- United States

- /

- Pharma

- /

- NasdaqGM:OCS

Does Oculis Holding's Shelf Registration Reflect a Strategic Shift in Funding Priorities for OCS?

Reviewed by Sasha Jovanovic

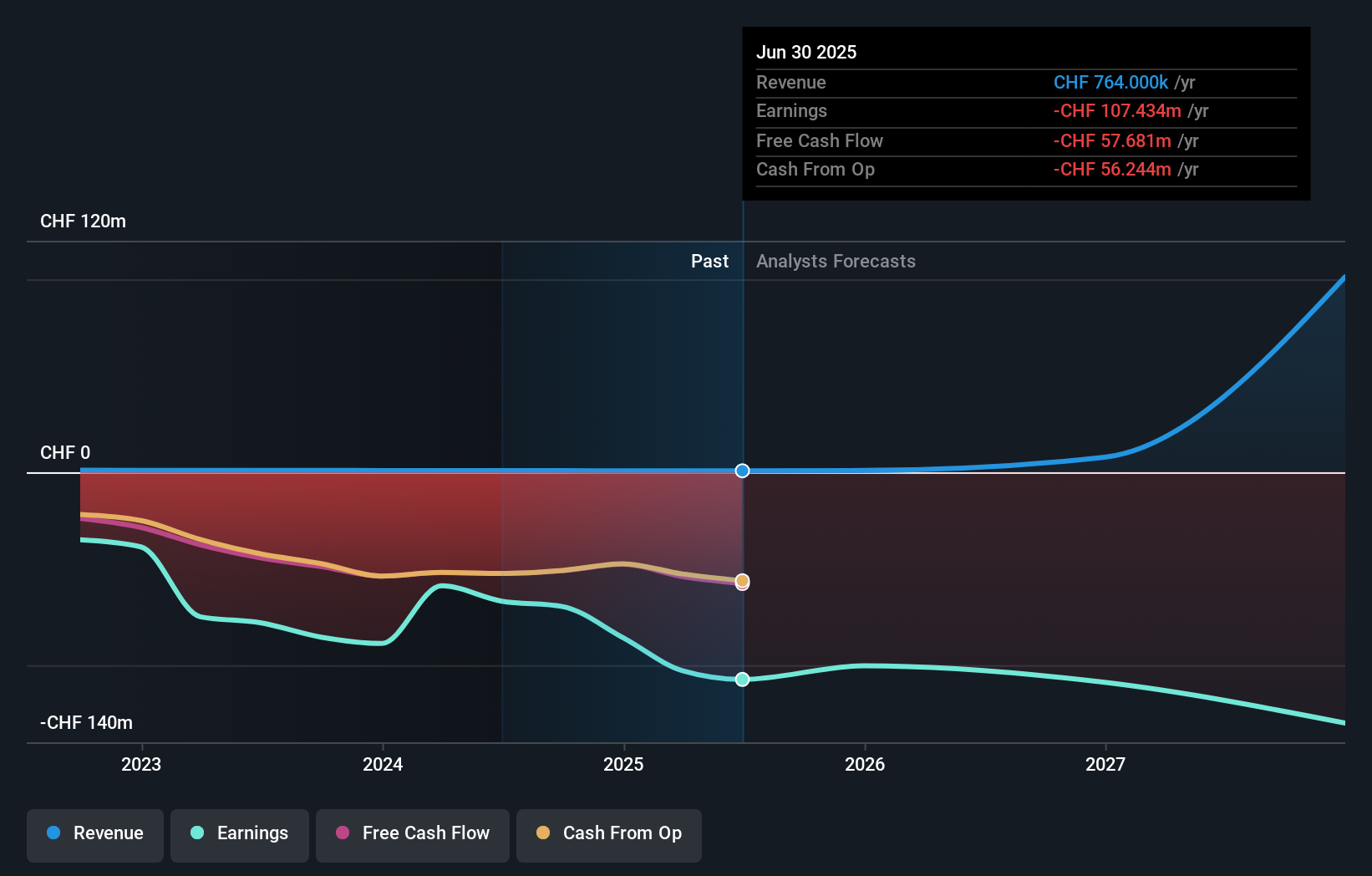

- Oculis Holding AG released its third quarter 2025 earnings, reporting revenue of CHF 243,000 and a net loss of CHF 16.86 million, along with filing a shelf registration for 494,259 ordinary shares valued at approximately US$9.50 million.

- While the company reduced its quarterly net loss compared to last year, its nine-month net loss grew, reflecting ongoing operational investment against modest revenue growth.

- We'll explore how the shelf registration filing shapes Oculis Holding's investment narrative amid continuing development-stage financial results.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Oculis Holding's Investment Narrative?

To be a shareholder in Oculis Holding, I think you really need to believe in the company's ability to turn its deep pipeline and clinical milestones into meaningful revenue over time, especially with ongoing losses and minimal current sales. The latest quarterly earnings show some narrowing of net losses but don't change the bigger picture: Oculis remains in an investment-heavy phase, with expenses outpacing modest top-line growth. The new shelf registration for nearly US$9.5 million, alongside the withdrawn follow-on offering last month, signals that further funding is top of mind and raises the possibility of future dilution for existing shareholders. Right now, the most important catalysts remain progress in key trials, like Privosegtor moving into registrational stages and early OCS-01 results. These financial updates don't materially alter near-term milestones, but they do add some urgency to questions about cash runway and fundraising. Although progress is steady, the risk of future dilution is not one to ignore.

Our comprehensive valuation report raises the possibility that Oculis Holding is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore another fair value estimate on Oculis Holding - why the stock might be worth just $43.57!

Build Your Own Oculis Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oculis Holding research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Oculis Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oculis Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OCS

Oculis Holding

A clinical-stage biopharmaceutical company, develops drug candidates to treat ophthalmic diseases in Switzerland, Iceland, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives