- United States

- /

- Biotech

- /

- NasdaqGS:MDGL

Assessing Madrigal Pharmaceuticals After FDA Approval and an 82% Share Price Surge

Reviewed by Bailey Pemberton

- Wondering if Madrigal Pharmaceuticals could be a smart buy at today's prices? You are not alone, especially with so much market chatter about where it's really worth putting your money right now.

- The stock has been on a serious roll, jumping 11.6% in the last week, 26.1% over the past month, and an eye-catching 76.4% year to date. This has culminated in an impressive 82.4% rally over the past year.

- Much of this momentum came after Madrigal received FDA approval for its liver disease drug, which has accelerated excitement among both investors and analysts. As anticipation builds around new treatment launches and expanded drug coverage, the market appears to be pricing in even more good news.

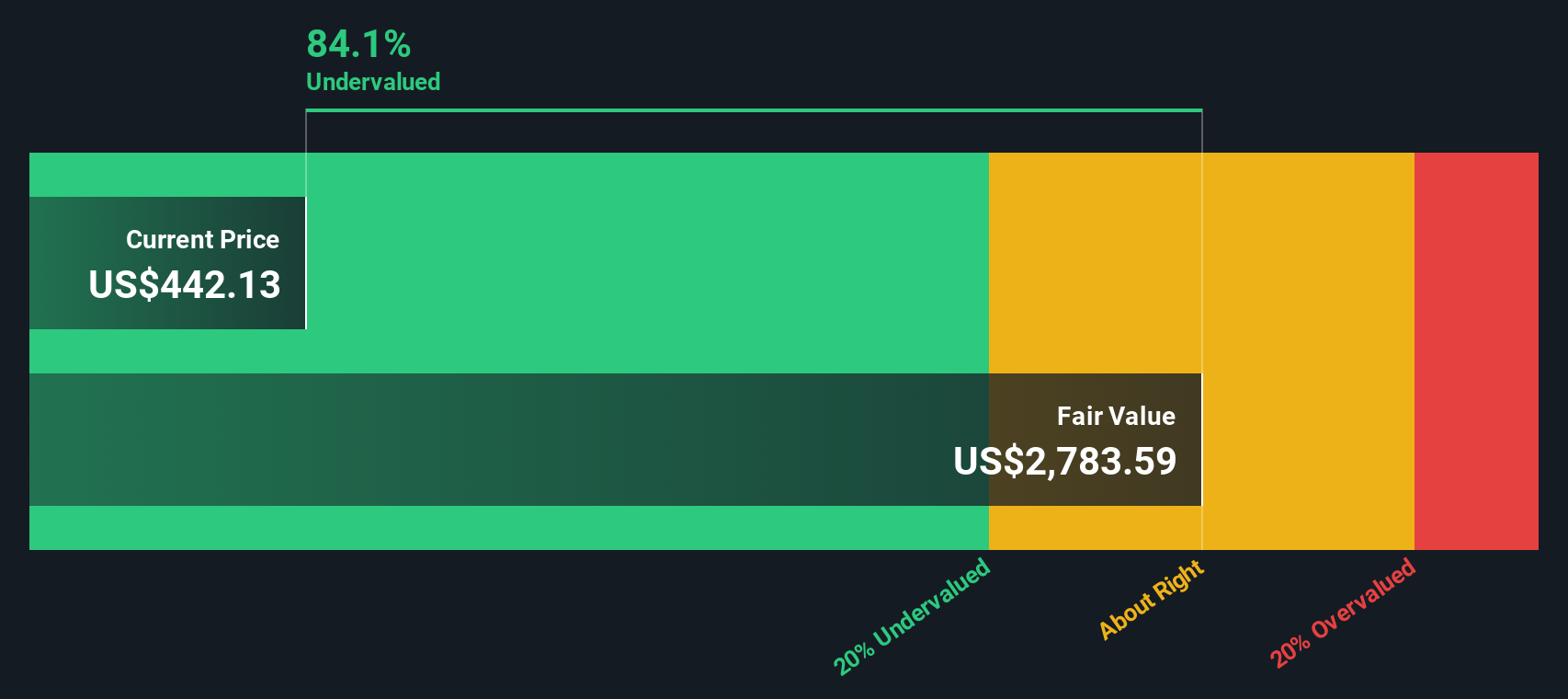

- Despite these big moves, Madrigal scores a 4 out of 6 on our valuation checks, indicating it is undervalued in most, but not all, key ways. To better understand this, let's break down the common valuation methods and discuss which one may be the best way to judge value.

Approach 1: Madrigal Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a tried-and-true approach for estimating the true value of a business. It works by forecasting all the cash that a company will generate in the future and then bringing those cash flows back to their present value using a discount rate. This helps investors understand what the business might be worth today based on its projected ability to generate cash.

For Madrigal Pharmaceuticals, the DCF model uses a two-stage method based on future free cash flow projections. As of the last twelve months, Madrigal reported negative free cash flow of $164 million, which is common for innovative biotechs in periods of heavy investment. However, analysts expect a rapid turnaround, with free cash flow projected to climb to over $1.6 billion by 2029. These near-term and long-term estimates, analyst-driven for the first five years and then extended by Simply Wall St’s extrapolation, suggest strong future growth as new products launch and sales ramp up.

According to this DCF analysis, the intrinsic value of Madrigal Pharmaceuticals is estimated at $2,584.45 per share. With the current price implying a 78.6% discount to that value, the stock appears to be significantly undervalued from a cash flow perspective.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Madrigal Pharmaceuticals is undervalued by 78.6%. Track this in your watchlist or portfolio, or discover 894 more undervalued stocks based on cash flows.

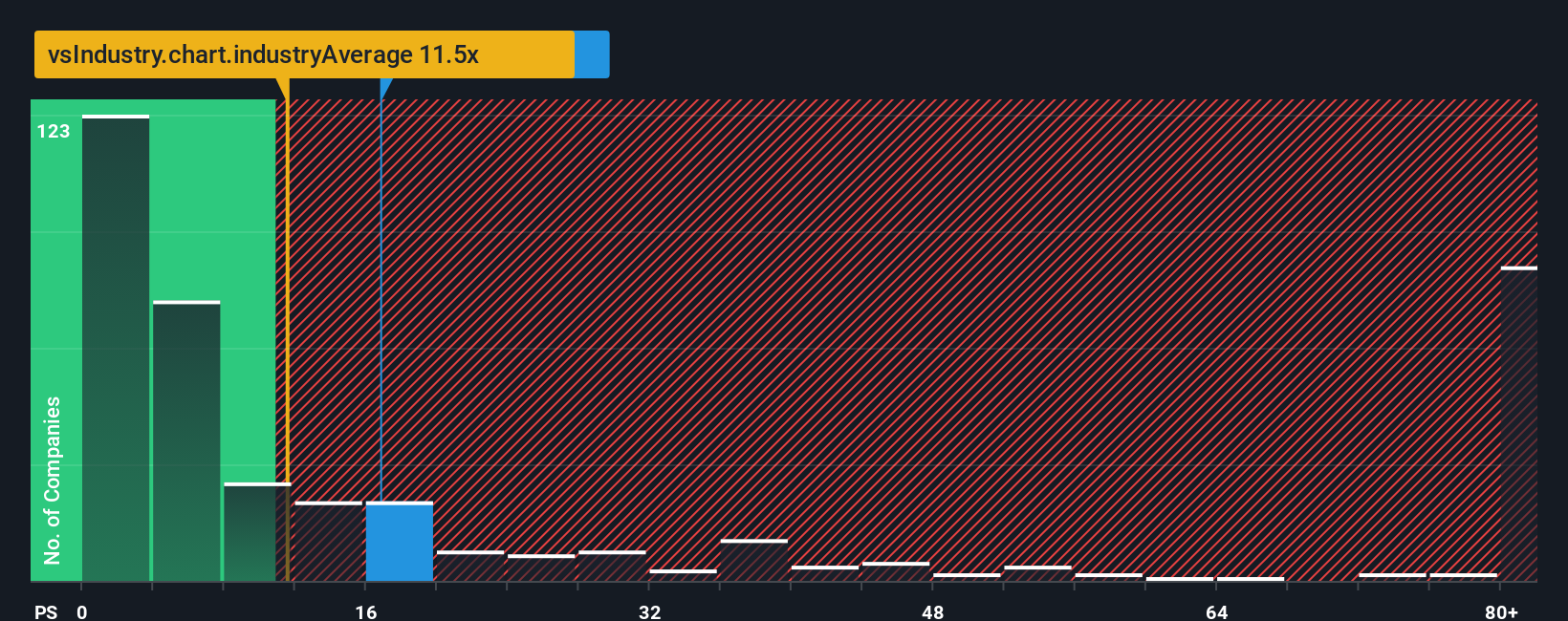

Approach 2: Madrigal Pharmaceuticals Price vs Sales

The Price-to-Sales (P/S) ratio is a popular metric for valuing biotech stocks, especially those that are not yet consistently profitable. In stages where companies are investing heavily for growth or awaiting the full commercial impact of a new product launch, earnings may be negative, making P/S more useful than Price-to-Earnings. The P/S ratio helps investors gauge how much the market is valuing the company’s actual revenue stream, which can be a good indicator for high-growth or early-stage companies like Madrigal Pharmaceuticals.

Growth expectations and company-specific risks play a major role in what is considered a "normal" P/S ratio. Companies expected to grow sales at a rapid pace, or those with lower operational risk, often command higher P/S multiples. On the other hand, firms with slower growth or elevated risks trade at a discount to their peers on this metric.

Currently, Madrigal Pharmaceuticals trades at a P/S ratio of 17.0x. For context, this is above the biotech industry average of 11.9x but below its peer group average of 24.3x. Simply Wall St’s proprietary "Fair Ratio" for Madrigal stands at 18.6x. Unlike broad industry or peer comparisons, the Fair Ratio tailors the valuation expectation using factors unique to the company, including projected growth, risks, profit margin, market cap, and sector trends. This offers a more nuanced and tailored perspective for retail investors.

With Madrigal’s actual P/S ratio just slightly below its Fair Ratio, the market appears to be pricing the stock at about what it is truly worth given its outlook and risks.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Madrigal Pharmaceuticals Narrative

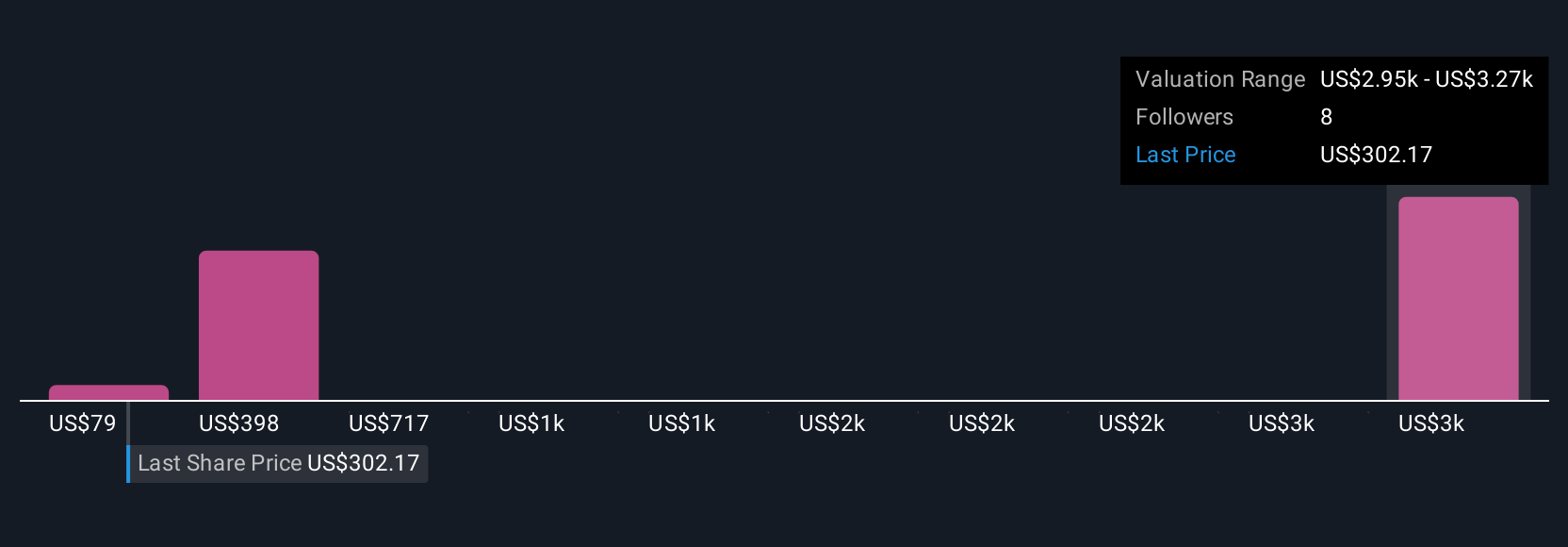

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, yet powerful tool that lets you write the story behind your investment view, connecting your assumptions about Madrigal Pharmaceuticals’ future revenue, earnings, and margins to a forecast of fair value. Instead of focusing solely on historical trends or standard valuation multiples, Narratives allow you to lay out your perspective on what will drive the company’s future, backing it up with both numbers and reasoning.

On Simply Wall St’s Community page, used by millions of investors worldwide, you can easily create and update your own Narrative in just a few clicks. Narratives make it clear whether you believe it is a good time to buy or sell by directly comparing your calculated fair value to today’s market price. As new quarterly earnings, news, or clinical updates arrive, these Narratives automatically reflect the latest data, helping you stay one step ahead.

For Madrigal Pharmaceuticals, one investor’s Narrative might see rapid global expansion for Rezdiffra and robust financials, supporting a bullish fair value near $567 per share. Another, more cautious investor may worry about competition and pricing pressure, setting a fair value closer to $266. With Narratives, you decide which story best fits your view and your investment, which can be an advantage in a dynamic market.

Do you think there's more to the story for Madrigal Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDGL

Madrigal Pharmaceuticals

A biopharmaceutical company, focuses on delivering novel therapeutics for metabolic dysfunction-associated steatohepatitis (MASH) in the United States.

Exceptional growth potential and good value.

Market Insights

Community Narratives