- United States

- /

- Biotech

- /

- NasdaqGM:NAMS

Does NewAmsterdam Pharma's Sharp Q3 Revenue Drop Reshape the Bull Case for NAMS?

Reviewed by Sasha Jovanovic

- On November 5, 2025, NewAmsterdam Pharma reported third quarter results showing sales fell to US$348,000 from US$29.11 million a year earlier, with net loss widening to US$72.01 million.

- Despite the sharp quarterly setback, the company's nine-month net loss and loss per share were smaller compared to the same period last year.

- We’ll explore how the sharp revenue contraction in the quarter shapes the current investment narrative for NewAmsterdam Pharma.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is NewAmsterdam Pharma's Investment Narrative?

The investment case for NewAmsterdam Pharma has largely centred on the expectation that successful clinical milestones and regulatory progress for obicetrapib could drive future growth, as shown by recent positive Phase 3 results and ongoing commercial partnerships. However, the stark decline in Q3 sales to just US$348,000 and the significant increase in net loss point to unexpected volatility in near-term revenue streams, raising questions about sustainability while awaiting potential approvals and launches. This sharp setback could shift investor focus from mainly clinical catalysts to short-term financial risks, particularly the company’s ability to manage cash burn and maintain operational momentum between regulatory and commercial milestones. While the broader strategy remains on track, the magnitude of the recent revenue contraction could prompt a reassessment of risk, especially if this signals deeper issues in pipeline monetization or timing.

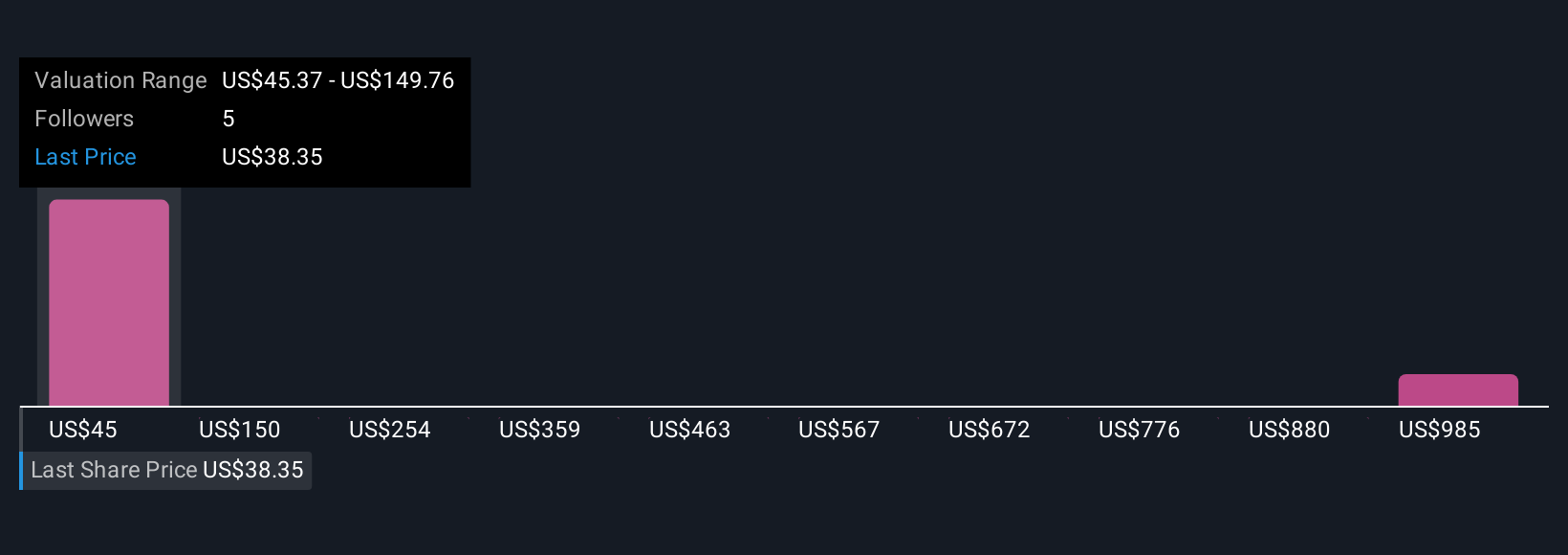

But, what happens if this recent revenue plunge isn't a one-off event? NewAmsterdam Pharma's shares have been on the rise but are still potentially undervalued by 44%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on NewAmsterdam Pharma - why the stock might be a potential multi-bagger!

Build Your Own NewAmsterdam Pharma Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NewAmsterdam Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NewAmsterdam Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NewAmsterdam Pharma's overall financial health at a glance.

No Opportunity In NewAmsterdam Pharma?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewAmsterdam Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NAMS

NewAmsterdam Pharma

A late-stage biopharmaceutical company, develops therapies to enhance patient care in populations with metabolic disease.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives