- United States

- /

- Pharma

- /

- NasdaqGM:OCUL

Ocular Therapeutix (OCUL): Assessing Valuation After Analyst Upgrades and Axpaxli Clinical Progress

Reviewed by Simply Wall St

Ocular Therapeutix (OCUL) has caught investors’ attention following progress in its Axpaxli treatments for retinal conditions and a successful fundraising round. These developments have spurred analyst confidence, as well as a wave of positive reviews.

See our latest analysis for Ocular Therapeutix.

Momentum has been picking up for Ocular Therapeutix as investors respond to upbeat news around its Axpaxli clinical trials and fresh capital raised, with the share price up 33.4% year-to-date. The one-year total shareholder return stands at 13.5%. It is the massive three-year total return of 228% that really puts the company’s long-term growth potential in perspective.

If you’re interested in companies at the forefront of biotech breakthroughs, take the next step and explore See the full list for free.

With shares on the rise and analysts projecting further growth, the big question for investors is whether Ocular Therapeutix is still undervalued or if all this optimism is already reflected in the current share price.

Most Popular Narrative: 46.8% Undervalued

With the last close at $11.66 and a fair value estimated around $21.92, the current narrative points to a substantial upside for Ocular Therapeutix if analyst expectations become reality. A sharp contrast between share price and long-term outlook sets the stakes for a turning point driven by future milestones.

The anticipated approval of AXPAXLI, potentially the first wet AMD product with a superiority label and longer dosing intervals (every 6, 12 months), may allow Ocular Therapeutix to capture significant market share in a rapidly growing population of elderly patients with retinal disease, unlocking large revenue growth opportunities as the global prevalence of ophthalmic disorders increases.

Curious what powers this bold forecast? The narrative projects a leap in margins and a rapid surge in revenues not seen elsewhere in the sector. What is driving these aggressive assumptions, and is this growth for real? Uncover the core numbers and judge if this valuation gamble holds up under scrutiny.

Result: Fair Value of $21.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if clinical or regulatory setbacks emerge in key AXPAXLI trials, or if competitive pressure intensifies, the bullish narrative could quickly unravel.

Find out about the key risks to this Ocular Therapeutix narrative.

Another View: The Risk Behind the Ratios

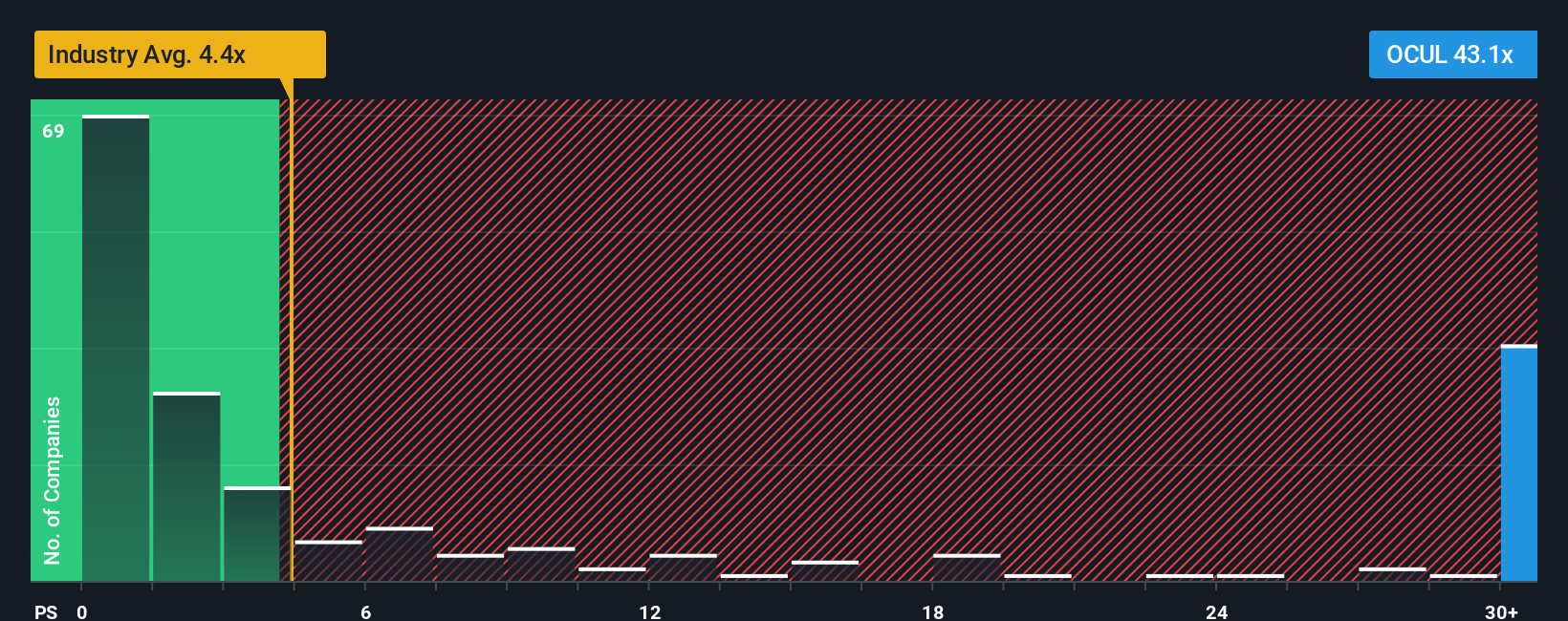

While the fair value model paints OCUL as significantly undervalued, a look at its price-to-sales ratio shows a different story. OCUL is trading at 43.6 times sales, far above both its industry average of 4.2x and its peers’ average of 2.1x, and even further from the fair ratio of 0.3x.

This wide gap raises the stakes for investors. Will market optimism win out, or does this premium pricing expose OCUL to sudden swings if expectations disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ocular Therapeutix Narrative

If you have your own take on OCUL’s future, or want to dig deeper into the numbers, it's easy to shape a custom thesis in just minutes. Do it your way

A great starting point for your Ocular Therapeutix research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't miss your chance to get ahead of the crowd. Leverage the Simply Wall Street Screener to spot fresh opportunities and sharpen your next move.

- Boost your income by tapping into these 20 dividend stocks with yields > 3% offering strong yields and resilient payout histories.

- Supercharge your portfolio’s tech edge by targeting these 27 AI penny stocks fueling the surge in artificial intelligence innovation.

- Secure compelling entry points as you hunt for these 839 undervalued stocks based on cash flows trading below their intrinsic value today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OCUL

Ocular Therapeutix

A biopharmaceutical company, engages in the development and commercialization of therapies for retinal diseases and other eye conditions using its bioresorbable hydrogel-based formulation technology in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives