- United States

- /

- Life Sciences

- /

- NasdaqGS:MEDP

Medpace (MEDP): Evaluating Valuation After Strong 22% Share Price Rally

Reviewed by Simply Wall St

Medpace Holdings (MEDP) has seen fresh attention from investors recently, with its stock posting a strong showing over the past month. Shares gained more than 22% during this period, which highlights ongoing momentum in the clinical research sector.

See our latest analysis for Medpace Holdings.

Medpace’s surge over the past month is just the latest in a string of gains. Its share price return sits at an impressive 80.79% for the year to date, and the 12-month total shareholder return is even higher at 83.27%. With momentum clearly building and recent highs reflecting stronger demand for clinical research, the company’s long-term track record suggests investors are noticing both its steady growth and sustained profitability.

If this kind of momentum has you searching for what else is accelerating, it’s a smart moment to check out See the full list for free.

With Medpace’s impressive run, some investors are wondering if its recent gains have outpaced the fundamentals or if there is still room for upside ahead. This raises the question of whether the stock is undervalued or already priced for perfection.

Most Popular Narrative: 32.7% Overvalued

Medpace closed at $605.20, but according to the most widely followed narrative, its fair value is set at $456 per share. That puts the latest price well above the level analysts believe is justified, raising questions about the strength of the company’s ongoing rally and whether current optimism has already been factored in.

Despite strong topline growth, win rates for new business were down and backlog is declining (down 1.8% year-over-year), suggesting competitive pressures and a lack of large contract wins may negatively impact future bookings and limit revenue and earnings visibility beyond 2025.

Want to know which financial levers support this elevated valuation? The fair value hinges on bold projections about revenue momentum, margin trends, and a powerful industry shift. Curious how analyst estimates on future profits and growth justify the gap between price and value? There is more beneath the surface; only the full narrative reveals the numbers behind this call.

Result: Fair Value of $456 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent strong demand for clinical trials or effective capital allocation could change the outlook and support continued growth for Medpace despite current concerns.

Find out about the key risks to this Medpace Holdings narrative.

Another View: Discounted Cash Flow Puts Value Higher

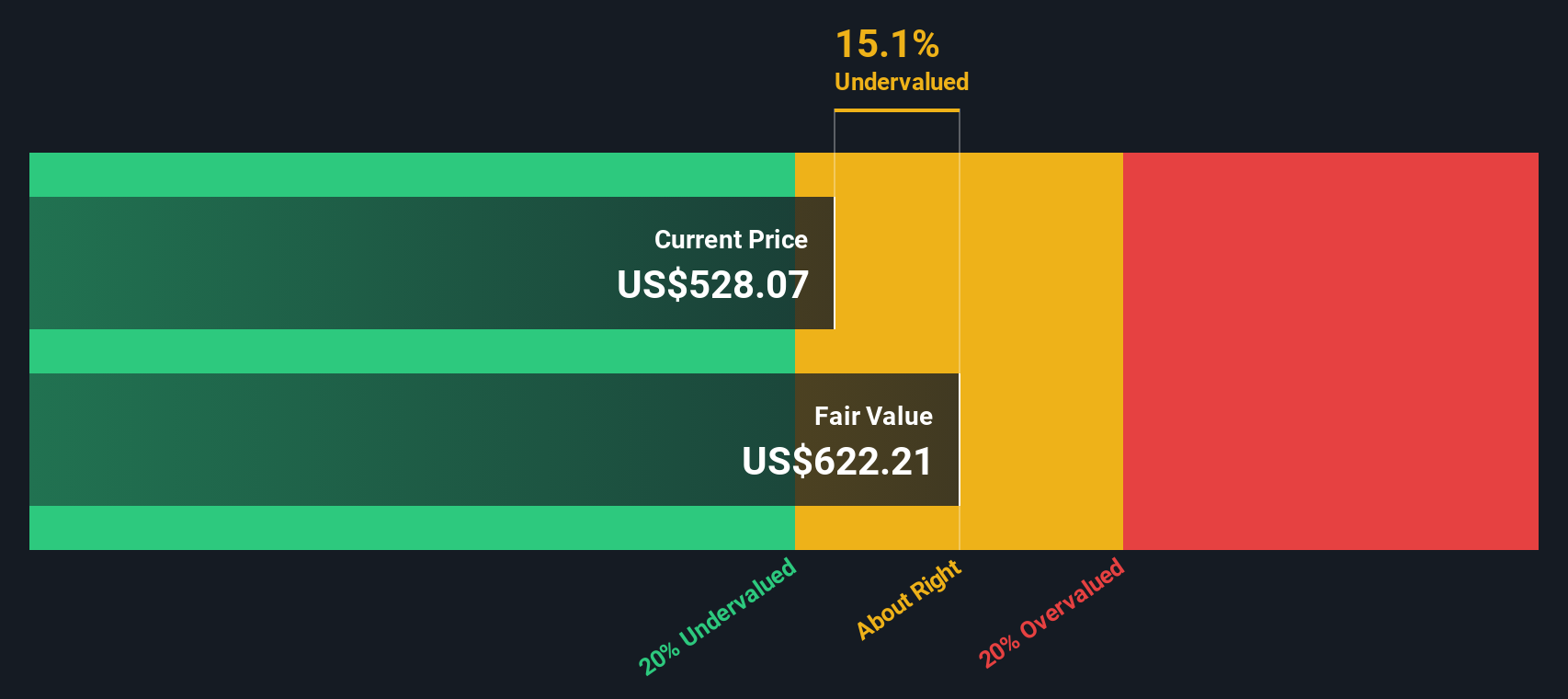

While analysts using market multiples see Medpace as overvalued, our SWS DCF model suggests the opposite. Based on projected cash flows and a fair value estimate of $714.90 per share, Medpace is actually trading about 15% below its intrinsic value. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Medpace Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Medpace Holdings Narrative

Whether you want to challenge the prevailing view or explore your own insights, you can craft a personalized narrative for Medpace in just a few minutes, letting the data guide your story. Do it your way

A great starting point for your Medpace Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. Switch up your strategy and tap into new trends using unique screeners that surface standout stocks from every corner of the market.

- Capitalize on emerging artificial intelligence by researching these 27 AI penny stocks positioned for transformative growth and innovation across multiple industries.

- Boost your income potential by targeting these 17 dividend stocks with yields > 3% with attractive yields and strong dividend histories.

- Take the lead in digital finance by analyzing these 80 cryptocurrency and blockchain stocks that are shaping tomorrow’s world through blockchain and cryptocurrency advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MEDP

Medpace Holdings

Provides clinical research-based drug and medical device development services in North America, Europe, and Asia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives