- United States

- /

- Pharma

- /

- NasdaqCM:LQDA

Liquidia (LQDA) Losses Worsen Despite Strong 43.7% Revenue Growth Forecast—Profitability Narrative in Focus

Reviewed by Simply Wall St

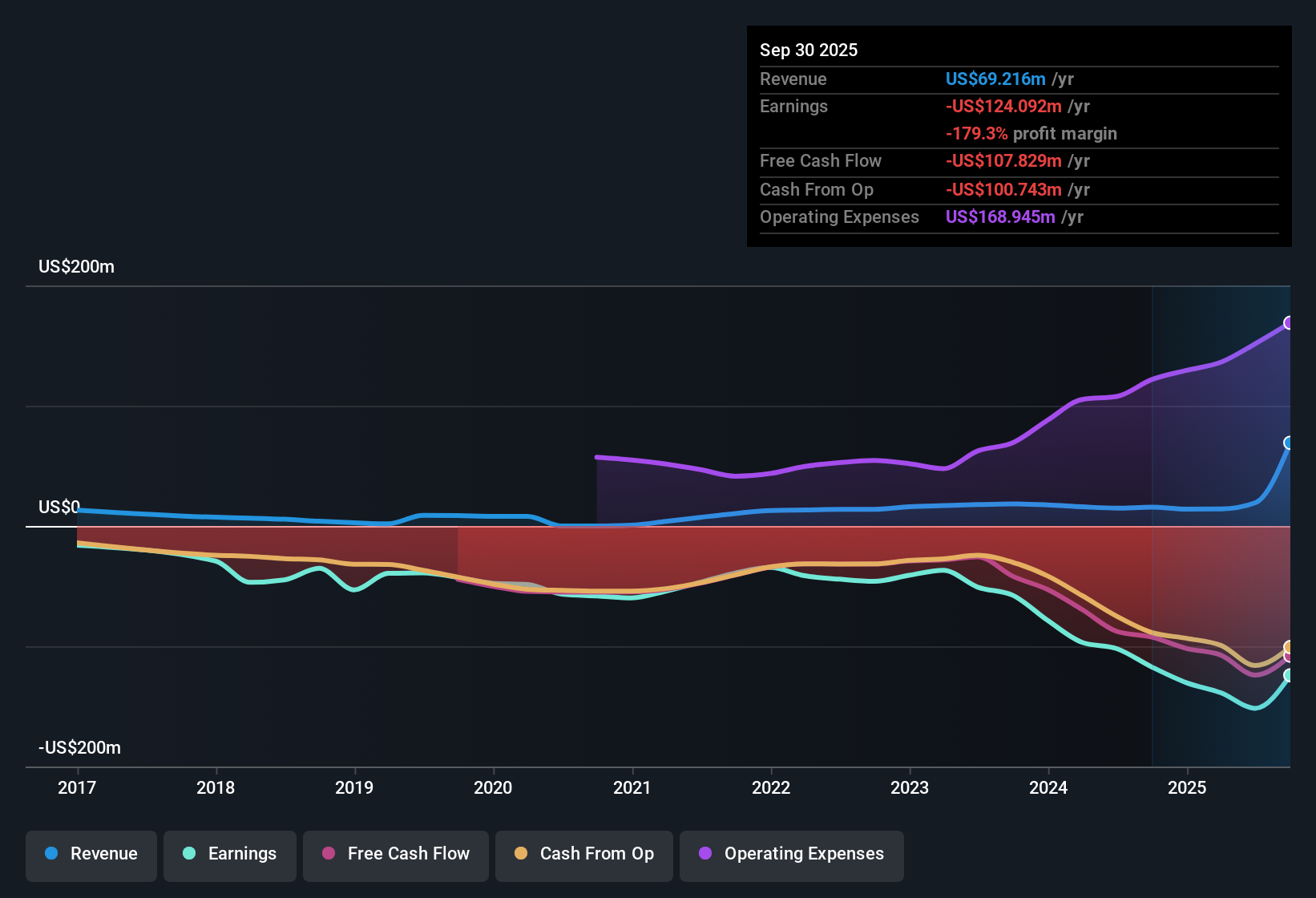

Liquidia (LQDA) is forecasting revenue growth of 43.7% per year, far outpacing the US market’s projected 10.5% annual growth rate. Earnings are expected to climb at 62.69% per year and the company is on track to become profitable within the next three years. For now, losses have grown at an annual rate of 25.7% over the past five years without improvement in margins. Investors appear caught between optimism around long-term growth and caution over current unprofitability, especially given valuation multiples that are high compared to industry peers.

See our full analysis for Liquidia.Next up, we’ll see how these headline numbers measure up against the prevailing narratives. Readers can examine where the consensus holds true and what aspects just might surprise investors.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Outpace Revenue Gains

- Annual losses have increased by 25.7% over the past five years, even as revenue is set for robust 43.7% yearly growth going forward.

- Analysts tracking the prevailing market view highlight a key tension: while strong revenue growth marks Liquidia as a high-upside story, the continued expansion of losses raises fresh questions about when those growth investments will deliver real bottom line returns.

- Pressure on margins persists, as profit margins have not improved in tandem with expanding top-line numbers.

- The market's optimism centers on Liquidia becoming profitable within three years. However, lack of historical margin improvement could lead to lingering volatility until that milestone is reached.

Valuation Skyrockets Above Peers

- Liquidia’s Price-to-Book ratio stands at a massive 142.9x, compared with peer and sector averages of 4x and 2.4x, respectively.

- Prevailing market analysis draws a sharp contrast: bulls appreciate the immense DCF upside, with the stock trading at $25.22 per share versus a DCF fair value of $135.81. On the other hand, critics highlight that such an extreme premium to book value has few counterparts in the industry.

- This premium could leave shares vulnerable if operational progress stalls or peer valuations compress.

- Alternatively, the current disparity with DCF fair value keeps speculation alive among risk-tolerant investors.

Minor Risk Signals in Insider Activity

- No notable insider selling has taken place despite growing losses and high market expectations, which often signals management conviction.

- The prevailing narrative points out that in a sector known for sharp insider moves during inflection points, the absence of selling might reassure some investors that leadership is confident in executing on pipeline catalysts.

- Still, investors are weighing these positive cues against premium valuations and a challenging road to sustained profitability.

- Patience is required as the market awaits proof that anticipated growth converts to stronger financial health.

To see how community and market narratives tie into these figures and add more context to Liquidia’s outlook, check out the latest consensus perspectives.

📊 Read the full Liquidia Consensus Narrative.Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Liquidia's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Liquidia’s expanding losses, persistent margin challenges, and high valuation multiples highlight a lack of proven financial stability compared to peers.

If you want stocks with more reliable foundations, check out solid balance sheet and fundamentals stocks screener (1978 results) to discover companies with stronger balance sheets and less financial risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LQDA

Liquidia

A biopharmaceutical company, develops, manufactures, and commercializes various products for unmet patient needs in the United States.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives