- United States

- /

- Biotech

- /

- NasdaqGM:LOGC

The LogicBio Therapeutics (NASDAQ:LOGC) Share Price Has Gained 12% And Shareholders Are Hoping For More

We believe investing is smart because history shows that stock markets go higher in the long term. But not every stock you buy will perform as well as the overall market. Over the last year the LogicBio Therapeutics, Inc. (NASDAQ:LOGC) share price is up 12%, but that's less than the broader market return. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for LogicBio Therapeutics

We don't think LogicBio Therapeutics' revenue of US$2,912,000 is enough to establish significant demand. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that LogicBio Therapeutics has the funding to invent a new product before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

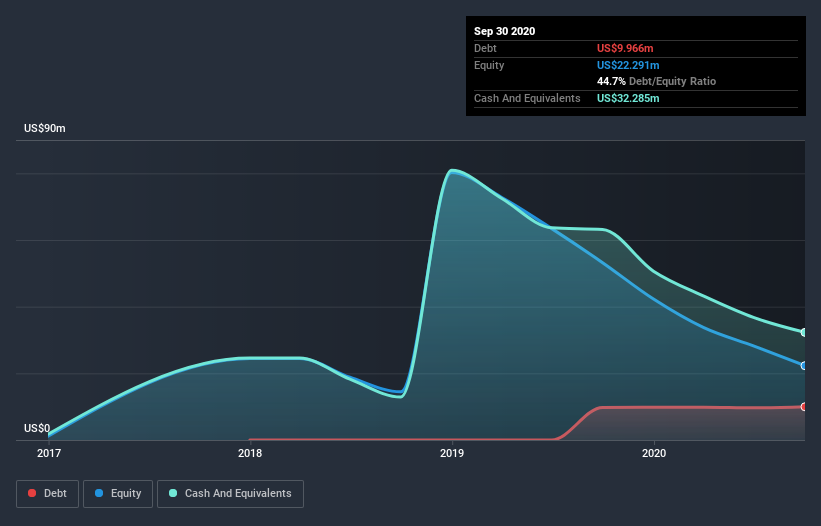

LogicBio Therapeutics had cash in excess of all liabilities of just US$13m when it last reported (September 2020). So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. It's a testament to the popularity of the business plan that the share price gained 157% in the last year , despite the weak balance sheet. You can click on the image below to see (in greater detail) how LogicBio Therapeutics' cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. One thing you can do is check if company insiders are buying shares. It's often positive if so, assuming the buying is sustained and meaningful. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

We're happy to report that LogicBio Therapeutics are up 12% over the year. Unfortunately this falls short of the market return of around 24%. Shareholders are doubtless excited that the stock price has been doing even better lately, with a gain of 28% in just ninety days. It's worth taking note when returns accelerate, as it can indicate positive change in the underlying business, and winners often keep winning. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - LogicBio Therapeutics has 5 warning signs (and 2 which are a bit unpleasant) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade LogicBio Therapeutics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:LOGC

LogicBio Therapeutics

LogicBio Therapeutics, Inc., a genetic medicine company, focuses on developing and commercializing genome editing and gene therapy treatments using its GeneRide and sAAVy platforms.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives