- United States

- /

- Pharma

- /

- NasdaqGS:NMRA

Will Neumora Therapeutics’ (NMRA) Novel Drug Pipeline Define Its Competitive Edge in Biotech?

Reviewed by Sasha Jovanovic

- Neumora Therapeutics recently announced the initiation of a Phase 1 study for NMRA-898, a selective muscarinic receptor modulator, and reported promising preclinical results for NMRA-215, an NLRP3 inhibitor showing significant weight loss effects in obesity studies.

- These advancements highlight the company's focus on innovative therapies for neuropsychiatric and cardiometabolic disorders, setting it apart in the biotechnology sector.

- We’ll examine how Neumora’s progress with next-generation obesity and brain disorder treatments influences its broader investment narrative.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Neumora Therapeutics' Investment Narrative?

Shareholders in Neumora Therapeutics need to believe in the potential of early-stage neuroscience and cardiometabolic drug innovation to deliver future value, even before commercial revenue materializes. The latest news, the Phase 1 start for NMRA-898 in schizophrenia and positive preclinical data for the obesity-targeting NMRA-215, has brought a new wave of sector attention and possibly reset the narrative on near-term catalysts. These advancements have been recognized with significant share price gains, suggesting that clinical progress has mitigated some immediate risks, most notably the concern around maintaining Nasdaq listing compliance. However, the company remains unprofitable, has no products on the market, and faces ongoing legal and dilution threats. While investors may see brighter short-term prospects with this pipeline momentum, long-term questions remain regarding regulatory progress, eventual commercialization, and the ability to secure additional funding. Yet, legal issues and the risk of further dilution still stand out as concerns investors should not overlook.

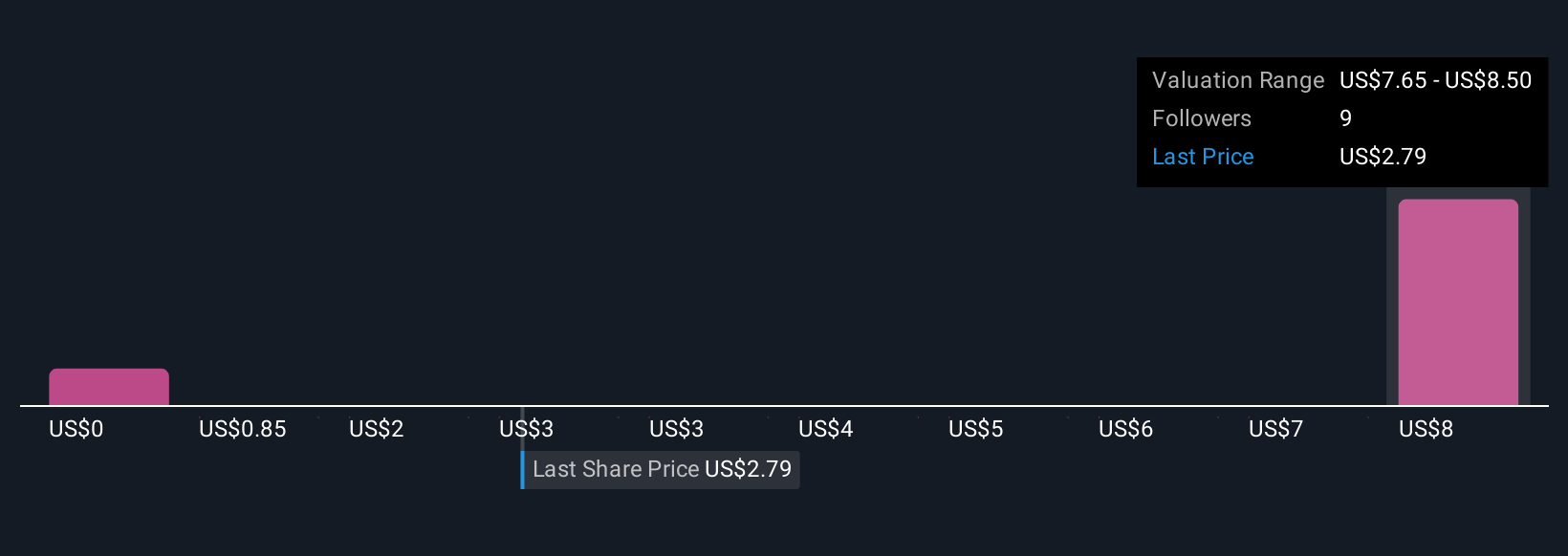

Insights from our recent valuation report point to the potential overvaluation of Neumora Therapeutics shares in the market.Exploring Other Perspectives

Explore 3 other fair value estimates on Neumora Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Neumora Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Neumora Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Neumora Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Neumora Therapeutics' overall financial health at a glance.

No Opportunity In Neumora Therapeutics?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neumora Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NMRA

Neumora Therapeutics

A clinical-stage biopharmaceutical company, engages in developing therapeutic treatments for brain diseases, neuropsychiatric disorders, and neurodegenerative diseases in the United States.

Excellent balance sheet with low risk.

Market Insights

Community Narratives