- United States

- /

- Pharma

- /

- NasdaqCM:LQDA

Does Liquidia’s Regulatory Breakthrough Still Leave Room for Gains After Shares Soar 130%?

Reviewed by Bailey Pemberton

- Ever found yourself wondering if Liquidia’s explosive growth means it’s a bargain or a bubble? Let’s break down whether there’s still value left for investors.

- This stock has been on a roll lately, soaring 20.6% in the past week, up 24.4% over the month, and a massive 130.7% year-to-date, topping off a 167.6% gain in the past year.

- Recent momentum goes beyond simple trading swings. Just last week, Liquidia announced a favorable regulatory breakthrough on its lead therapy, sparking renewed optimism among investors. The news sent waves through the biotech sector and drew fresh attention to where the company’s true value might lie.

- On our current valuation scorecard, Liquidia clocks in at 2 out of 6, showing some undervalued potential but also clear room for debate. This brings us to the real question: how do different valuation methods stack up, and could there be an even smarter way to appraise this stock’s worth by the article’s end?

Liquidia scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Liquidia Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s underlying value by projecting its future cash flows and discounting them back to today’s value. This method helps investors look beyond short-term price moves and focus instead on what the business could generate in the long term.

For Liquidia, the most recent reported Free Cash Flow (FCF) stands at -$115.86 million, reflecting significant investment in growth initiatives. Analyst consensus projects that FCF will turn positive and rise sharply, with estimates reaching $342.77 million by 2029. In total, projections extend out over the next decade, with cash flow expected to keep increasing. Only the first five years are based on analyst input, and beyond 2029, forecasts rely on long-term growth rates estimated by Simply Wall St. These forecasts show continued optimism for the company’s future earnings power.

According to this DCF analysis, Liquidia’s intrinsic value lands at $134.40 per share. Compared to current market levels, this suggests Liquidia is trading at a 79.2% discount. This implies significant undervaluation based on future cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Liquidia is undervalued by 79.2%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

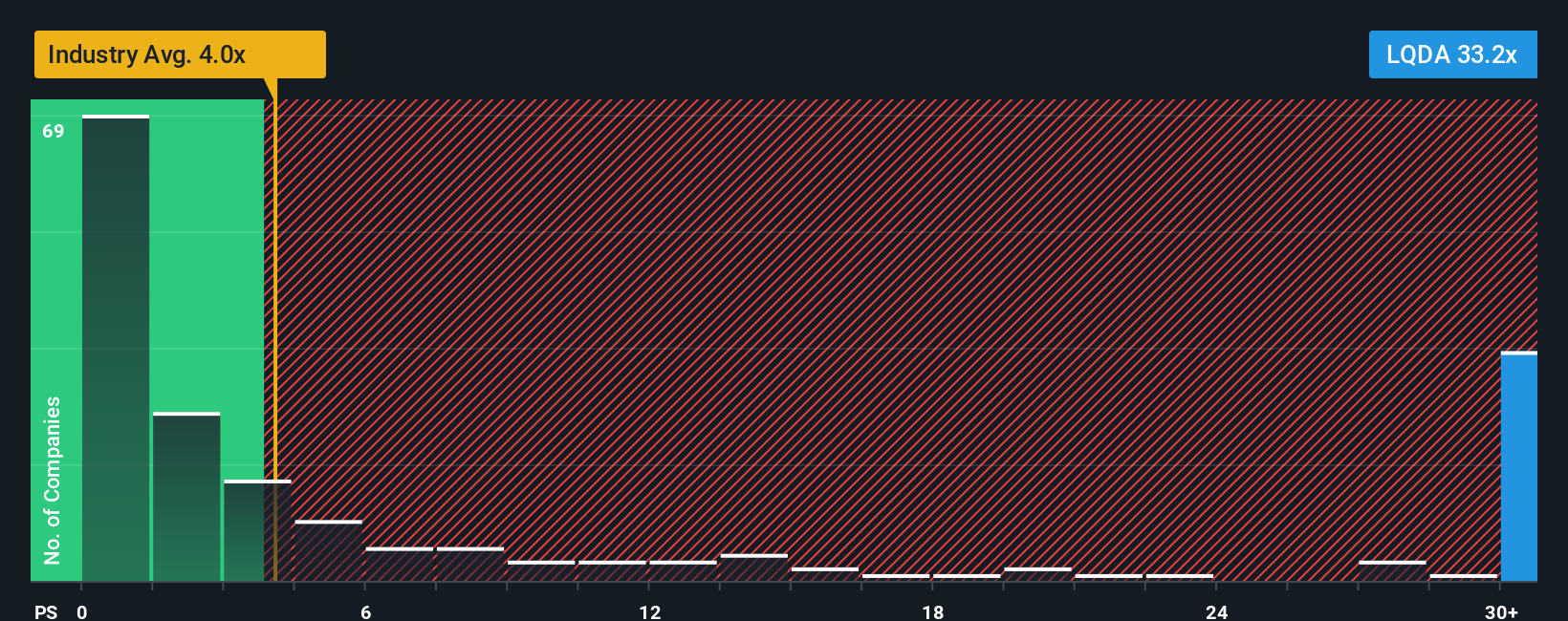

Approach 2: Liquidia Price vs Sales

The price-to-sales (P/S) ratio is often the go-to valuation metric for biotech and pharmaceutical companies, especially those not yet recording consistent profits. This measure helps investors compare the market value of the company to its current revenues and is considered especially useful in high-growth sectors where earnings may be negative even as sales accelerate.

Growth expectations, potential profits, and company-specific risks all shape what a “normal” P/S ratio should be. Companies expected to deliver rapid sales growth or ramp up margins might command higher multiples, while those facing significant uncertainties or slowdowns tend to be valued more conservatively.

Right now, Liquidia’s P/S multiple stands at 35.08x. For comparison, the average for similar pharmaceutical peers is 4.25x, and the broader industry trades around 4.20x. At first glance, this hefty premium suggests the stock could be expensive relative to its sales.

However, Simply Wall St’s proprietary Fair Ratio pegs a more appropriate value for Liquidia at 13.88x, based on a comprehensive analysis of company growth forecasts, market cap, profit margin, risks, and its industry context. Unlike basic peer or industry comparisons, this Fair Ratio approach tailors expectations for the company’s unique situation.

Since Liquidia’s actual P/S is well above even the Fair Ratio, the market seems to be pricing in very high growth or future profits that may not yet be certain.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

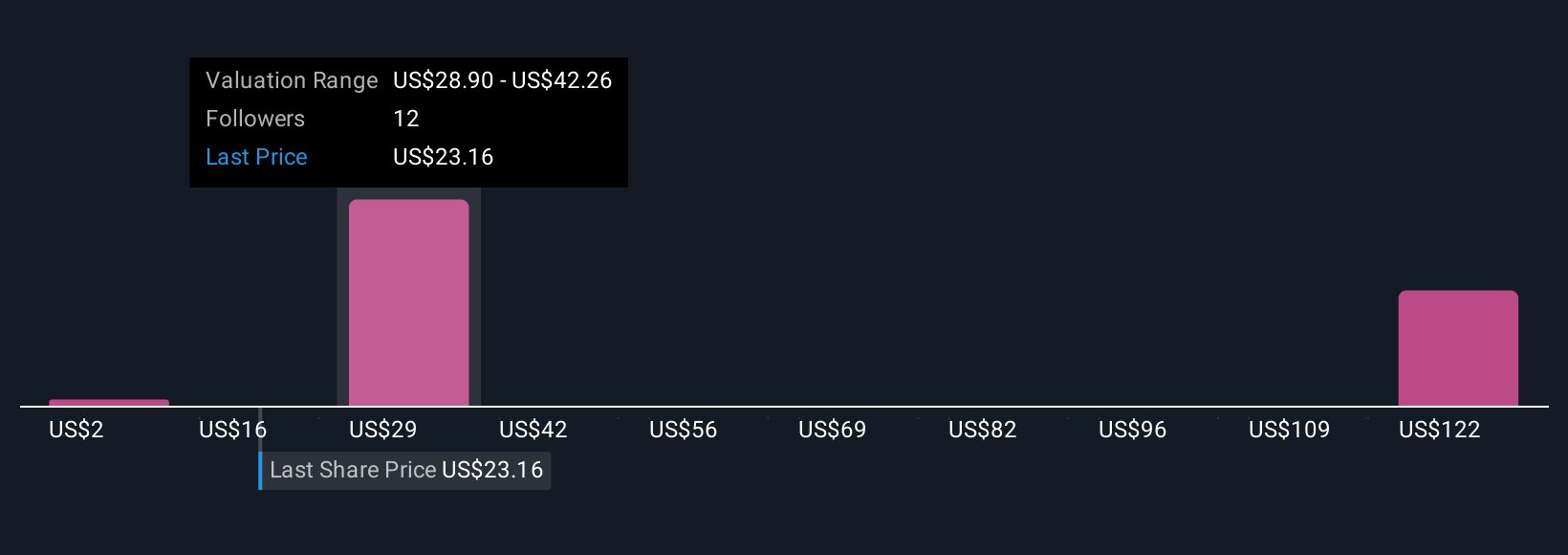

Upgrade Your Decision Making: Choose your Liquidia Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Simply put, a Narrative is your own story about a company. It is your perspective on how the business will perform, paired with your forecasts for revenue, earnings, and margins. Narratives make it easy to see how these assumptions translate into a Fair Value for the stock, connecting the company’s story to real numbers and forward-looking estimates.

Available on Simply Wall St’s Community page, Narratives are trusted by millions of investors and help you make buy or sell decisions by directly comparing Fair Value to the current price. Because Narratives are updated dynamically when new news or earnings break, your investment view always stays relevant.

With Narratives, you are not stuck with a single opinion. You can see a range of values based on different investors’ perspectives. For example, some users believe Liquidia is worth over $200 per share while others see fair value closer to $80, showing just how much the story and outlook can vary from person to person.

Do you think there's more to the story for Liquidia? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LQDA

Liquidia

A biopharmaceutical company, develops, manufactures, and commercializes various products for unmet patient needs in the United States.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives