- United States

- /

- Biotech

- /

- NasdaqGS:LEGN

Can Legend Biotech’s (LEGN) US Expansion Shape Its Innovation Edge in CAR-T Therapies?

Reviewed by Sasha Jovanovic

- Legend Biotech recently celebrated the official opening of its new Philadelphia R&D facility, strengthening its innovation capabilities and expanding its footprint in the United States, with approximately 55 new full-time employees joining the team.

- The company also reported third-quarter results showing a significant increase in revenue to US$272.33 million and a substantial reduction in quarterly net loss, reflecting operational progress and momentum behind its CAR-T therapy franchise.

- We'll explore how the launch of the Philadelphia R&D center may influence Legend Biotech's future innovation and growth narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Legend Biotech Investment Narrative Recap

To be a Legend Biotech shareholder, you need to believe in the company's ability to extend CARVYKTI’s early leadership in multiple myeloma and successfully broaden its cell therapy pipeline while managing its dependence on a single commercial product. The launch of the Philadelphia R&D center provides additional research capacity, but it doesn’t directly change the most important short-term catalyst, expansion of CARVYKTI into earlier treatment lines, nor does it address the current product concentration risk, which remains material for the business.

The most relevant recent announcement is the FDA’s approval of an updated CARVYKTI label reflecting significant survival advantages over standard therapy. This regulatory development directly supports the key commercial catalyst for Legend, broadening CARVYKTI’s presence in earlier lines, and is highly pertinent to the company’s growth strategy, especially as its research operations expand in the United States.

In contrast, investors should be aware that reliance on a single approved therapy leaves Legend exposed if...

Read the full narrative on Legend Biotech (it's free!)

Legend Biotech's narrative projects $2.3 billion revenue and $632.7 million earnings by 2028. This requires 42.3% yearly revenue growth and an earnings increase of $958 million from the current earnings of -$325.3 million.

Uncover how Legend Biotech's forecasts yield a $75.06 fair value, a 166% upside to its current price.

Exploring Other Perspectives

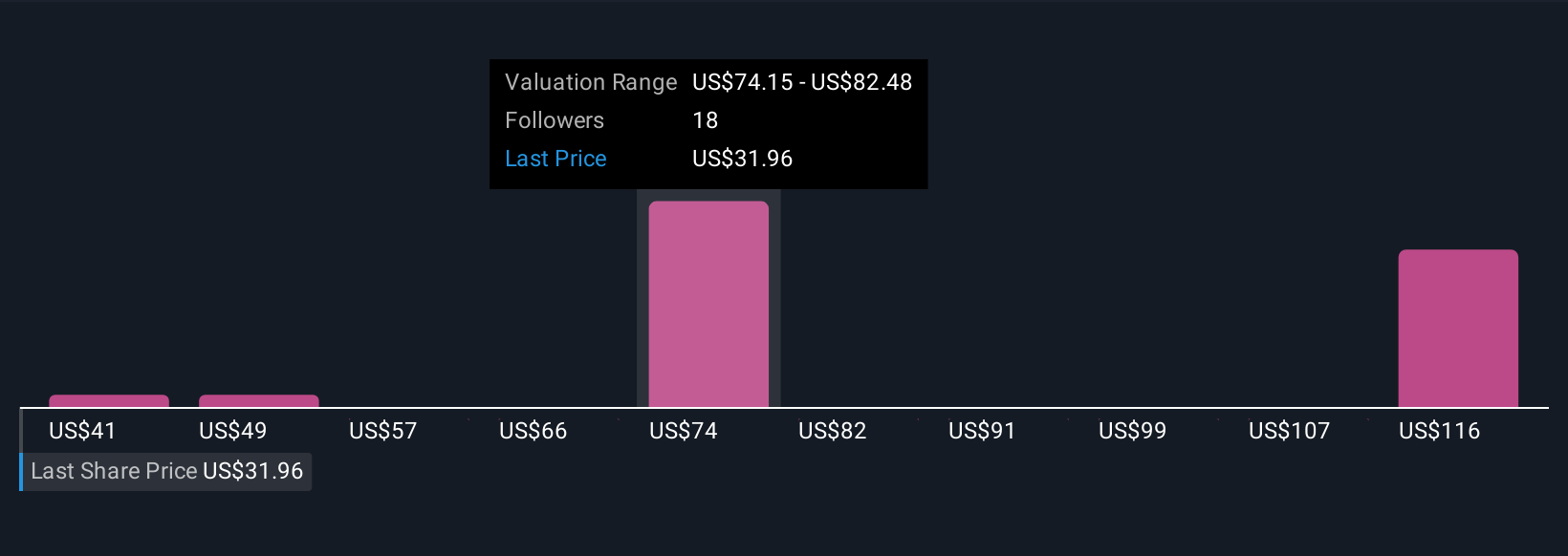

Community fair value estimates for Legend Biotech range widely from US$40.82 to US$179.09, based on six Simply Wall St Community opinions. While recent regulatory wins boost the CARVYKTI narrative, views differ sharply on concentration risk and long-term sustainability, so explore several viewpoints before deciding.

Explore 6 other fair value estimates on Legend Biotech - why the stock might be worth over 6x more than the current price!

Build Your Own Legend Biotech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Legend Biotech research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Legend Biotech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Legend Biotech's overall financial health at a glance.

No Opportunity In Legend Biotech?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LEGN

Legend Biotech

Through its subsidiaries, operates as a biopharmaceutical company that discovers, develops, manufactures, and commercializes novel cell therapies for oncology and other indications in the United States, China, and Europe.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives