- United States

- /

- Pharma

- /

- NasdaqGM:OCUL

Ocular Therapeutix (OCUL): Evaluating Valuation as Investors Anticipate Key Healthcare Conference Updates

Reviewed by Simply Wall St

Ocular Therapeutix (OCUL) is attracting attention as investors make moves ahead of two key healthcare conferences this week. Management is expected to shed light on its product pipeline and future plans at these events.

See our latest analysis for Ocular Therapeutix.

After a tough stretch earlier this year, Ocular Therapeutix has seen renewed momentum, with its share price advancing 36% since January and a strong 1-year total shareholder return of nearly 37%. While headwinds such as declining revenues and a wider net loss were reported earlier this month, investor optimism seems to be building again, fueled by hopes for clarity on pipeline updates and future strategy at this week’s key conferences. Over the longer term, the company’s 3-year total return is an eye-catching 299%. However, five-year holders are still waiting to break even, underscoring both the risk and the excitement surrounding OCUL right now.

Curious which other healthcare stocks are drawing attention ahead of industry events? Take the next step and explore See the full list for free.

With shares trading at a substantial discount to analyst price targets, is Ocular Therapeutix still undervalued ahead of these pivotal updates, or have investors already accounted for all the future growth potential?

Most Popular Narrative: 48% Undervalued

With Ocular Therapeutix shares last closing at $11.89 and the most widely followed narrative pegging fair value at $22.92, the valuation gap is hard to ignore. The narrative is built on optimism around pipeline progress and future revenue expansion, and its assumptions set the tone for the current bullish outlook.

The anticipated approval of AXPAXLI, potentially the first wet AMD product with a superiority label and longer dosing intervals (every 6 to 12 months), may allow Ocular Therapeutix to capture significant market share in a rapidly growing population of elderly patients with retinal disease, unlocking large revenue growth opportunities as the global prevalence of ophthalmic disorders increases.

What is the secret sauce behind this high fair value? The numbers depend on forecasts of explosive sales growth, surging future earnings, and a multiple more commonly reserved for booming tech disruptors. Can their ambitious clinical pipeline turn these projections into reality? Only a close look at the underlying financial logic will reveal how bullish this narrative really is.

Result: Fair Value of $22.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in late-stage clinical trials or slower than expected adoption for new indications could quickly challenge the current optimism and growth projections.

Find out about the key risks to this Ocular Therapeutix narrative.

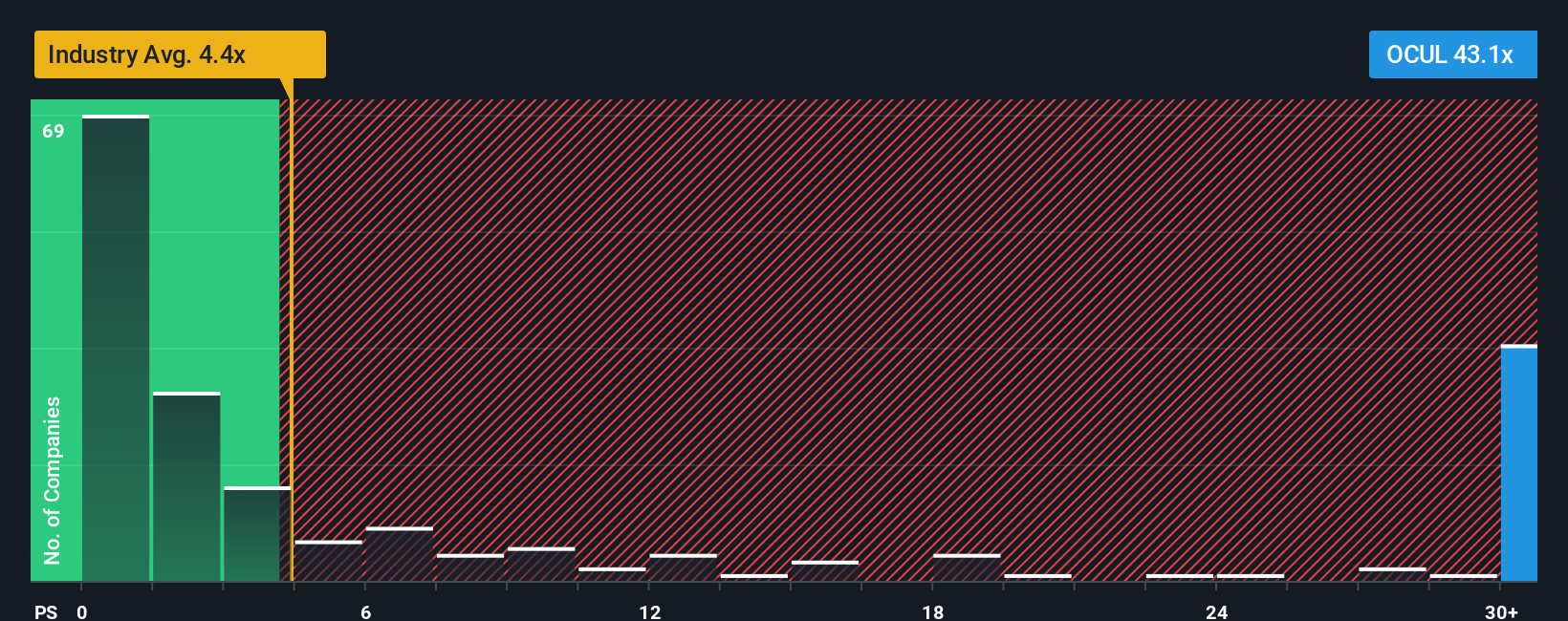

Another View: High Sales Ratio Signals Caution

Taking a different approach, if we compare Ocular Therapeutix’s current share price to its sales, the story feels less comfortable. Its price-to-sales ratio stands at 45.4 times, a figure that is dramatically higher than both the US pharmaceutical industry average of 4 times and the peer average of 1.7 times. The fair ratio, based on market trends, sits only at 0.2 times. This premium suggests investors could be taking on significant valuation risk unless revenue growth accelerates even faster than expected. Is the optimism fully priced in, or could future growth surprise to the upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ocular Therapeutix Narrative

If you want to see the numbers for yourself or prefer to develop your own take, you can quickly build a personal view in under three minutes with Do it your way

A great starting point for your Ocular Therapeutix research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize fresh opportunities now and don’t let these standout stocks pass you by. Simply Wall Street’s screener brings compelling investment angles right to your fingertips.

- Power up your portfolio with innovation and tap into future growth through these 27 AI penny stocks shaping breakthroughs in artificial intelligence.

- Put value front and center and uncover hidden gems by reviewing these 894 undervalued stocks based on cash flows trading at compelling discounts to their cash flow potential.

- Capture income and boost yield by focusing on these 18 dividend stocks with yields > 3% that consistently deliver attractive payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OCUL

Ocular Therapeutix

A biopharmaceutical company, engages in the development and commercialization of therapies for retinal diseases and other eye conditions using its bioresorbable hydrogel-based formulation technology in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives