- United States

- /

- Biotech

- /

- NasdaqGS:NBIX

Neurocrine Biosciences (NBIX): Assessing Valuation After Strong Q3 Results and Pipeline Progress

Reviewed by Simply Wall St

Neurocrine Biosciences (NBIX) caught Wall Street’s attention after delivering third quarter results that outpaced expectations. The strong performance was driven by solid revenue and earnings growth from its core drugs INGREZZA and CRENESSITY.

See our latest analysis for Neurocrine Biosciences.

Momentum has been building for Neurocrine Biosciences, with the stock climbing 11.5% over the past 90 days and delivering a strong 1-year total shareholder return of 18.8%. Recent quarterly beats, new clinical trial progress, and sales force expansion have helped reinforce a positive longer-term outlook.

If growth stories like this have you searching for the next opportunity, the Simply Wall St Healthcare Screener is a smart way to discover other promising companies moving in health and biotech. See the full list for free.

With the stock up nearly 12% in just three months and solid analyst price targets ahead, the question is whether Neurocrine Biosciences is still attractively valued or if the recent gains already reflect future growth potential.

Most Popular Narrative: 41.5% Undervalued

Based on the fair value estimate in the leading narrative from kapirey, Neurocrine Biosciences’ recent closing price sits dramatically below its projected worth. With such a wide gap, the market appears to be overlooking major drivers supporting a far higher valuation.

PipelineCrenessity@CRENESSITY Capsule 50/100 MG $766.66 packaging 50 MG 60u $45,999.60 packaging 100 MG 30u. Starts at approximately $21,338.71 USD for a monthly supply. Ingrezza@Ingrezza (valbenazine) As of July 2025, the average pharmacy acquisition cost for Ingrezza capsules in the U.S. is approximately:

- $274.54 per capsule for the 60 mg and 80 mg strengths

- $250.16 per capsule for the 40 mg strength. Other Products: Tetrabenazine Tablet 12.5 MG $62.52, Austedo Tablet 6 MG $100.06, Austedo XR Tablet 6 MG $100.06, Xenazine Tablet 12.5 MG $227.88. Assumptions Risks

Can a company’s earnings justify such a steep premium? This narrative leans on bullish revenue and profit growth, plus an aggressive earnings multiple that you’d usually see reserved for the market’s most hyped stories. Curious what key projections are making the case for this sky-high fair value? Dive deeper and see which assumptions drive this bold gap between price and value.

Result: Fair Value of $244.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any regulatory setbacks or increased competition could quickly undermine the optimistic outlook and challenge the current valuation narrative.

Find out about the key risks to this Neurocrine Biosciences narrative.

Another View: Market Multiples Show a Hefty Price Tag

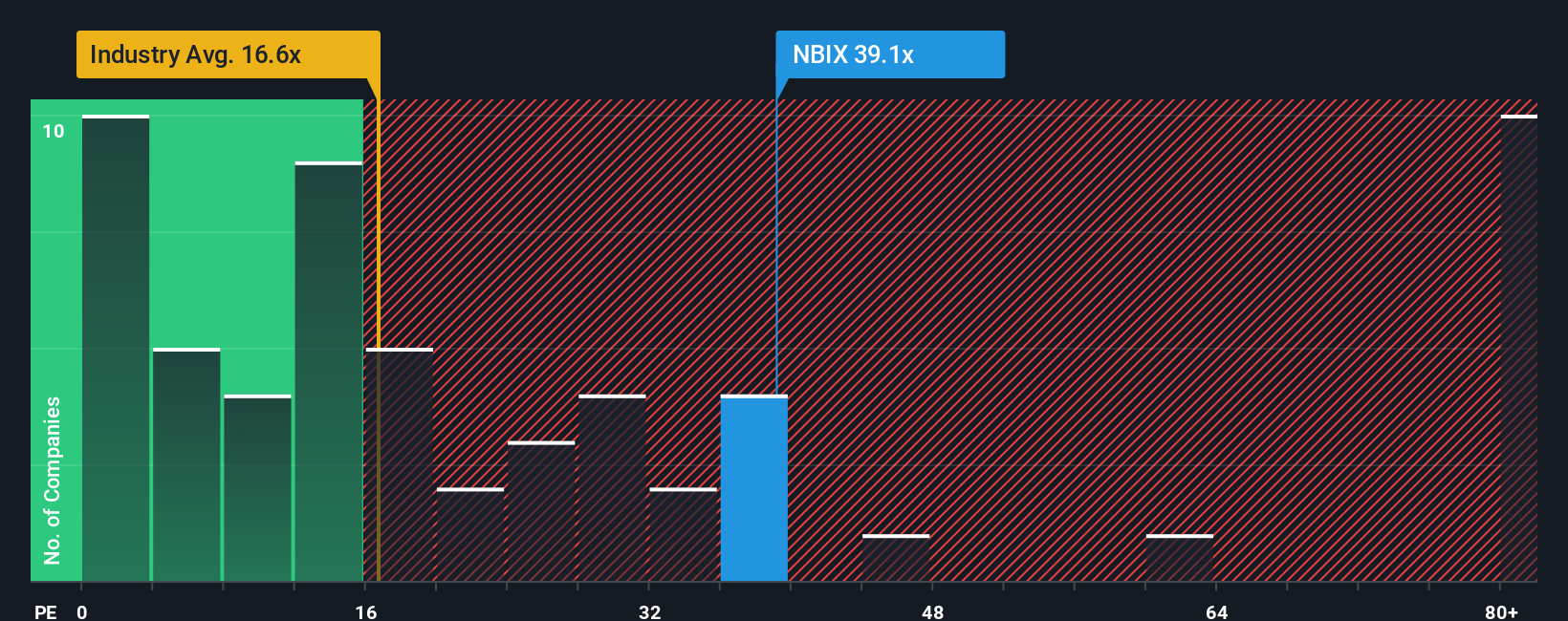

Despite the narrative pointing to big upside, Neurocrine Biosciences trades at a price-to-earnings ratio of 33.4, nearly double the US Biotechs industry average of 17.7 and higher than comparable peers. The fair ratio for this stock is 25.2, meaning shares could be exposed if the market shifts closer to typical valuations. Is all that optimism already baked in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Neurocrine Biosciences Narrative

If you see the story differently or want to dig into the numbers your own way, you can build and share your own view in just a few minutes, right from the platform. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Neurocrine Biosciences.

Looking for More Ways to Spark Your Portfolio?

Smart investors always have an edge by tracking emerging trends. Set yourself up for tomorrow’s winners by tapping straight into these handpicked stock opportunities below.

- Tap into next-generation finance and track real businesses making strides in blockchain technology with these 81 cryptocurrency and blockchain stocks.

- Unlock generous income potential and find stocks with yields surpassing 3% using these 20 dividend stocks with yields > 3%.

- Catch the wave of healthcare revolution, where artificial intelligence is powering innovation, through these 33 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurocrine Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIX

Neurocrine Biosciences

Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives