- United States

- /

- Pharma

- /

- NasdaqCM:NKTR

Nektar Therapeutics (NKTR): Assessing Valuation After High-Profile REZOLVE-AD Data Announced for ACAAI 2025 Meeting

Reviewed by Simply Wall St

Nektar Therapeutics (NKTR) is gaining attention after announcing that new findings from its REZOLVE-AD Phase 2b study in atopic dermatitis will be presented at the ACAAI 2025 Annual Scientific Meeting. The FDA’s Fast Track designation for its lead drug candidate also adds to the company’s momentum this year.

See our latest analysis for Nektar Therapeutics.

All eyes have been on Nektar Therapeutics, and for good reason: the stock has surged over 316% year-to-date, with a remarkable 140% gain in the past quarter, reflecting renewed investor optimism after a string of positive trial announcements and regulatory milestones. While short-term price swings remain volatile, the total shareholder return over five years is still deeply negative, showing how momentum has only recently shifted to the upside.

If biotech breakthroughs are on your radar, you might want to see which other healthcare stocks are gaining traction: See the full list for free.

With all this excitement and a stock price still trading at a significant discount to analyst targets, is Nektar Therapeutics undervalued? Or is the market already factoring in the company’s future growth story?

Most Popular Narrative: 36% Undervalued

With the most closely tracked narrative assigning Nektar Therapeutics a fair value of $93.86, the latest closing price of $60.10 points to a market lagging well behind the bullish outlook. The narrative sharpens in focus as investors weigh sustained clinical momentum against ongoing financial pressures.

Strong initial Phase IIb and ongoing data for REZPEG in atopic dermatitis, combined with a large and growing addressable market (expected to reach nearly $30B by 2033), position Nektar to access significant new revenue streams and improve long-term earnings as the population ages and chronic inflammatory diseases rise globally. FDA Fast Track designation for REZPEG in both atopic dermatitis and alopecia areata gives Nektar an accelerated regulatory path and could potentially reduce time to market and R&D costs. This may improve net margins and cash flow if approvals are achieved ahead of competitors.

Curious about the financial leap underlying this target price? Hidden inside the narrative are huge earnings projections and a multiple rarely seen outside high-growth tech. Which wild assumptions propel Nektar to such a premium? Click through to see the exact forecasts and market logic fueling this valuation.

Result: Fair Value of $93.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued operating losses and heavy reliance on REZPEG's success mean that any setback in trials or commercialization could quickly undermine bullish assumptions.

Find out about the key risks to this Nektar Therapeutics narrative.

Another View: Pricing vs. Peers and Fair Value

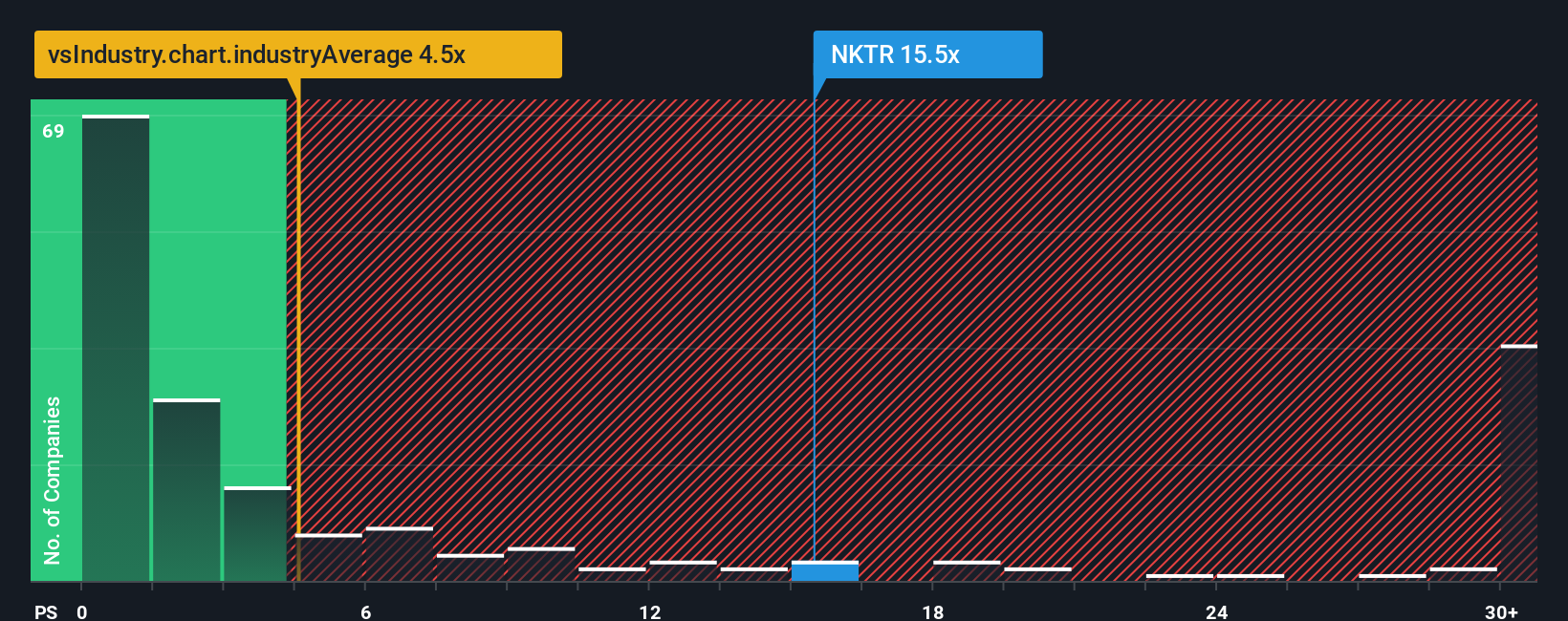

Looking at valuation through the lens of the price-to-sales ratio, Nektar trades at 15.3 times sales while similar U.S. pharmaceutical firms average just 4.6 times. Even the fair ratio, which the market could reasonably move toward, stands at 6.1. This steep gap highlights just how optimistic investors may be about Nektar’s prospects. Is this a setup for future returns, or a sign that expectations are running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nektar Therapeutics Narrative

If you want to dive deeper and piece together your own view of Nektar Therapeutics, it only takes a few minutes to create your own narrative: Do it your way.

A great starting point for your Nektar Therapeutics research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count by seeking out unique opportunities across the market. These carefully chosen ideas could be the edge you need to stay ahead.

- Unlock overlooked value with these 877 undervalued stocks based on cash flows, which offers compelling growth potential at prices the market may have missed.

- Tap into the unstoppable momentum of innovators by checking out these 27 AI penny stocks, advancing artificial intelligence breakthroughs that could redefine entire industries.

- Boost your portfolio’s cash flow by targeting stability and income through these 17 dividend stocks with yields > 3%, featuring companies with consistent, strong yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nektar Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NKTR

Nektar Therapeutics

A biopharmaceutical company, focuses on discovering and developing therapies that selectively modulate the immune system to treat autoimmune disorders in the United States and internationally.

Medium-low risk with concerning outlook.

Similar Companies

Market Insights

Community Narratives