- United States

- /

- Biotech

- /

- NasdaqGM:NTLA

A Look at Intellia Therapeutics’s Valuation Following FDA Clinical Hold on CRISPR Trial

Reviewed by Simply Wall St

The FDA’s recent decision to place a clinical hold on Intellia Therapeutics (NTLA) Phase 3 trials for nexiguran ziclumeran is drawing close investor scrutiny. The halt comes after reports of severe liver-related side effects.

See our latest analysis for Intellia Therapeutics.

Intellia’s recent setbacks with its Phase 3 trials have weighed heavily on the share price, with a 7-day share price return of -50.7%. This result reflects just how quickly risk perceptions can shift after major clinical news. Despite this, Intellia’s 90-day share price return is slightly positive. However, the company’s longer-term total shareholder return tells a less optimistic story, with a 1-year total return of -14.8% and a three-year total return of -75.2%. These figures underscore the volatility and challenges in biotech investing when expectations meet regulatory hurdles.

If you’re keeping an eye on biotech momentum, it might be the perfect moment to explore other healthcare innovators using our See the full list for free..

With Intellia trading at a sizable discount to its analyst price target after this regulatory setback, the big question for investors is whether this downturn represents a real buying opportunity or if the market has already accounted for all foreseeable risks and future growth.

Most Popular Narrative: 60.9% Undervalued

The most popular narrative calculates Intellia Therapeutics' fair value at $32.30, significantly above its last close at $12.62. This wide valuation gap draws attention to the company’s future outlook and the numbers underpinning such optimism.

Growing patient and physician enthusiasm for Intellia's lead in vivo CRISPR therapies is driving faster-than-expected enrollment across multiple late-stage clinical trials (including an expanded 1,200-patient ATTR cardiomyopathy study and strong uptake in HAE). This positions the company to achieve meaningful clinical readouts and regulatory milestones ahead of prior guidance, which advances timelines to potential commercialization and drives long-term revenue growth prospects.

Is Intellia’s blockbuster potential just hype or grounded in bold projections? The full narrative reveals eye-popping revenue growth rates, ambitious path-to-profit assumptions, and places a hefty future multiple on earnings. See what sets these projections apart and whether the optimism looks justified.

Result: Fair Value of $32.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition and lingering safety concerns could quickly challenge this upbeat outlook. These factors may put pressure on Intellia’s market share and projected revenue growth.

Find out about the key risks to this Intellia Therapeutics narrative.

Another View: Are Shares Still Expensive?

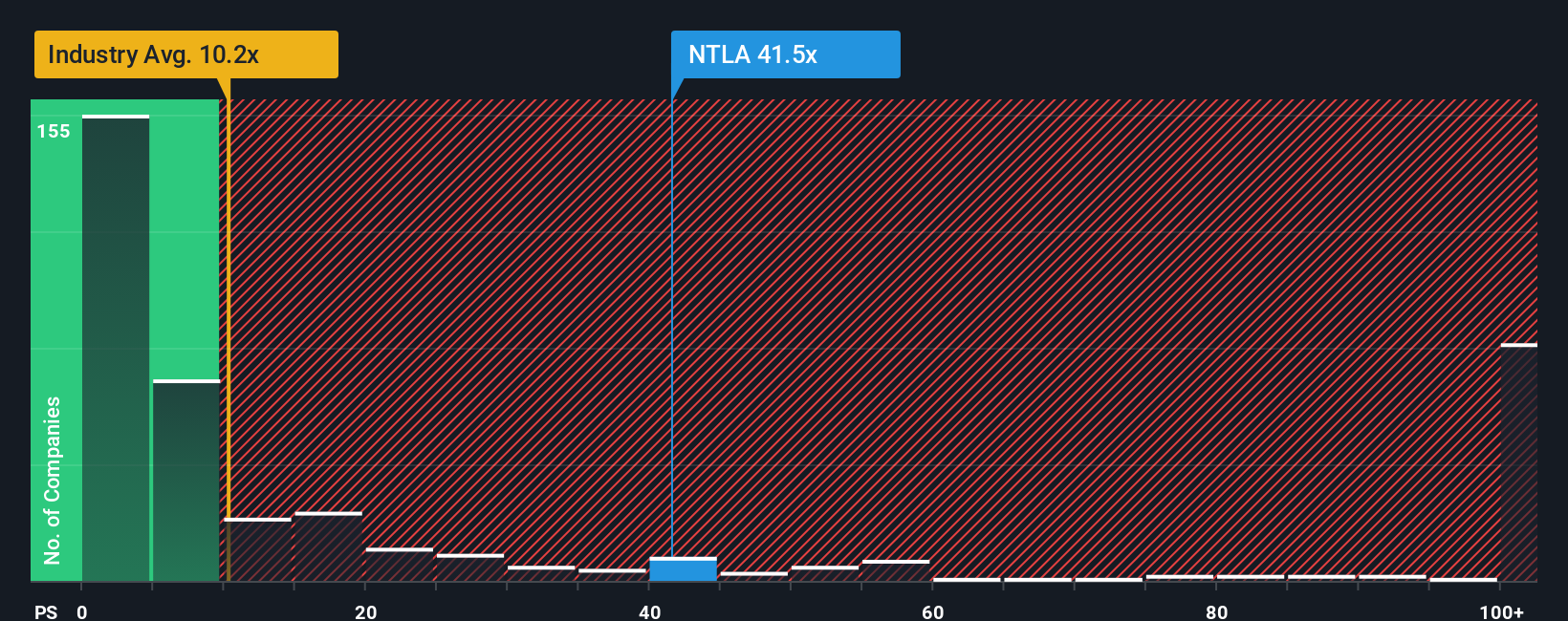

Looking at Intellia through the lens of its price-to-sales ratio provides a different perspective. The company trades at 25.6 times sales, which is well above the US Biotechs industry average of 11.2 and the peer average of 3.7. Even when compared to a fair ratio of 0, this premium suggests that despite recent drops, shares may still carry significant valuation risk, especially if optimistic growth assumptions are not met. Does this multiple leave enough margin of safety for investors navigating the recent volatility?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intellia Therapeutics Narrative

If you see things differently or want to dig deeper into the data yourself, you can craft your own take in just a few minutes. Then Do it your way.

A great starting point for your Intellia Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

There’s a world of high-potential stocks beyond Intellia waiting for you. Tap into new opportunities now, or risk missing the next breakout story.

- Find bargains with strong earnings power and expanding market influence by starting with these 839 undervalued stocks based on cash flows.

- Stay up to date on emerging healthcare trends by exploring these 33 healthcare AI stocks, which focuses on AI innovations transforming the industry.

- Explore potential growth in rapidly evolving digital currencies with these 81 cryptocurrency and blockchain stocks at the forefront of blockchain development and fintech innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NTLA

Intellia Therapeutics

A clinical-stage gene editing company, focuses on the development of curative genome editing treatments.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives