- United States

- /

- Biotech

- /

- NasdaqGS:KURA

A Look at Kura Oncology’s Valuation Following KOMZIFTI’s FDA Approval for Relapsed AML

Reviewed by Simply Wall St

Kura Oncology recently attracted attention after KOMZIFTI, its once-daily oral menin inhibitor, secured full FDA approval for adults with relapsed or refractory acute myeloid leukemia with a susceptible NPM1 mutation. This milestone addresses a treatment gap in AML care.

See our latest analysis for Kura Oncology.

Kura Oncology’s momentum has picked up meaningfully after KOMZIFTI’s approval, with the share price up over 48% in the past three months and 38% year-to-date. While recent investor enthusiasm is clear, the one-year total shareholder return stands at a more modest 7%. The stock remains well below its five-year highs, reflecting earlier volatility and the long-term stakes in biotech innovation.

If the KOMZIFTI milestone has you watching biotech more closely, now is a great time to see which other innovators are making waves via our See the full list for free.

With analyst targets now far above current levels, investors are left wondering whether Kura Oncology’s recent rally has further to run or if the market has already priced in much of the company’s future growth potential.

Most Popular Narrative: 62.3% Undervalued

With the most widely followed narrative assigning a fair value of $31.80, Kura Oncology's last close of $11.99 is notably lower. Momentum has grown as investors react to new product approvals. Narrative projections point to a larger potential upside based on expectations for future growth.

The recent FDA approval of ziftomenib, branded as Komzifti, is seen as a transformative event. This development provides stronger confidence in Kura Oncology’s pipeline and growth trajectory.

Curious what assumptions are fueling such a bullish price target? Behind this number are aggressive growth forecasts and analyst expectations for a significant shift in future earnings. Get the inside story on the projections that could move the stock next.

Result: Fair Value of $31.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks such as slower than expected product launches or increased competition could quickly dampen recent optimism and reshape Kura Oncology’s outlook.

Find out about the key risks to this Kura Oncology narrative.

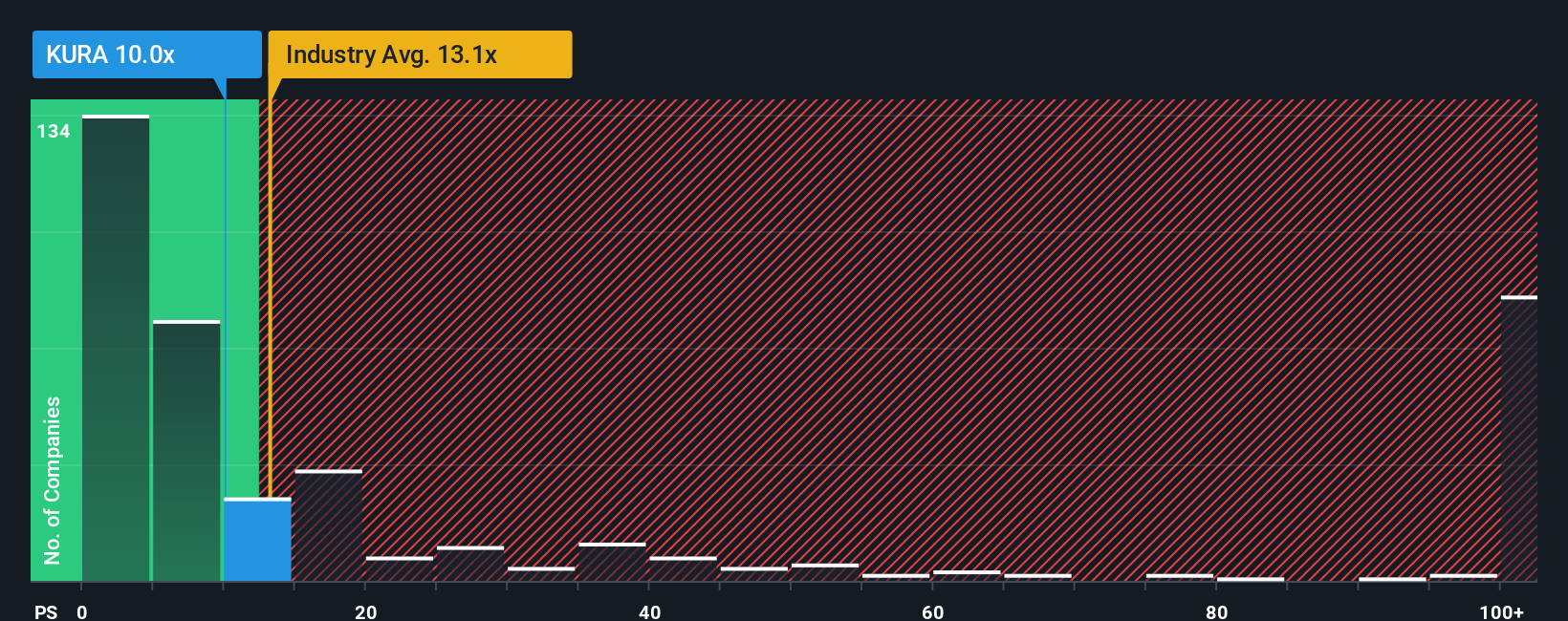

Another View: Multiples Comparison Raises Caution

Looking at valuation through the lens of the price-to-sales ratio, Kura Oncology trades at 10x sales. This is double the peer average of 5.1x, and well above the fair ratio of 2x that the market might eventually target. While the sector average is 12.3x, this premium could signal valuation risk instead of opportunity. Which approach should investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kura Oncology Narrative

If you have your own viewpoint or want to dig deeper into the numbers, you can put together an independent narrative in just a few minutes. Do it your way

A great starting point for your Kura Oncology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Missing the next big move can mean leaving profit on the table. Take charge of your investments and unlock new opportunities with these handpicked stock ideas from Simply Wall Street’s Screener:

- Boost your growth potential by targeting specialists in artificial intelligence through these 25 AI penny stocks, which could be shaping tomorrow’s most innovative breakthroughs.

- Capture value that others might overlook by investigating these 927 undervalued stocks based on cash flows, offering strong fundamentals at compelling prices right now.

- Maximize your income strategy by zeroing in on these 15 dividend stocks with yields > 3%, delivering generous yields above 3% and the stability to sustain them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kura Oncology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KURA

Kura Oncology

A clinical-stage biopharmaceutical company, develops medicines for the treatment of cancer.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success