- United States

- /

- Biotech

- /

- NasdaqGS:NVAX

Novavax (NVAX) Is Down 11.4% After Sanofi Vaccine Deal and Q3 Results - Has the Narrative Shifted?

Reviewed by Sasha Jovanovic

- In November 2025, Novavax completed the transfer of U.S. marketing authorization for its COVID-19 vaccine to Sanofi and reported third quarter results, which included revenue of US$70.45 million and a net loss of US$202.38 million for the quarter, but net income of US$422.78 million for the nine months ended September 30, 2025.

- This collaboration with Sanofi not only delivered a US$25 million milestone payment to Novavax, but also positions the company for future milestone and royalty revenue based on product commercialization and new developments under the agreement.

- We'll now explore how the completed Sanofi transfer and accompanying milestone payment could shape Novavax’s broader investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Novavax Investment Narrative Recap

To be a Novavax shareholder today, you need to believe in the company’s ability to secure milestone and royalty revenues through its partnerships, primarily with Sanofi, and to effectively manage declining demand for standalone COVID-19 vaccines. The recent US$25 million milestone payment from Sanofi provides some short-term confidence, but does not fundamentally change the primary catalyst: the pace and success of Nuvaxovid commercialization and combination vaccine development, or the main risk: reliance on partners achieving timely regulatory and market milestones.

The November 2025 announcement of the completed transfer of Nuvaxovid’s U.S. marketing authorization to Sanofi is the most significant recent event. This move initiates new financial inflows for Novavax and intensifies its dependence on outcomes delivered by external partners, directly linking revenue stability to Sanofi’s commercial performance in a very competitive market. The relationship’s future impact on Novavax will largely hinge on...

Read the full narrative on Novavax (it's free!)

Novavax's narrative projects $348.5 million revenue and $55.9 million earnings by 2028. This requires a 31.4% yearly revenue decline and a $366.9 million decrease in earnings from $422.8 million.

Uncover how Novavax's forecasts yield a $13.11 fair value, a 76% upside to its current price.

Exploring Other Perspectives

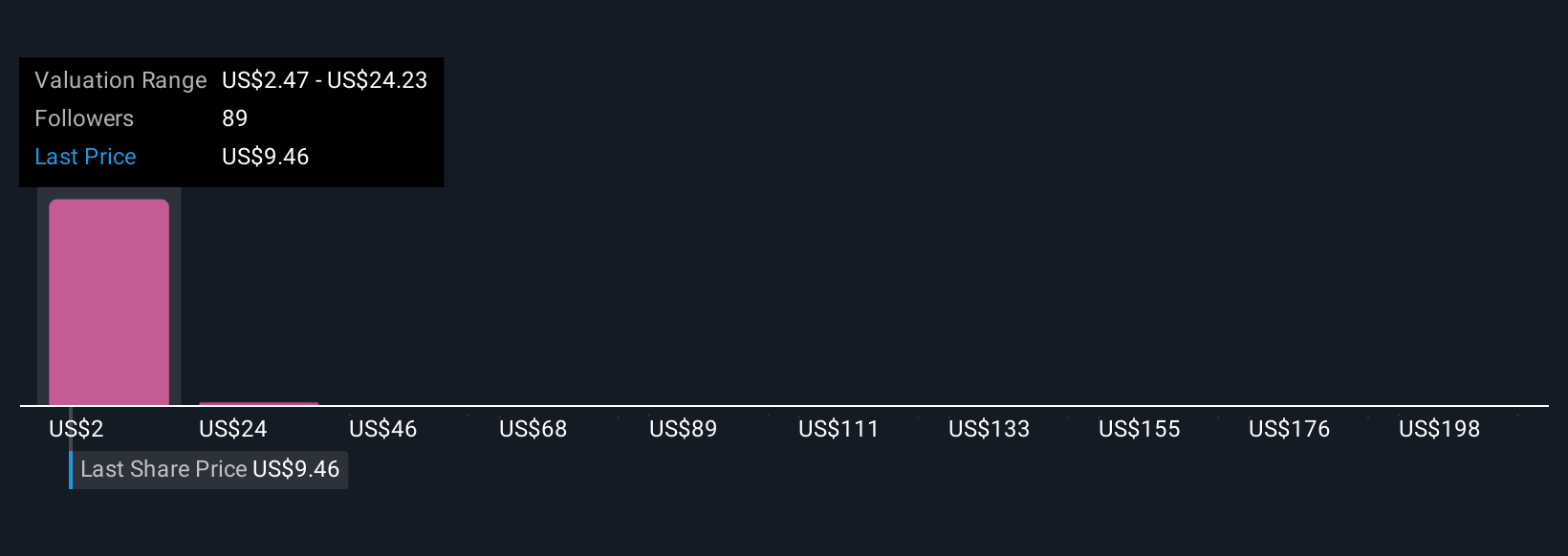

Simply Wall St Community members offered 10 independent fair value targets for Novavax, ranging widely from US$4.30 up to US$100 per share. While opinions vary, increased reliance on partners like Sanofi remains a key factor for Novavax’s future growth and risk profile, make sure to review several viewpoints before deciding where you stand.

Explore 10 other fair value estimates on Novavax - why the stock might be a potential multi-bagger!

Build Your Own Novavax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novavax research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Novavax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novavax's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novavax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVAX

Novavax

A biotechnology company, engages in the discovering, developing, and commercializing vaccines to protect against serious infectious diseases in the United States, Europe, and internationally.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives