- United States

- /

- Biotech

- /

- NasdaqGS:KRYS

Krystal Biotech (KRYS): Margin Drop Challenges Bullish Growth Narratives Despite Strong Top-Line Outlook

Reviewed by Simply Wall St

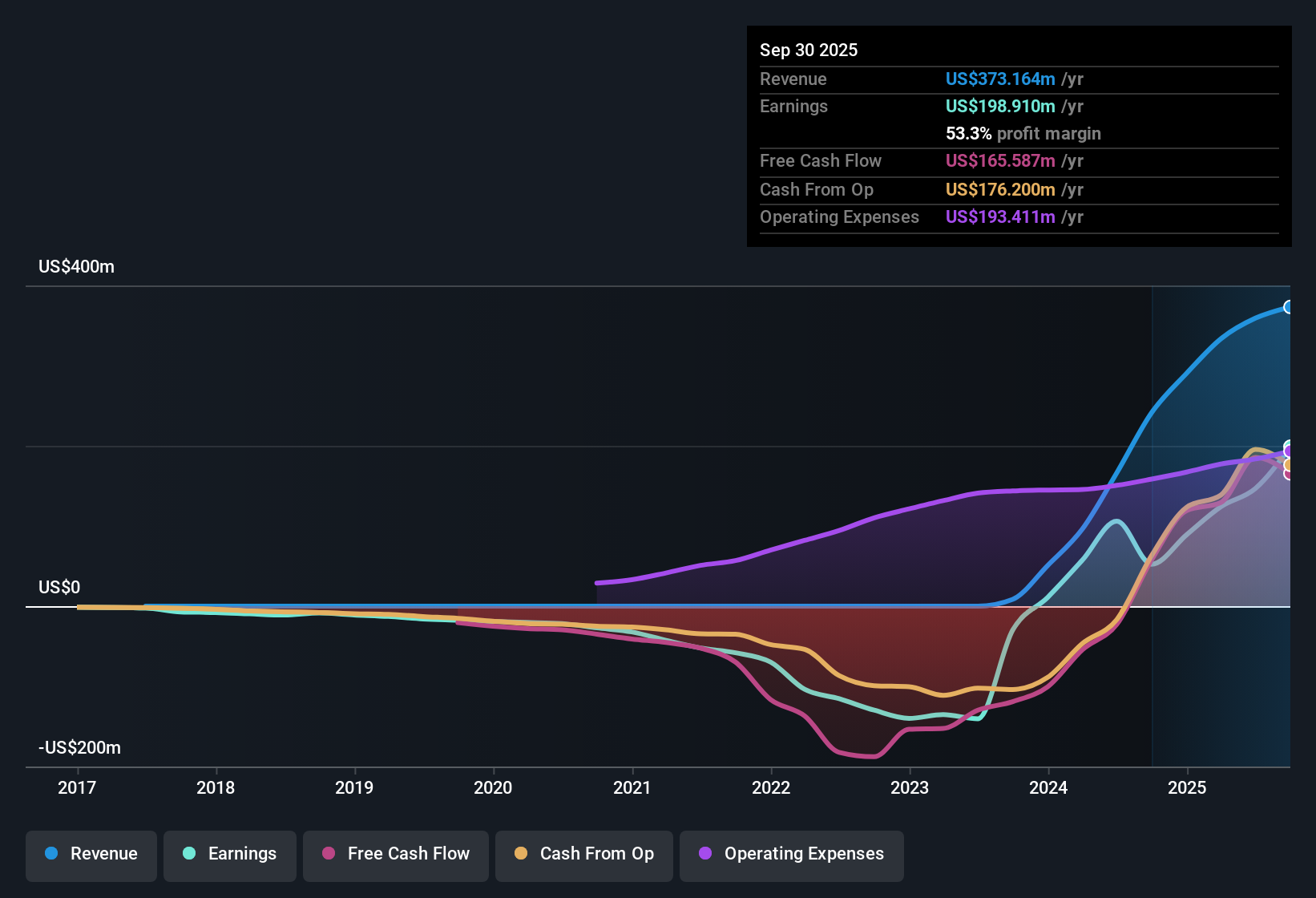

Krystal Biotech (KRYS) delivered earnings growth of 38.5% over the past year, falling short of its five-year average growth rate of 43.4% per year. The company’s net profit margin came in at 40.8%, a notable drop from 63.7% the previous year. Earnings are projected to expand at 34.4% annually going forward. Solid revenue growth projections and favorable valuation measures provide a strong backdrop. However, the decline in profit margins offers investors a reason to keep a close watch on profitability trends.

See our full analysis for Krystal Biotech.Next up, we’ll see how these latest figures compare against the main market narratives circulating about Krystal Biotech. This will highlight where the numbers confirm the story and where they raise new questions.

See what the community is saying about Krystal Biotech

Margin Recovery Ahead: Projections Point to 57.2% Net Margin

- Analysts forecast that Krystal Biotech’s net profit margin will climb from 40.8% today to 57.2% over the next three years. This represents a major rebound even after the recent contraction from last year’s 63.7%.

- According to the analysts' consensus view, this expected margin improvement is being driven by operational leverage and high gross margins already near 93%. These margins are supported by in-house manufacturing and broadening reimbursement in key global markets.

- The consensus narrative notes that with European and Japanese launches underway, combined with global healthcare systems more willing to pay for high-value therapies, the company’s profitability profile could rapidly improve if execution matches forecasts.

- Nonetheless, continued investment in R&D and a potential ramp-up in operating expenses create a test for the consistency of margin gains compared to purely forecast-driven optimism.

- What happens next for margins could set the tone for investors as Krystal seeks to deliver on its expanded international footprint and pipeline programs. 📊 Read the full Krystal Biotech Consensus Narrative.

Revenue Pace Tops Market: 25.8% Growth Vs. 10.5% Sector

- Revenue at Krystal Biotech is projected to grow at 25.8% annually, which is more than double the 10.5% rate expected for the US market overall.

- The analysts' consensus view calls out this growth as fundamental to anchoring the bullish case, highlighting two reinforcing factors:

- Broad regulatory approvals and established reimbursement in new international markets are anticipated to unlock consistently higher revenue streams beyond a single blockbuster therapy.

- At the same time, new pipeline advances in lung disease, oncology, and ophthalmology are expected to diversify the underlying business and reduce revenue concentration risk, which many analysts believe strengthens long-term earnings potential.

Valuation: Trading at a Premium, But DCF Suggests Upside

- Despite recent profit margin weakness, Krystal’s share price of $197.85 remains at a premium to many biotech peers on a P/E basis. However, it still sits well below its estimated DCF fair value of $438.38.

- According to the analysts' consensus view, this valuation tension is pivotal because:

- On one hand, the share price does not fully reflect aggressive growth and profitability improvements forecasted by analysts, offering opportunity if the company delivers against its plan.

- On the other hand, a drop in net margins alongside rising SG&A costs could prompt investors to demand more evidence before re-rating the stock closer to fair value, especially given the heavy reliance on one drug and pricing pressures abroad.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Krystal Biotech on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a unique angle on Krystal Biotech's results? Share your perspective and shape your own story in just a few minutes: Do it your way

A great starting point for your Krystal Biotech research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Krystal Biotech’s fluctuating profit margins and dependence on a single drug expose investors to volatility and uncertainty in sustaining long-term earnings growth.

If you’d prefer more predictable results, use our stable growth stocks screener (2094 results) to find companies that consistently deliver steady revenue and earnings regardless of the market climate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Krystal Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KRYS

Krystal Biotech

A commercial-stage biotechnology company, discovers, develops, manufactures, and commercializes genetic medicines to treat diseases with high unmet medical needs in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives