- United States

- /

- Pharma

- /

- NasdaqGM:OCS

Oculis Holding (OCS) Raises $110 Million for Privosegtor Development Will Its R&D Bet Pay Off?

Reviewed by Sasha Jovanovic

- Oculis Holding AG recently announced the pricing of a follow-on equity offering, issuing 5,432,098 ordinary shares at US$20.25 each for expected gross proceeds of US$110 million to advance its neuroprotective clinical candidate, Privosegtor.

- This significant capital raise is aimed at accelerating clinical development in eye disorders with unmet needs, reflecting the company’s commitment to pipeline progress.

- We’ll explore how Oculis Holding’s decision to raise fresh capital for Privosegtor development shapes the company’s investment story.

We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Oculis Holding's Investment Narrative?

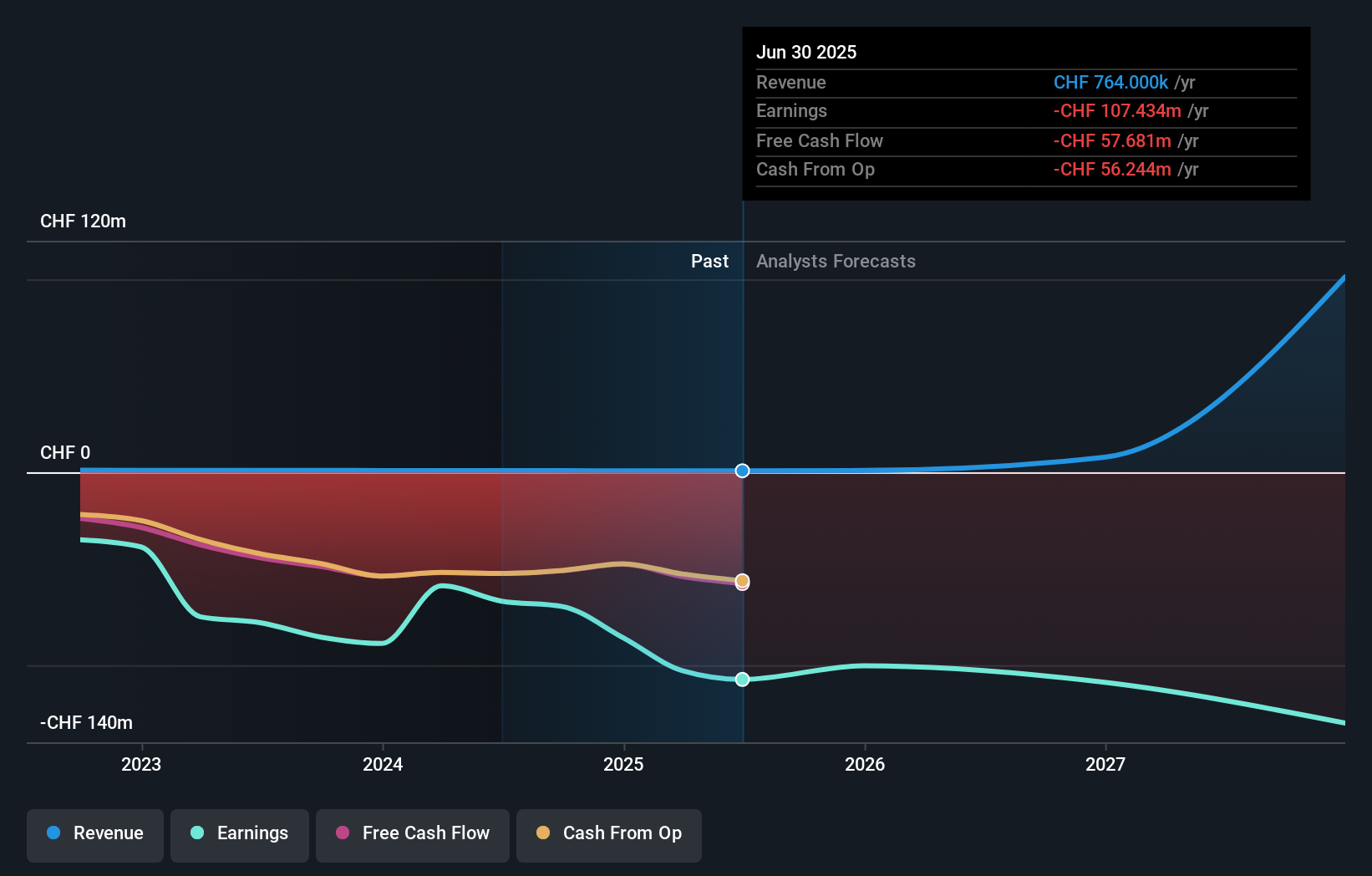

To back Oculis Holding, investors need to see genuine, long-term value in neuroprotective innovation for eye disorders with few treatment options, while accepting the realities of a high-risk, early-stage biotech. The recent US$110 million equity raise is a meaningful event, providing financial strength to advance Privosegtor, potentially speeding up key milestones in two closely watched neuro-ophthalmology trials. This addresses previous risks about running lean on capital and offers some clarity on how the pipeline can progress through regulatory and clinical catalysts. However, this same capital raise comes with fresh dilution for existing shareholders, which could affect near-term sentiment. Oculis remains unprofitable, with losses increasing and limited revenue at present. The big risks now tilt less toward funding shortfalls and more toward clinical trial outcomes and the ability to build a commercial pipeline from promising science. In contrast, potential shareholder dilution is a key factor current investors should be aware of.

The valuation report we've compiled suggests that Oculis Holding's current price could be inflated.Exploring Other Perspectives

Explore another fair value estimate on Oculis Holding - why the stock might be worth over 2x more than the current price!

Build Your Own Oculis Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oculis Holding research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Oculis Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oculis Holding's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OCS

Oculis Holding

A clinical-stage biopharmaceutical company, develops drug candidates to treat ophthalmic diseases in Switzerland, Iceland, and internationally.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives