- United States

- /

- Life Sciences

- /

- NasdaqCM:NAGE

A Look at Niagen Bioscience (NAGE) Valuation After New Skincare Launch and Long COVID Study Results

Reviewed by Simply Wall St

Niagen Bioscience (NAGE) is in focus after unveiling Tru Niagen Beauty, a new supplement that taps into the NAD+ skincare trend. The company also shared peer-reviewed clinical evidence on Niagen's benefits for individuals with long COVID.

See our latest analysis for Niagen Bioscience.

Momentum for Niagen Bioscience has varied this year. After surging earlier in 2025, the stock has seen some pullback, with a 1-year total shareholder return of -9.8%. Despite this, the stock has shown a year-to-date share price gain, and its three-year total shareholder return of over 300% signals long-term growth potential. Recent product launches and positive clinical trial data may help restore investor confidence and support momentum.

If you’re curious to see which other healthcare innovators are gaining traction, don’t miss the discovery opportunity with our handpicked list: See the full list for free.

Given Niagen Bioscience's recent innovation streak and strong multi-year returns, the key question is whether the current share price reflects untapped value, or if the market has already priced in the company's future growth trajectory.

Most Popular Narrative: 57% Undervalued

The most widely followed narrative sees substantial upside compared to the last close of $6.89, framing the current price as far below fair value. Anticipated catalysts and a robust growth outlook set the narrative apart from market expectations.

Expansion into the pharmaceutical-grade Niagen ingredient market, including the launch of Niagen IV and injections at clinics, is expected to drive future revenue growth due to increasing demand and the anticipated resolution of supply chain issues. Continued e-commerce growth, supported by a significant increase in the Shopify platform's performance and a rising awareness of NAD-boosting products, suggests potential for further revenue growth and improved net margins due to the higher profitability of direct-to-consumer channels.

Want to know what powers such a bold valuation gap? This narrative hinges on major shifts in product strategy and substantial assumptions about future sales margins. Curious about the projected profit forecasts and the multiples behind this fair value? Dive in for the precise figures that have investors buzzing.

Result: Fair Value of $16.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intense competition in the NAD+ market and ongoing supply chain challenges could still threaten the company’s ability to deliver on growth expectations.

Find out about the key risks to this Niagen Bioscience narrative.

Another View: What Do the Numbers Say?

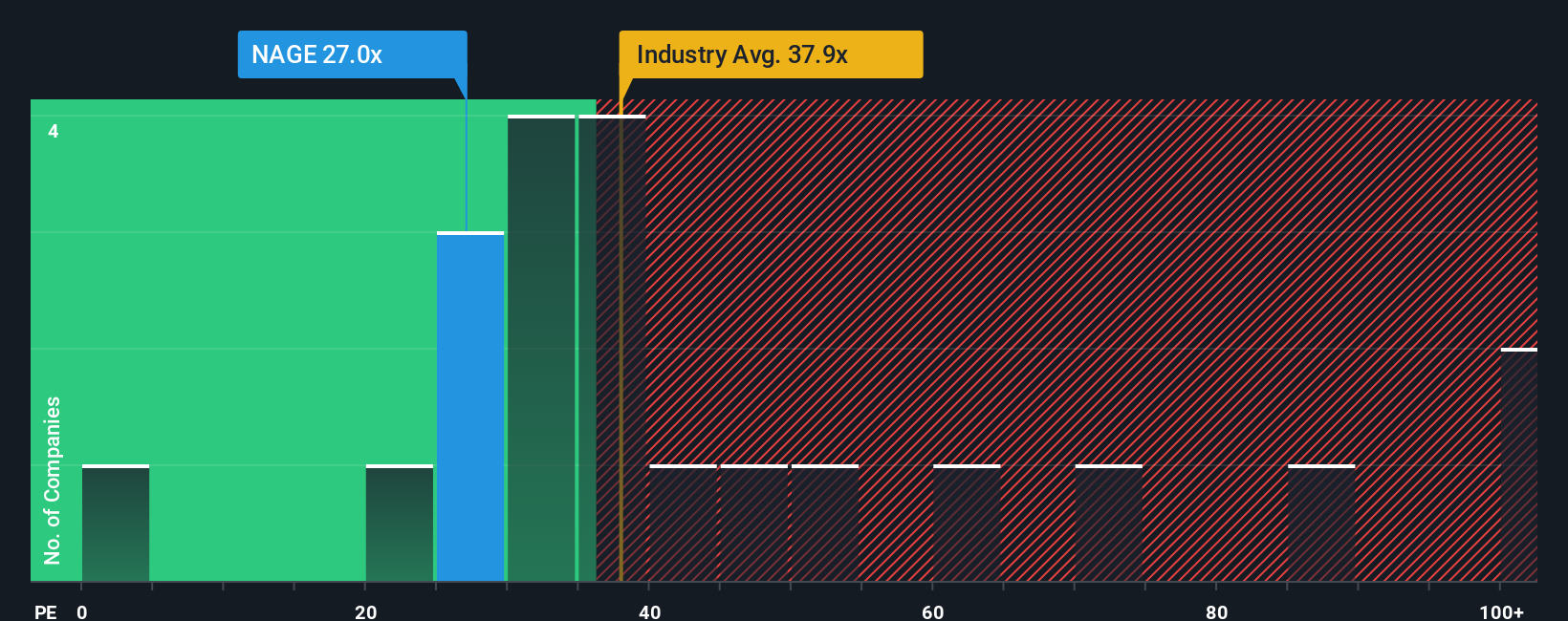

Valuation based on the latest price-to-earnings ratio tells a more cautious story. Niagen Bioscience trades at 27x, which is higher than its fair ratio of 25.4x, but significantly lower than the industry average of 37.9x and far cheaper than peers averaging 71.8x. This middle ground could suggest either a hidden opportunity or a warning sign. Are investors too optimistic or not optimistic enough?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Niagen Bioscience Narrative

If you want to examine the numbers and challenge the consensus, you can quickly piece together your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Niagen Bioscience.

Looking for More Smart Investment Ideas?

Level up your research with fresh opportunities that could reshape your portfolio. These curated ideas are too important to miss out on today.

- Spot financial resilience by evaluating solid yields and long-term potential with these 15 dividend stocks with yields > 3%, which offer consistent income above 3%.

- Get ahead of innovation trends by reviewing these 25 AI penny stocks, powering breakthroughs in automation, data intelligence, and disruptive digital transformation.

- Capitalize on unique pricing windows by finding these 929 undervalued stocks based on cash flows, which stand out for value based on underlying cash flows and market mispricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Niagen Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NAGE

Niagen Bioscience

Operates as a bioscience company engages in developing healthy aging products.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success