- United States

- /

- Biotech

- /

- NasdaqGM:MIRM

Is Mirum Pharmaceuticals Still a Good Value After Recent Clinical Milestones and 80% Stock Surge?

Reviewed by Bailey Pemberton

- Wondering whether Mirum Pharmaceuticals might be a hidden bargain or already fairly priced? If evaluating stock value is on your radar, you are in the right place for a deep dive into what is driving this company.

- Mirum’s stock has had an impressive run recently, up 72.8% year-to-date and soaring 79.6% over the past year. However, the last 30 days have seen a minor dip of just 0.4%.

- Recent headlines about industry partnerships and regulatory advancements have put Mirum Pharmaceuticals in the spotlight. These factors have fueled upbeat sentiment following several major clinical milestones. The company’s progress in drug pipelines has helped explain the strong momentum behind recent price moves.

- When it comes to valuation, Mirum scores a 4 out of 6 on our value checklist, which you can explore in detail here. Next, we will break down how analysts assess value using traditional methods. Stay tuned to discover an even more insightful approach to evaluating Mirum’s true worth.

Approach 1: Mirum Pharmaceuticals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) analysis estimates what a company’s shares should be worth today by extrapolating future cash flows and then discounting them back to their present value. For Mirum Pharmaceuticals, this means looking at the amount of cash the company is expected to generate over the next several years and adjusting for the time value of money.

Currently, Mirum reports a free cash flow (FCF) of -$13 million, indicating ongoing investments and developmental expenses typical of growth-stage biotech firms. Analyst estimates project a significant ramp-up in annual free cash flow. By 2029, FCF is forecast to reach approximately $297 million. The DCF model draws on both analyst-provided figures for the next five years and further extrapolates growth in subsequent years.

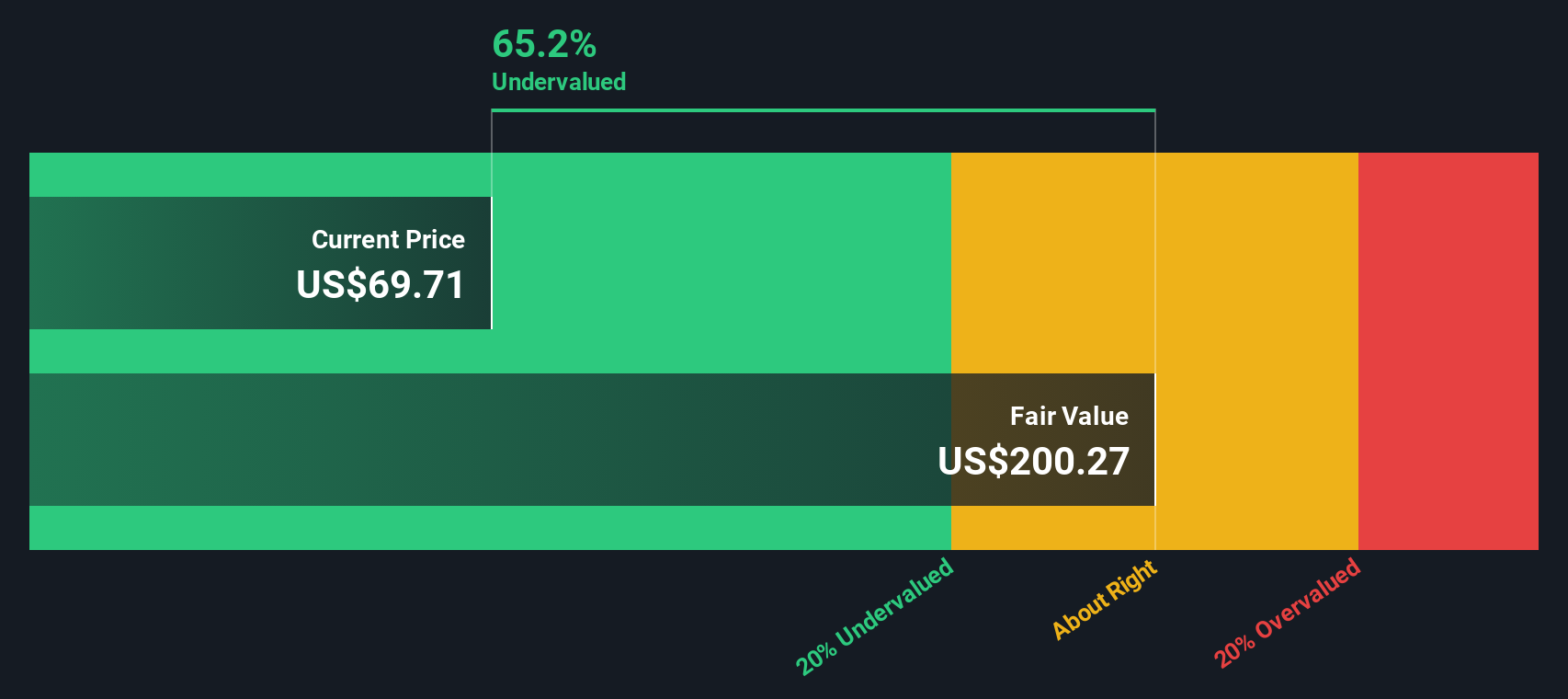

Based on the 2 Stage Free Cash Flow to Equity model, the intrinsic value for Mirum Pharmaceuticals is estimated at $208.38 per share. The current market price represents a 65.1% discount to this fair value, so the DCF suggests that the stock is considerably undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mirum Pharmaceuticals is undervalued by 65.1%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Mirum Pharmaceuticals Price vs Sales

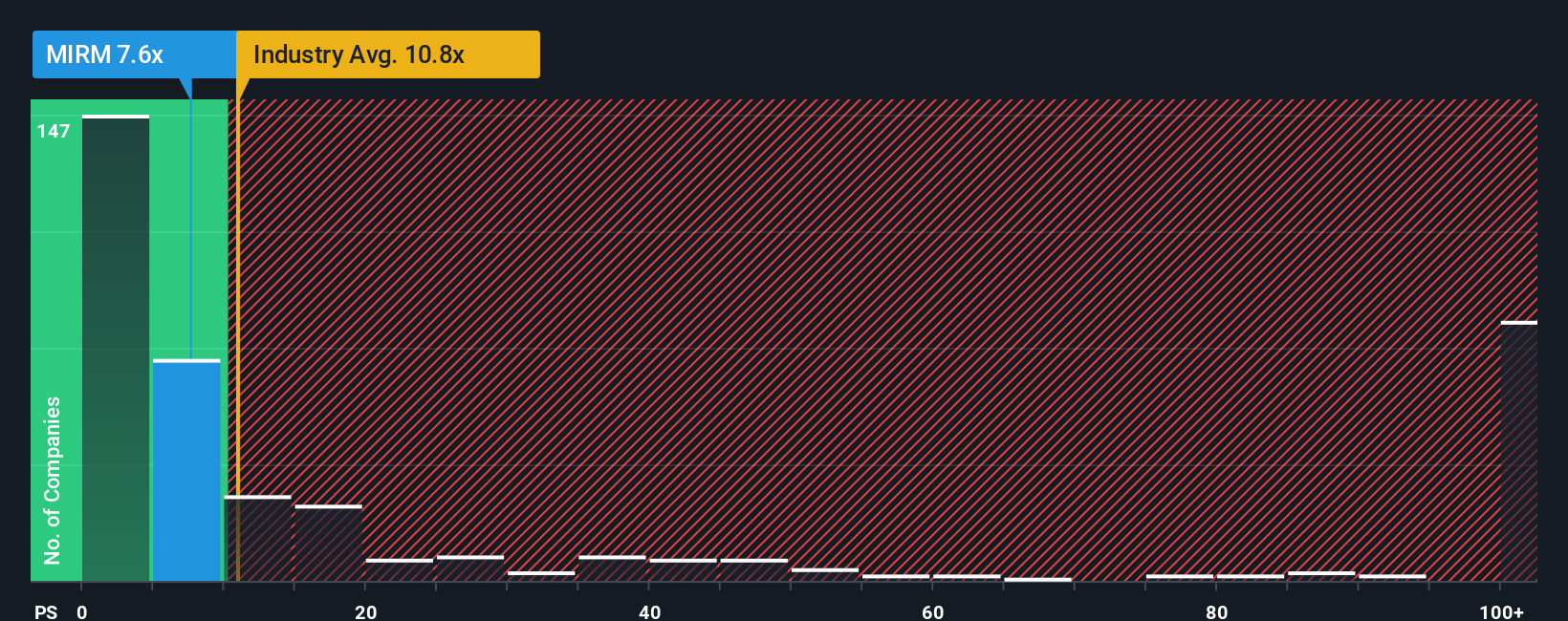

For biotech companies like Mirum Pharmaceuticals, which are not yet consistently profitable, the Price-to-Sales (P/S) ratio is often the preferred valuation multiple. The P/S ratio provides a straightforward way to compare companies regardless of their current profit levels, and it is particularly useful in industries where earnings are volatile or still developing.

The "normal" or fair P/S ratio is influenced by expectations for future growth and the underlying risk profile of the business. Fast-growing companies with a clear pathway to profitability often deserve higher P/S multiples than more mature or riskier firms. For context, Mirum currently trades at a P/S ratio of 8.5x. This is below both the Biotechs industry average of 10.8x and the peer group average of 10.3x, indicating Mirum trades at a discount to its closest benchmarks.

Simply Wall St’s proprietary "Fair Ratio" provides an even more tailored valuation lens. Unlike simple industry comparisons, the Fair Ratio (6.96x for Mirum) takes into account multiple factors such as expected revenue growth, profit margins, market cap, and company-specific risks. This results in a more nuanced benchmark tailored to Mirum’s situation, rather than relying solely on broad averages that may not capture the company's unique dynamics.

Comparing Mirum’s actual P/S ratio of 8.5x against its Fair Ratio of 6.96x suggests the current stock price is somewhat elevated relative to its underlying fundamentals.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mirum Pharmaceuticals Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, user-friendly way to tell your story about a company, laying out your perspective on where Mirum Pharmaceuticals is headed, why you believe it will grow (or not), and what those opinions mean for future revenue, earnings, and a fair value estimate. Narratives help you connect the company’s business story to the numbers by turning your assumptions and beliefs into a clear financial forecast, which then produces your own fair value calculation.

Available to everyone in the Simply Wall St Community, Narratives are designed to help you make more informed buy and sell decisions. They show at a glance whether your Fair Value is above or below today’s share price, and update automatically as new news, earnings, or developments are announced. Different investors may create vastly different Narratives. For example, some expect Mirum Pharmaceuticals could be worth as much as $89 if it delivers on pipeline expansion and execution, while more cautious perspectives currently place fair value closer to $53 based on concerns about competition and revenue concentration. Narratives put you in control of your decision process, bridging company updates and your personal outlook with dynamic, data-driven valuation.

Do you think there's more to the story for Mirum Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MIRM

Mirum Pharmaceuticals

A biopharmaceutical company, focuses on the development and commercialization of novel therapies for debilitating rare and orphan diseases.

Good value with reasonable growth potential.

Market Insights

Community Narratives