- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

Natera (NTRA): Evaluating Valuation After Q3 Growth, Analyst Upgrades, and OncoEMR Integration

Reviewed by Simply Wall St

Natera (NTRA) has been making waves following its strong third quarter, with year-over-year sales of the company’s Signatera test jumping 78%. The recent integration of Natera’s oncology portfolio into Flatiron Health’s OncoEMR platform also stands out as an important move. This integration makes test ordering more seamless for thousands of U.S. cancer care providers.

See our latest analysis for Natera.

Natera’s recent moves have sparked a surge in momentum, with a 41.95% share price return over the last 90 days and the stock sitting at $230.63. With an impressive 3-year total shareholder return above 500%, both short- and long-term gains indicate rising investor confidence and optimism about the company’s growth path in healthcare diagnostics.

If Natera’s adoption in cancer care has you thinking about the next wave of innovation, take the chance to explore See the full list for free..

With analyst upgrades piling up and Natera trading just below price targets, the key question becomes whether its rapid growth and innovations are already priced in or if there is still buying opportunity for investors.

Most Popular Narrative: 3.6% Overvalued

With Natera trading at $230.63 and the narrative fair value set at $222.58, expectations around clinical momentum and valuation are running high. The following quote from the most widely followed narrative highlights a key business catalyst shaping these estimates.

Accelerated integration of AI and automation into diagnostic processes and revenue cycle management is providing greater operating leverage and efficiency. This is resulting in lower COGS as well as improving operating margins and net earnings over time.

Want to know if bold earnings acceleration supports this heady price? The narrative hinges on future margin transformation and relentless top-line growth. What numbers justify this premium? Unlock the full story behind the financial leap analysts are betting on.

Result: Fair Value of $222.58 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution hiccups, such as delays in trial success or persistent pressure on margins, could quickly challenge today’s optimism about Natera’s growth story.

Find out about the key risks to this Natera narrative.

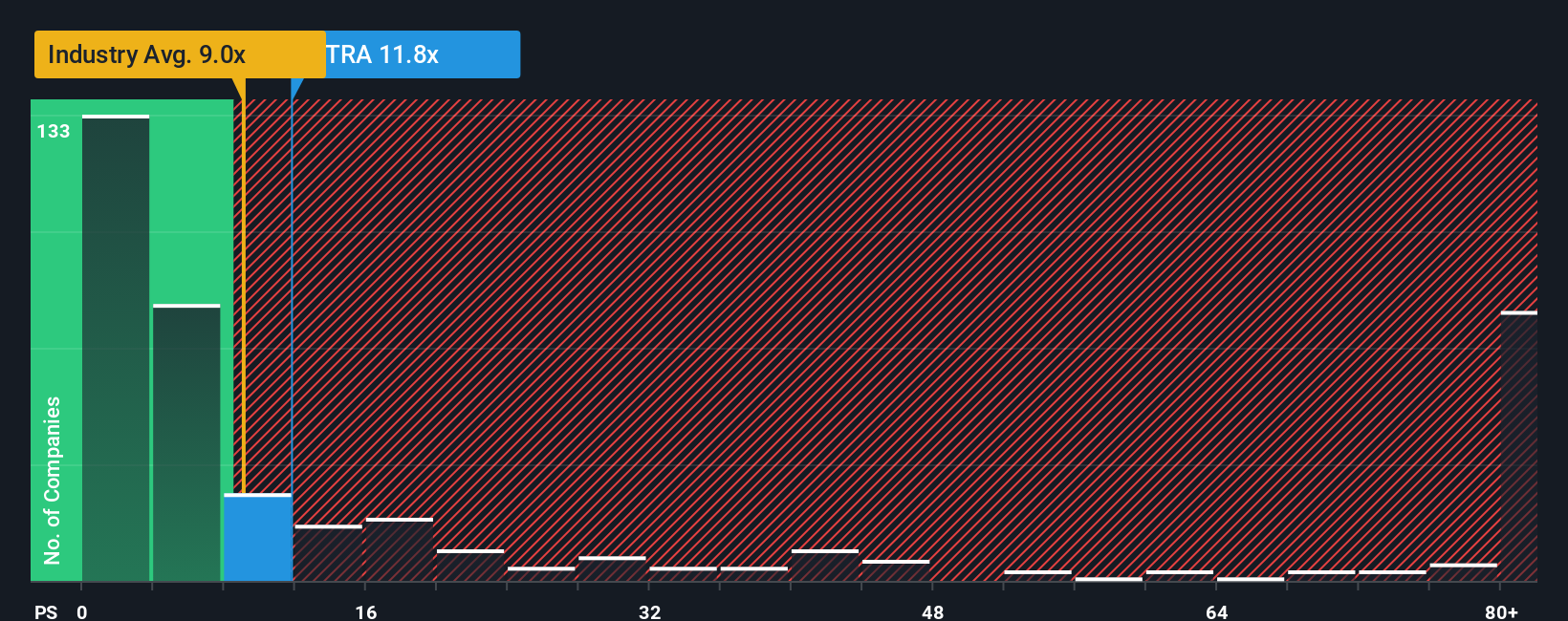

Another View: The Risk in Revenue Multiples

While the fair value narrative sees Natera overvalued, a look at its price-to-sales ratio tells its own story. At 15 times sales, Natera trades significantly above both the peer average of 9.1 and the US Biotechs industry at 11.6. Even more striking, this remains far above the fair ratio of 8.1, a level the market could revert toward with changing sentiment. That kind of premium spells both promise and risk for investors. Is Natera’s future growth already fully baked in, or is there more runway left?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Natera for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Natera Narrative

If you want to dig deeper or see things from a fresh angle, you can research the data and craft your own perspective in just a few minutes: Do it your way.

A great starting point for your Natera research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Do not settle for just one opportunity when markets are always moving, and new winners emerge every day. Stay ahead by looking at other promising opportunities today. Being proactive means you do not let a potential winner pass you by.

- Start building your portfolio with steady income by checking out these 16 dividend stocks with yields > 3% offering attractive yields and proven stability.

- Unlock incredible growth prospects by targeting these 26 AI penny stocks positioned at the forefront of the artificial intelligence revolution.

- Tap into next-level innovation with these 26 quantum computing stocks that are reshaping industries with breakthrough computing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRA

Natera

A diagnostics company, provides molecular testing services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives