- United States

- /

- Life Sciences

- /

- NasdaqGS:LAB

Standard BioTools Inc. (NASDAQ:LAB) Stocks Pounded By 26% But Not Lagging Industry On Growth Or Pricing

The Standard BioTools Inc. (NASDAQ:LAB) share price has fared very poorly over the last month, falling by a substantial 26%. For any long-term shareholders, the last month ends a year to forget by locking in a 64% share price decline.

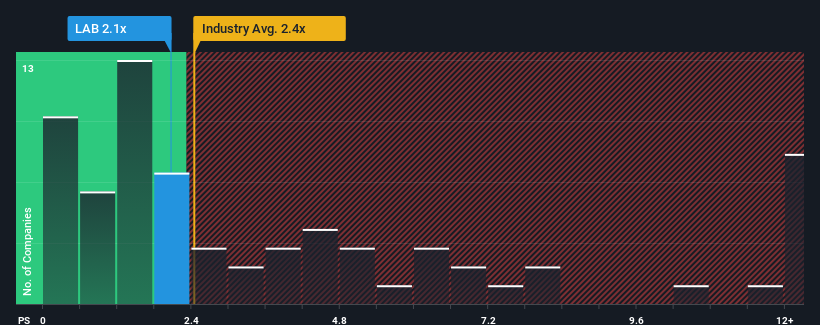

In spite of the heavy fall in price, it's still not a stretch to say that Standard BioTools' price-to-sales (or "P/S") ratio of 2.1x right now seems quite "middle-of-the-road" compared to the Life Sciences industry in the United States, where the median P/S ratio is around 2.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Standard BioTools

What Does Standard BioTools' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Standard BioTools has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Standard BioTools.How Is Standard BioTools' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Standard BioTools' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 34% gain to the company's top line. Pleasingly, revenue has also lifted 37% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 7.3% per annum over the next three years. With the industry predicted to deliver 7.0% growth per year, the company is positioned for a comparable revenue result.

With this information, we can see why Standard BioTools is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Standard BioTools' P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Standard BioTools looks to be in line with the rest of the Life Sciences industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Standard BioTools' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Standard BioTools, and understanding should be part of your investment process.

If you're unsure about the strength of Standard BioTools' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LAB

Standard BioTools

Develops, manufactures, and sells a range of instrumentation, consumables, and services to scientists and biomedical researchers to develop therapeutics in the Americas, Europe, the Middle East, Africa, and the Asia pacific.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion