- United States

- /

- Biotech

- /

- NasdaqGS:NBIX

A Look at Neurocrine Biosciences (NBIX) Valuation After Setback in Depression Drug Trial

Reviewed by Simply Wall St

Neurocrine Biosciences (NBIX) recently reported results from its Phase 2 trial of NBI-1070770 for major depressive disorder. The investigational drug did not meet the primary endpoint. This outcome could impact the company's expansion plans.

See our latest analysis for Neurocrine Biosciences.

Shares of Neurocrine Biosciences have pulled back slightly in the past month, likely reflecting investor reaction to the disappointing Phase 2 trial results for NBI-1070770. Despite recent challenges, the stock still delivered an 11% total shareholder return over the past year. This suggests that long-term momentum remains intact even as short-term sentiment wavers.

If you’re watching how the latest clinical news is shaping the sector, don’t miss your chance to explore breakthroughs and growth trends with our healthcare stock screener: See the full list for free.

With shares now trading at a notable discount to analyst price targets, investors may be wondering whether Neurocrine Biosciences is undervalued after its recent setback, or if the market is already factoring in its future growth potential.

Most Popular Narrative: 43% Undervalued

The most widely followed narrative, according to kapirey, sees Neurocrine Biosciences trading well below its projected fair value, with significant upside potential from the last close price. This bold viewpoint pivots the stock's current weakness into possible opportunity and sets the stage for a pivotal outlook on future performance.

Risks and uncertainties associated with Neurocrine Biosciences business and finances in general, risks and uncertainties associated with the commercialization of INGREZZA and CRENESSITY. Risks related to the development of product candidates.

Want to know what powers this striking valuation gap? The narrative hinges on ambitious revenue growth and an aggressive future profit multiple that hint at a dramatic turnaround. Could one underlying factor tip the balance for fair value? Uncover the driving force behind this estimate. Your next move could depend on what you discover.

Result: Fair Value of $244.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in regulatory approvals or increased competition from generics could quickly challenge the current outlook and change Neurocrine's valuation story.

Find out about the key risks to this Neurocrine Biosciences narrative.

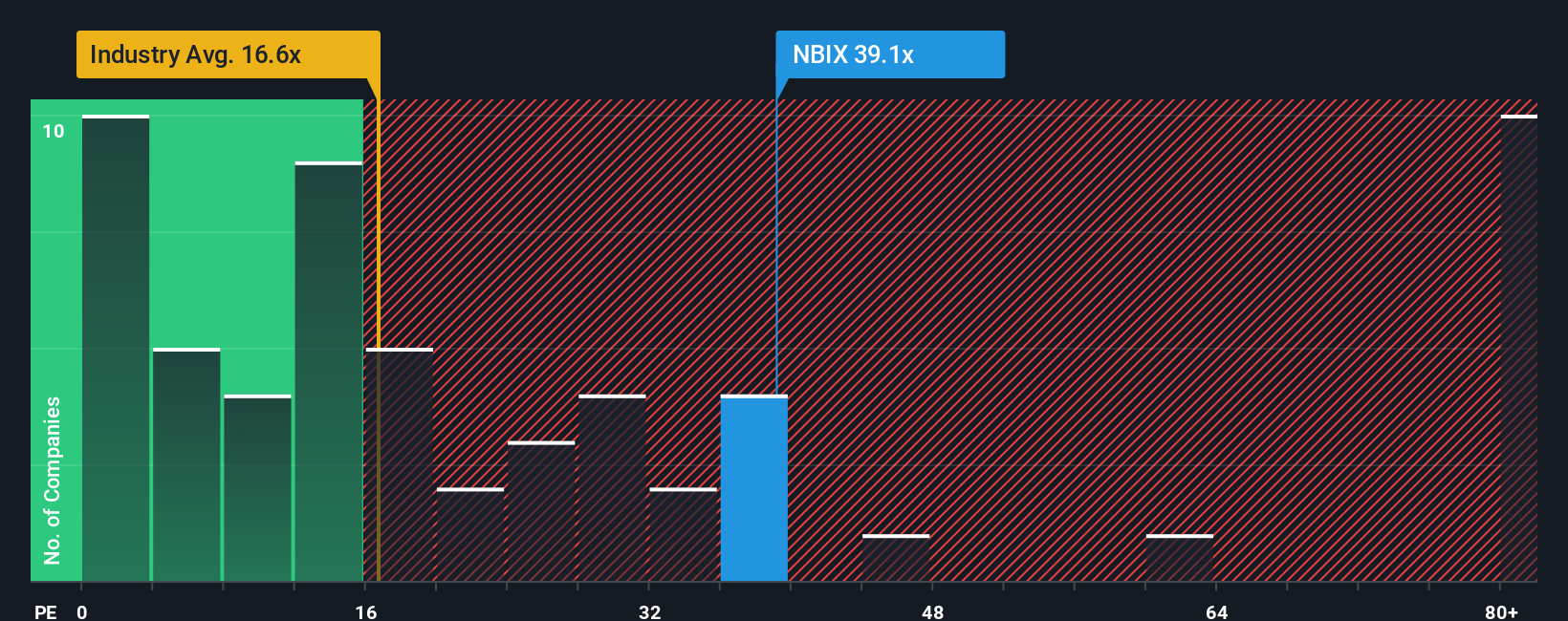

Another View: Valuation by Market Multiples

Looking at market multiples gives a starkly different perspective. Neurocrine Biosciences trades at a price-to-earnings ratio of 32.4x, much higher than both the US biotech industry average (17.4x), its peer average (17.2x), and even the fair ratio of 25.1x. This gap signals higher valuation risk if momentum wanes. Could sentiment change faster than fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Neurocrine Biosciences Narrative

If you prefer to draw your own conclusions or want to dive deeper into the numbers, you can shape your own perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Neurocrine Biosciences.

Looking for more investment ideas?

Great opportunities abound for those ready to move fast. Don’t let unique stock stories pass you by when market leadership could be just a click away.

- Kickstart your search for overlooked value with these 919 undervalued stocks based on cash flows, which may be trading below their fair price and primed for a turnaround.

- Boost your future income by tapping into these 16 dividend stocks with yields > 3%, offering attractive yields and reliable dividend histories for steady growth.

- Ride the innovation wave by checking out these 26 AI penny stocks, which harness artificial intelligence to transform industries and spark new investment trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurocrine Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIX

Neurocrine Biosciences

Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives