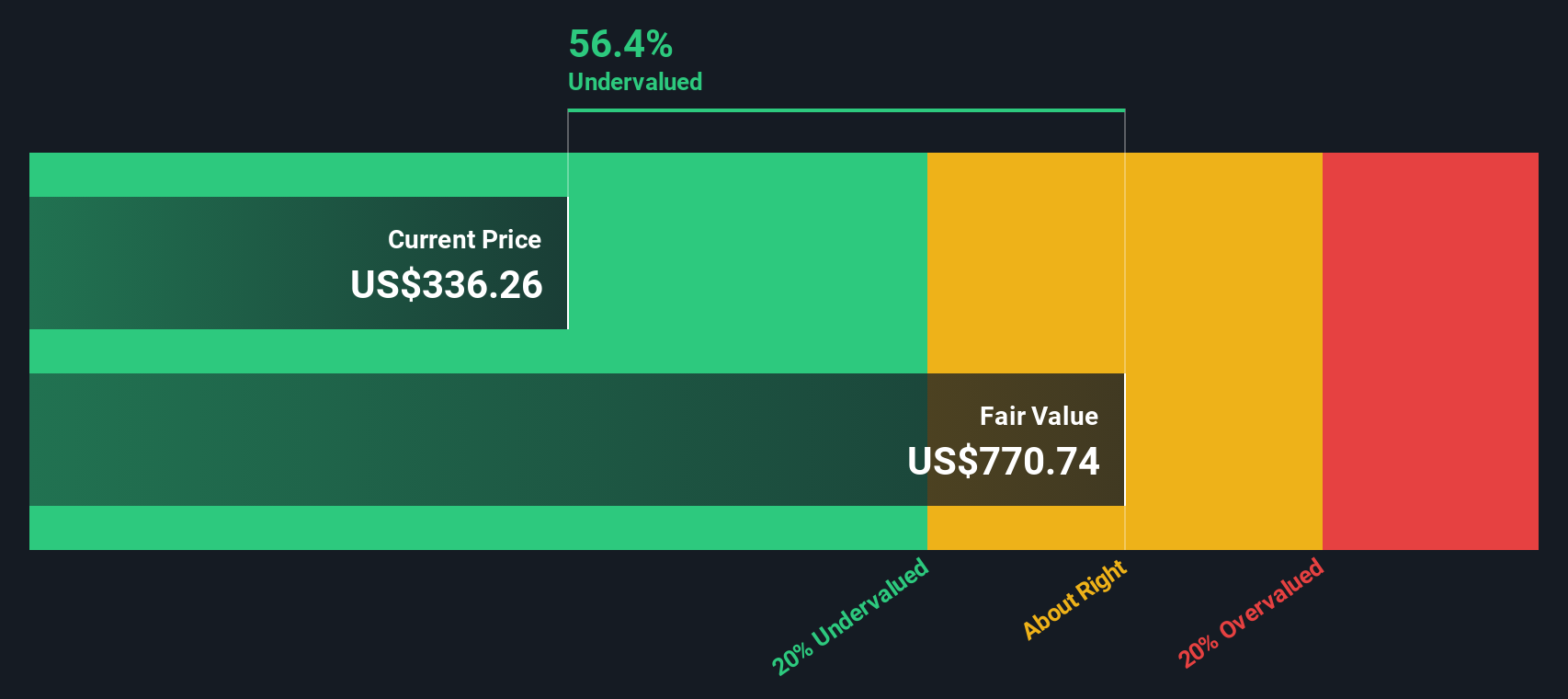

While analysts’ price targets suggest BeOne Medicines is undervalued, our SWS DCF model also indicates the shares may be trading well below intrinsic value. However, the question remains whether future growth will unfold as expected.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BeOne Medicines Narrative

If you see things differently or want to run your own analysis, you can dig into the numbers and shape your personalized perspective in just a few minutes. Then Do it your way.

A great starting point for your BeOne Medicines research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Want to make your portfolio stand out? Use the Simply Wall Street Screener and don’t let high-potential opportunities pass you by. These unique strategies are helping investors spot tomorrow’s outperformers today. Now it’s your turn.

- Strengthen your holdings with reliable cash flow by uncovering companies offering dividend stocks with yields > 3%. These could help power your returns with robust yields.

- Ignite your strategy and target game-changing innovation by tracking the leaders at the forefront of artificial intelligence with AI penny stocks.

- Find hidden gems that others might overlook, and gain an edge by targeting equities trading below their true worth using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeOne Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:ONC

BeOne Medicines

BeOne Medicines Ltd., an oncology company, engages in discovering and developing various treatments for cancer patients in the United States, China, Europe, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives