- United States

- /

- Biotech

- /

- NasdaqGS:LEGN

Legend Biotech (NasdaqGS:LEGN): Assessing Valuation After Strong Results and New Philadelphia R&D Launch

Reviewed by Simply Wall St

Legend Biotech's latest quarterly report highlights a sharp jump in revenue and a much smaller net loss compared to last year, signaling real traction in its cell therapy business. At the same time, the company just opened a new research and development facility in Philadelphia, which further strengthens its position in oncology and immunology.

See our latest analysis for Legend Biotech.

Legend Biotech’s momentum has shifted this year, with its expanded R&D efforts and stronger revenue failing so far to ignite the share price. Legend’s shares are down around 19% over the past three months, and the one-year total shareholder return stands at -34%. Long-term investors have faced even steeper declines, but recent operational progress and high-profile milestones suggest market sentiment could rebound if execution continues to improve.

If Legend’s push into the cell therapy space has you watching the sector, you might find more innovation stories waiting with our healthcare stock discovery tool: See the full list for free.

Given these mixed signals, is the current weakness in Legend Biotech’s share price an opportunity for investors to buy into future growth? Or is the market already accounting for the company’s improving fundamentals and pipeline potential?

Most Popular Narrative: 62.5% Undervalued

Legend Biotech’s most widely-followed narrative estimates fair value at a significant premium to the closing price of $28.17, suggesting a dramatic disconnect between market pricing and future potential. This sets up a compelling backdrop for the growth drivers that fuel such optimism.

Global roll-out and scaling production enhance operating leverage, broaden market reach, and improve margins while maintaining competitive advantage with innovative CAR-T technologies.

Curious why the narrative points to such a massive upside? One key ingredient hiding in plain sight: analysts are betting on explosive revenue growth, sharply expanding profit margins, and a future multiple that would put most biotech stocks to shame. Discover the numbers and turning points the narrative relies on. The math behind the optimism may surprise you.

Result: Fair Value of $75.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the bull case could unravel if CARVYKTI faces swift competition or if pipeline delays undercut Legend’s revenue momentum and profit recovery.

Find out about the key risks to this Legend Biotech narrative.

Another View: Sizing Up Value by the SWS DCF Model

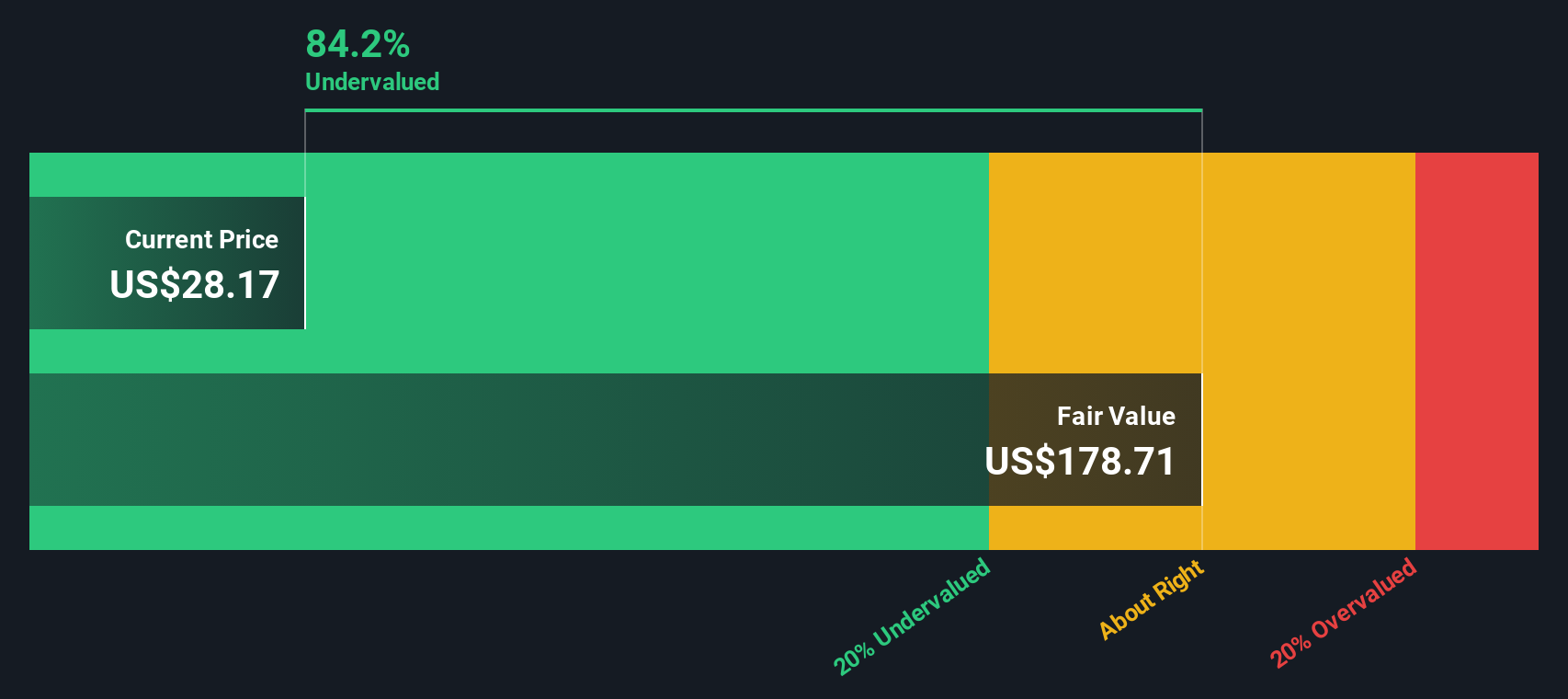

While analyst targets paint a bullish picture, our DCF model points to an even more dramatic valuation gap. Based on discounted future cash flows, Legend trades at over 80% below what the model considers fair value. That is a huge margin, but could future execution risks justify such a steep discount?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Legend Biotech Narrative

If the consensus leaves you unconvinced or you want to dig into the numbers for yourself, you can craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Legend Biotech.

Looking for more investment ideas?

Staying ahead in today’s market means tracking the trends others overlook. Let Simply Wall Street’s powerful screener open your eyes to tomorrow’s top opportunities.

- Tap into potential with these 26 AI penny stocks as these companies are positioned to benefit from the increasing demand for artificial intelligence solutions across industries.

- Unlock strong income prospects by exploring these 15 dividend stocks with yields > 3% which offer attractive yields above 3% for your portfolio.

- Gain an edge by targeting these 926 undervalued stocks based on cash flows that may be trading below intrinsic value and could appeal to savvy investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LEGN

Legend Biotech

Through its subsidiaries, operates as a biopharmaceutical company that discovers, develops, manufactures, and commercializes novel cell therapies for oncology and other indications in the United States, China, and Europe.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives