- United States

- /

- Biotech

- /

- NasdaqCM:OCGN

Ocugen (OCGN): Valuation Pressures Challenge Bullish Narrative as Profitability Remains Elusive

Reviewed by Simply Wall St

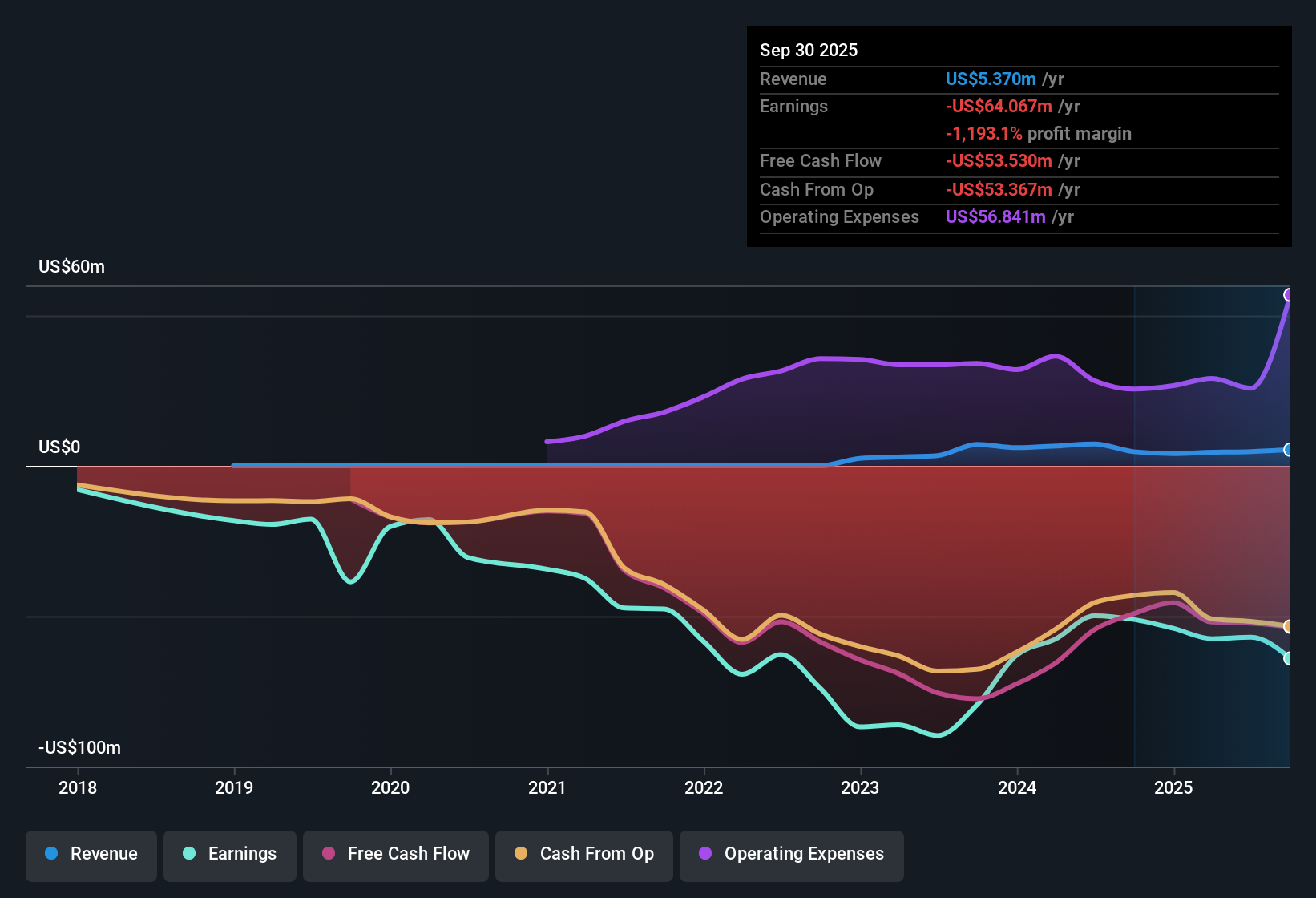

Ocugen (OCGN) is projected to deliver rapid revenue growth of 75.3% per year, with earnings expected to rise 77.45% annually, both far exceeding the broader US market estimates. The company remains unprofitable, having posted a 3.8% average annual increase in losses over the past five years, and its share price currently trades at $1.38. Investors will weigh these aggressive growth forecasts against Ocugen’s continued net margin struggles and premium valuation, especially given a Price-To-Book Ratio of 122x compared with peers averaging just 5.5x.

See our full analysis for Ocugen.Next, we will see how these headline figures stack up against the prevailing narrative and market expectations, and whether the latest numbers change the story.

See what the community is saying about Ocugen

Cash Burn Puts Pressure on Profit Margins

- Ocugen reported a net loss of $15.3 million for the quarter, with ongoing cash burn intensifying as research and development expenses rise year-over-year. The company’s cash runway currently extends only into the first quarter of 2026, signaling potential funding challenges ahead.

- Bears point to the risk that continued cash outflows, coupled with escalating R&D costs, could force Ocugen to seek additional capital before reaching profitability. This could potentially occur through shareholder dilution or debt, which would affect future net margins and investor returns.

- Consensus narrative notes that every delay in clinical milestones or regulatory approvals for late-stage therapies could rapidly eliminate anticipated revenue streams.

- Existing dependence on a limited pipeline of unapproved products increases the impact of trial setbacks or regulatory stumbles on future cash flow and valuation.

Gene Therapy Pipeline Drives Revenue Story

- Three gene therapy candidates — OCU400, OCU410, and OCU410ST — are progressing toward late-stage trials and regulatory filings, with plans to file three market authorization applications in the next three years. These programs address large patient populations and underpin analyst projections of 228.1% average annual revenue growth over that period.

- Analysts’ consensus view is that advances in regulatory engagement and manufacturing partnerships (including a transition to in-house production) could pave the way for faster market entry, stronger long-term profit margins, and greater earnings leverage than peers.

- Completion of a dedicated GMP manufacturing facility and non-dilutive funding agreements are expected to reduce costs and future reliance on dilutive shareholder raises.

- Innovative gene therapy targets with heightened pricing and reimbursement potential offer runway for margin improvement, so long as development and approval timelines hold up.

Consensus says the next big leap for Ocugen hangs on whether clinical progress and regulatory wins can outpace cash constraints and sector competition. 📊 Read the full Ocugen Consensus Narrative.

Valuation Premium Far Above Peers

- Ocugen trades at a Price-To-Book Ratio of 122x, making it substantially pricier than both the peer average (5.5x) and the US biotech industry average (2.4x), even as the business remains unprofitable and faces ongoing margin struggles.

- Analysts’ consensus view highlights that for today’s $1.38 share price to justify analyst projections, investors must assume not only major revenue and earnings growth, but also a path toward industry-leading profitability and a future price-to-earnings ratio of 95.5x, well above the sector average of 16.3x.

- This premium reflects high expectations for the commercial success of Ocugen’s gene therapies, but any setbacks would leave the valuation exposed to sharp corrections.

- Despite these pressures, some analysts price in expected pipeline milestones and margin expansions as sufficient reasons to support the current market value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ocugen on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the figures? Share your perspective and shape your story in minutes. Do it your way

A great starting point for your Ocugen research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Ocugen’s aggressive growth forecasts are overshadowed by ongoing cash burn, persistent net losses, and the risk that further fundraising could dilute shareholder value.

If you want to focus on businesses with sensible valuations and fewer red flags, discover opportunities among these 853 undervalued stocks based on cash flows that may offer better value for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OCGN

Ocugen

A biopharmaceutical company, focuses on discovering, developing, and commercializing novel gene and cell therapies, biologic, and vaccines that improve patients’ health.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives