- United States

- /

- Biotech

- /

- NasdaqGS:NUVL

Nuvalent (NUVL): Reassessing Valuation Following New Clinical Trial Data on Neladalkib

Reviewed by Simply Wall St

Nuvalent (NUVL) just shared preliminary results from its ALKOVE-1 Phase 1/2 clinical trial, focusing on neladalkib in advanced ALK-positive solid tumors, excluding non-small cell lung cancer. These findings were highlighted in advance of a presentation at ESMO 2025.

See our latest analysis for Nuvalent.

Nuvalent’s latest trial results seem to have ignited fresh optimism, with momentum clearly building. The 1-month share price return stands at 20.05%, and its total shareholder return over three years remains an impressive 173.62%. While the stock’s 1-year total return of 5.42% signals a more modest run recently, investors are clearly keeping an eye on long-term clinical milestones and potential breakthroughs.

If Nuvalent’s surge caught your attention, it might be the perfect moment to discover other promising biotech innovators — See the full list for free.

Given the mix of upbeat trial data, a 21% discount to the average analyst price target, and robust longer-term returns, investors must now ask: Is there more upside ahead, or is future growth already reflected in Nuvalent’s share price?

Price-to-Book Ratio of 7.5x: Is it justified?

Nuvalent’s stock is currently trading at a price-to-book (P/B) ratio of 7.5x based on the last closing price of $97.71. This is notably higher than both the US Biotechs industry average and its peer group.

The price-to-book ratio compares a company's market value to its book value, offering insight into how much investors are willing to pay for each dollar of net assets. For rapidly evolving biotech firms like Nuvalent, a high P/B ratio can reflect expectations for future innovation and clinical breakthroughs, even if the company is not yet profitable.

Nuvalent's current P/B multiple is three times the US Biotechs industry average of 2.5x and is also above the peer average of 6.5x. This suggests that the market is pricing in significant expectations for growth, exceeding what is typical for its sector or comparable companies.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 7.5x (OVERVALUED)

However, slower revenue growth or sustained net losses could quickly temper optimism and lead to a sharp reassessment of Nuvalent's current valuation.

Find out about the key risks to this Nuvalent narrative.

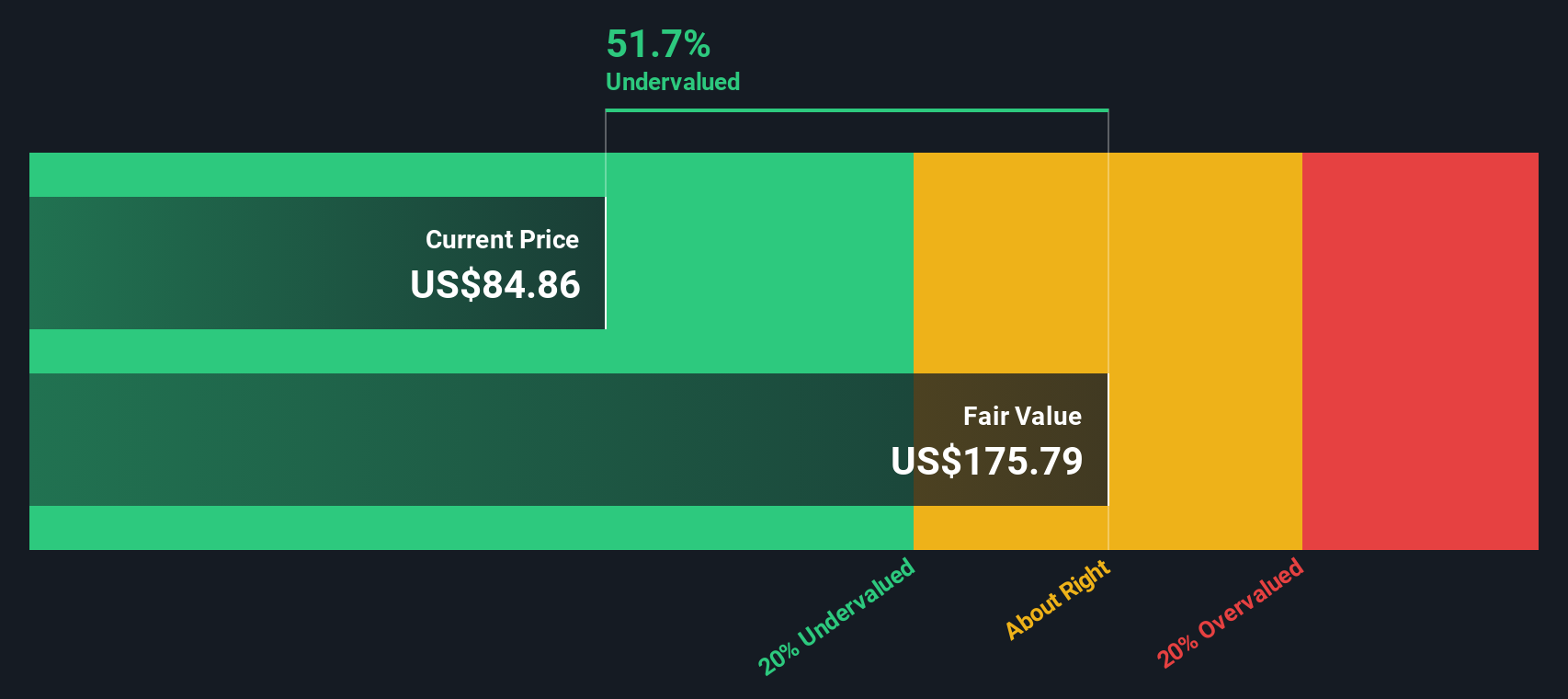

Another View: SWS DCF Model Suggests Undervaluation

While the lofty price-to-book ratio signals Nuvalent may be overvalued versus industry standards, our DCF model offers a different perspective. Based on long-term cash flow projections, the SWS DCF model estimates fair value at $150.41, which is well above the current price of $97.71. This suggests the stock could be trading at a 35% discount.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nuvalent for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nuvalent Narrative

For those who have their own insights or value digging into the numbers firsthand, you're just a few minutes away from building your own view. So why not Do it your way

A great starting point for your Nuvalent research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors act on opportunity before it’s obvious to everyone else. These handpicked stock ideas could boost your portfolio and help you stay ahead of the curve.

- Tap into under-the-radar potential by reviewing these 3564 penny stocks with strong financials which are showing strong fundamentals and financial resilience.

- Accelerate your returns by checking out these 27 AI penny stocks at the forefront of artificial intelligence and automation breakthroughs.

- Boost your passive income strategy with these 19 dividend stocks with yields > 3% that offer yields above 3% for reliable cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvalent might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NUVL

Nuvalent

A clinical-stage biopharmaceutical company, engages in the development of therapies for patients with cancer.

Excellent balance sheet and fair value.

Market Insights

Community Narratives