- United States

- /

- Biotech

- /

- NasdaqGS:MDGL

How Investors May Respond To Madrigal Pharmaceuticals (MDGL) Securing First EU Approval for MASH Therapy

Reviewed by Simply Wall St

- On August 19, 2025, Madrigal Pharmaceuticals announced that the European Commission had granted conditional marketing authorization for Rezdiffra as the first and only approved therapy for adults with noncirrhotic MASH with moderate to advanced fibrosis in the European Union.

- This milestone opens the door to a significant new market, with Madrigal estimating 370,000 patients currently diagnosed and under specialist care for MASH across Europe.

- We'll examine how this landmark European approval, which confers first-mover advantage in the MASH market, impacts Madrigal's investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Madrigal Pharmaceuticals Investment Narrative Recap

For those considering Madrigal Pharmaceuticals, the core investment thesis centers on the commercial success and broad adoption of Rezdiffra, particularly as regulatory milestones unfold. The August 19, 2025 European Commission approval meaningfully accelerates the company's entry into a sizeable new EU market and strengthens the near-term catalyst of international launch momentum, while operational and reimbursement execution in Europe remains the most important risk in the short term.

Of the company's recent announcements, the extension of Rezdiffra's U.S. patent protection until 2045 stands out as especially relevant. This additional period of exclusivity secures Madrigal's first-mover advantage at a time when European launch activities and associated revenue ramp are moving to the forefront of its growth story.

Yet, in contrast to these growth drivers, investors should be aware of challenges tied to reimbursement and payer acceptance across diverse EU markets, especially as...

Read the full narrative on Madrigal Pharmaceuticals (it's free!)

Madrigal Pharmaceuticals is projected to reach $2.5 billion in revenue and $862.7 million in earnings by 2028. This outlook assumes annual revenue growth of 69.3% and an earnings increase of $1.14 billion from current earnings of -$281.9 million.

Uncover how Madrigal Pharmaceuticals' forecasts yield a $449.57 fair value, a 15% upside to its current price.

Exploring Other Perspectives

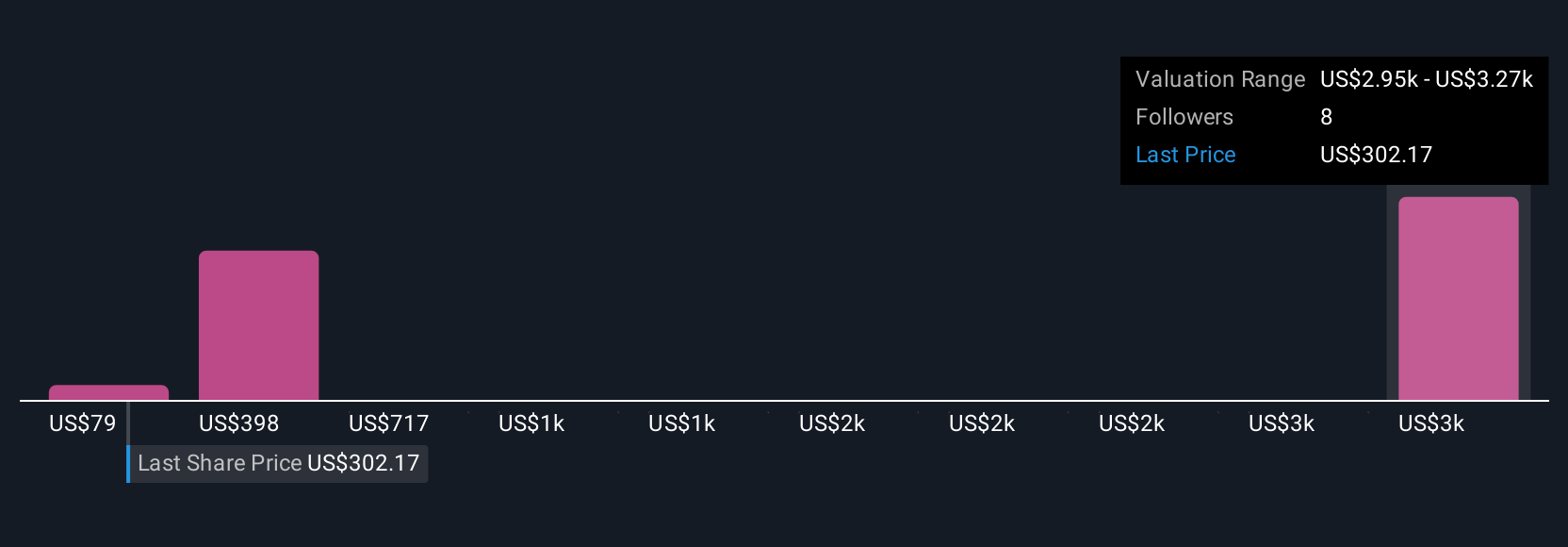

Simply Wall St Community estimates for Madrigal’s fair value range widely from US$449 to nearly US$2,981, based on just two individual forecasts. With operational hurdles in Europe as a key risk, you may want to consider why outlooks for future performance often diverge so dramatically.

Explore 2 other fair value estimates on Madrigal Pharmaceuticals - why the stock might be worth just $449.57!

Build Your Own Madrigal Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Madrigal Pharmaceuticals research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Madrigal Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Madrigal Pharmaceuticals' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDGL

Madrigal Pharmaceuticals

A biopharmaceutical company, focuses on delivering novel therapeutics for metabolic dysfunction-associated steatohepatitis (MASH) in the United States.

High growth potential and good value.

Market Insights

Community Narratives