- United States

- /

- Pharma

- /

- NasdaqCM:NKTR

What Nektar Therapeutics (NKTR)'s US$110 Million Equity Offering Means For Shareholders

Reviewed by Sasha Jovanovic

- Nektar Therapeutics has recently announced multiple shelf registration filings and a follow-on equity offering for up to US$110 million in common stock, with additional shelf registrations covering various other securities and an ESOP-related offering, after updating investors on new study data and regulatory milestones for rezpegaldesleukin.

- This series of capital-raising initiatives signals the company's intent to strengthen its financial position, which may alter its funding runway and impact existing shareholders by increasing the total shares outstanding.

- We'll now explore how Nektar's capital-raising activities, particularly the large follow-on equity offering, may influence its investment outlook and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Nektar Therapeutics Investment Narrative Recap

For investors considering Nektar Therapeutics, the main conviction centers on rezpegaldesleukin’s progress, as clinical and regulatory milestones for this late-stage asset are pivotal to future value creation. The $110 million follow-on equity offering and shelf registrations improve Nektar’s financial runway in the short term, but they are not expected to materially shift the immediate significance of Rezpegaldesleukin study updates, the company’s leading catalyst, or change that near-term dilution risk remains the biggest concern.

The recent presentation of new REZOLVE-AD Phase 2b results at the ACAAI 2025 Annual Meeting is highly relevant, as continued positive trial data represents the clearest catalyst for the business and may unlock further regulatory momentum following this year’s FDA Fast Track designations. However, there is still a need for careful attention to...

Read the full narrative on Nektar Therapeutics (it's free!)

Nektar Therapeutics' narrative projects $40.9 million revenue and $9.5 million earnings by 2028. This requires an 18.3% yearly revenue decline and an earnings increase of $131.8 million from -$122.3 million today.

Uncover how Nektar Therapeutics' forecasts yield a $93.86 fair value, a 66% upside to its current price.

Exploring Other Perspectives

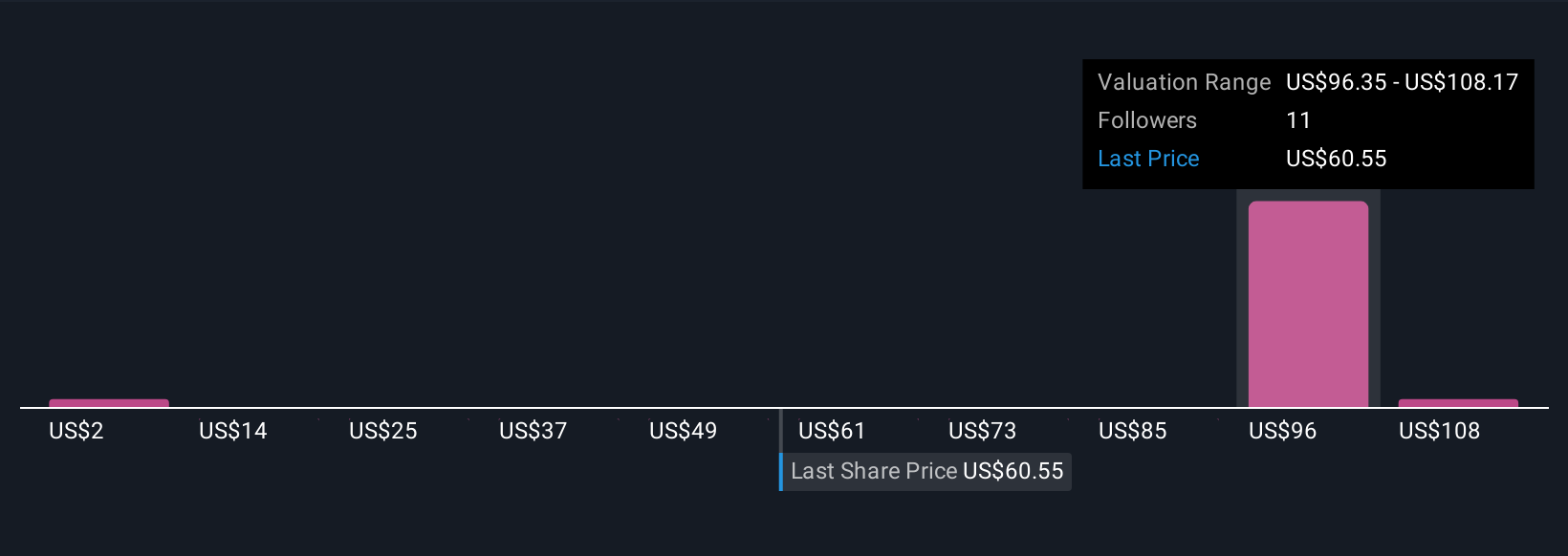

Four members of the Simply Wall St Community set fair values for Nektar Therapeutics ranging from just US$1.74 to US$120. Keep in mind, while opinions differ widely, recent capital-raising activity highlights how funding pressure can weigh on actual business outcomes.

Explore 4 other fair value estimates on Nektar Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own Nektar Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nektar Therapeutics research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Nektar Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nektar Therapeutics' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nektar Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NKTR

Nektar Therapeutics

A biopharmaceutical company, focuses on discovering and developing therapies that selectively modulate the immune system to treat autoimmune disorders in the United States and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives