- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

Natera (NTRA) Valuation in Focus After New Clinical Advances in Cancer and Prenatal Testing

Reviewed by Kshitija Bhandaru

Natera (NTRA) has drawn renewed attention after announcing the successful enrollment of over 1,600 participants in its pivotal EXPAND trial for the Fetal Focus prenatal test. The company also released promising peer-reviewed studies on its Signatera test for cancer recurrence monitoring.

See our latest analysis for Natera.

Natera has seen significant momentum over the past year, building on breakthrough results for Signatera and a major clinical milestone in the EXPAND trial. While the share price is up just over 5% year-to-date, the total shareholder return for one year is an impressive 30%. The three-year total shareholder return is a remarkable 308%, suggesting that investor optimism has strong foundations in both recent advances and longer-term performance.

If you’re tracking where biotech innovation meets real market impact, the best next step is to check out the full list of healthcare standouts in our See the full list for free..

With shares still trading at a notable discount to analyst price targets and major clinical data on the horizon, the real question is whether Natera remains undervalued or if the market has already priced in future breakthroughs.

Most Popular Narrative: 12.7% Undervalued

Natera's most followed narrative points to a fair value of $193.80, compared to a last close of $169.27. This narrows the gap between current market sentiment and analysts’ medium-term vision for the company.

Accelerated integration of AI and automation into diagnostic processes and revenue cycle management is providing greater operating leverage and efficiency, resulting in lower COGS and improving operating margins and net earnings over time.

Are you curious what makes this outlook so bold? One foundational financial assumption could shake up how the entire sector is valued. Click through to uncover the underlying levers. Will the trajectory be as optimistic as forecast, or is there a hidden catch?

Result: Fair Value of $193.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any setbacks in clinical trial results or regulatory approvals could quickly challenge the current growth story and shift investor sentiment.

Find out about the key risks to this Natera narrative.

Another Perspective: Is The High Revenue Multiple Justified?

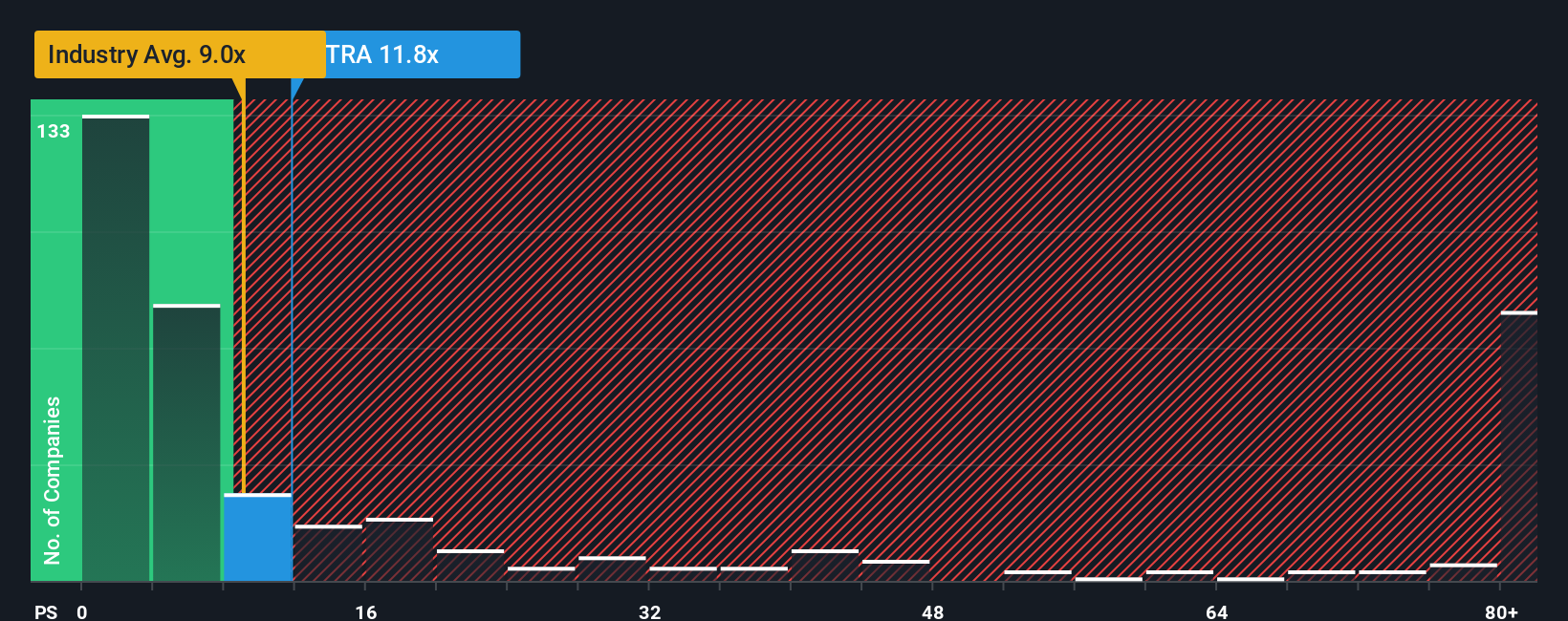

Looking at the numbers from a different angle, Natera is currently trading at a much higher price-to-sales ratio (11.8x) than both the US Biotechs industry average (10.4x) and its peers (5.8x). The fair ratio, based on regression analysis, sits at just 7.2x. This significant gap suggests there may be notable valuation risk if the market returns to more typical levels. Will justified optimism win out, or could this premium fade if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Natera Narrative

Want to dig into the details yourself and reach your own view? You can craft and share your take on Natera’s story in just a few minutes. Do it your way

A great starting point for your Natera research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Opportunities are waiting beyond Natera. Make your next market move count by checking out these unique strategies that top investors are using right now.

- Unlock the potential of market upswings by tapping into these 898 undervalued stocks based on cash flows, a resource packed with stocks trading below their intrinsic value and poised for growth.

- Capture reliable income streams that yesterday’s savers wish they’d found by skimming through these 19 dividend stocks with yields > 3%, which features companies with yields over 3%.

- Stay ahead of trends and innovation by targeting the future with these 24 AI penny stocks, designed to highlight leading-edge artificial intelligence opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRA

Natera

A diagnostics company, provides molecular testing services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives