- United States

- /

- Biotech

- /

- NasdaqGM:MNKD

MannKind Corporation (NASDAQ:MNKD) Surges 35% Yet Its Low P/S Is No Reason For Excitement

MannKind Corporation (NASDAQ:MNKD) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.6% over the last year.

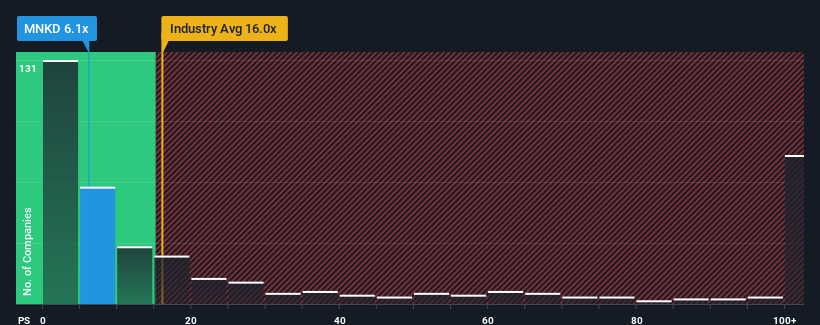

Although its price has surged higher, MannKind may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 6.1x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 16x and even P/S higher than 75x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for MannKind

How Has MannKind Performed Recently?

MannKind could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MannKind.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, MannKind would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 99% gain to the company's top line. The latest three year period has also seen an excellent 205% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 24% per year as estimated by the six analysts watching the company. That's shaping up to be materially lower than the 277% per year growth forecast for the broader industry.

With this information, we can see why MannKind is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From MannKind's P/S?

Shares in MannKind have risen appreciably however, its P/S is still subdued. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of MannKind's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware MannKind is showing 2 warning signs in our investment analysis, and 1 of those is potentially serious.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:MNKD

MannKind

A biopharmaceutical company, focuses on the development and commercialization of therapeutic products and services for endocrine and orphan lung diseases in the United States.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives