- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The Information Technology sector gained 3.3% while the market remained flat over the last week, and the market is up 22% over the past year with earnings forecast to grow by 15% annually. In this favorable environment, identifying high growth tech stocks can be crucial for investors looking to capitalize on robust sector performance and promising future earnings potential.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.49% | 27.13% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Sarepta Therapeutics | 24.13% | 44.72% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.44% | 65.92% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Ascendis Pharma | 39.71% | 68.43% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.81% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 250 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Veracyte (NasdaqGM:VCYT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Veracyte, Inc. is a diagnostics company that provides genomic testing and diagnostic services in the United States and internationally, with a market cap of $2.33 billion.

Operations: Veracyte generates revenue primarily from its diagnostic products, which amounted to $399.58 million. The company operates in both the United States and international markets.

Veracyte's recent earnings report highlights a significant turnaround, with net income reaching $5.73 million in Q2 2024 compared to a net loss of $8.4 million the previous year. Revenue grew from $90.32 million to $114.43 million, driven by innovative diagnostic solutions in oncology and pulmonology sectors, which are increasingly adopting AI-driven technologies for precision medicine. The company forecasts annual revenue growth of 10.7%, outpacing the US market average of 8.6%. Veracyte’s R&D expenses underscore its commitment to innovation, accounting for substantial investments aimed at enhancing its product pipeline and maintaining competitive advantage.

Krystal Biotech (NasdaqGS:KRYS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on discovering, developing, and commercializing genetic medicines for patients with rare diseases in the United States, with a market cap of $5.71 billion.

Operations: Krystal Biotech focuses on the discovery, development, and commercialization of genetic medicines targeting rare diseases in the U.S. The company operates as a commercial-stage entity with a market cap of $5.71 billion.

Krystal Biotech's recent performance showcases a remarkable turnaround, with net income reaching $15.57 million in Q2 2024 from a net loss of $33.21 million the previous year. The company's earnings are forecast to grow at an impressive 34.2% annually, significantly outpacing the US market's average growth rate of 15%. R&D expenses have been substantial, reflecting Krystal’s commitment to innovation and product development; this is evident from their strategic focus on the KB301 clinical program and Jeune’s pipeline products. Revenue is expected to grow by 33% per year, positioning Krystal as a strong contender in the biotech sector.

- Dive into the specifics of Krystal Biotech here with our thorough health report.

Understand Krystal Biotech's track record by examining our Past report.

Pure Storage (NYSE:PSTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pure Storage, Inc. provides data storage and management technologies, products, and services both in the United States and internationally with a market cap of $15.63 billion.

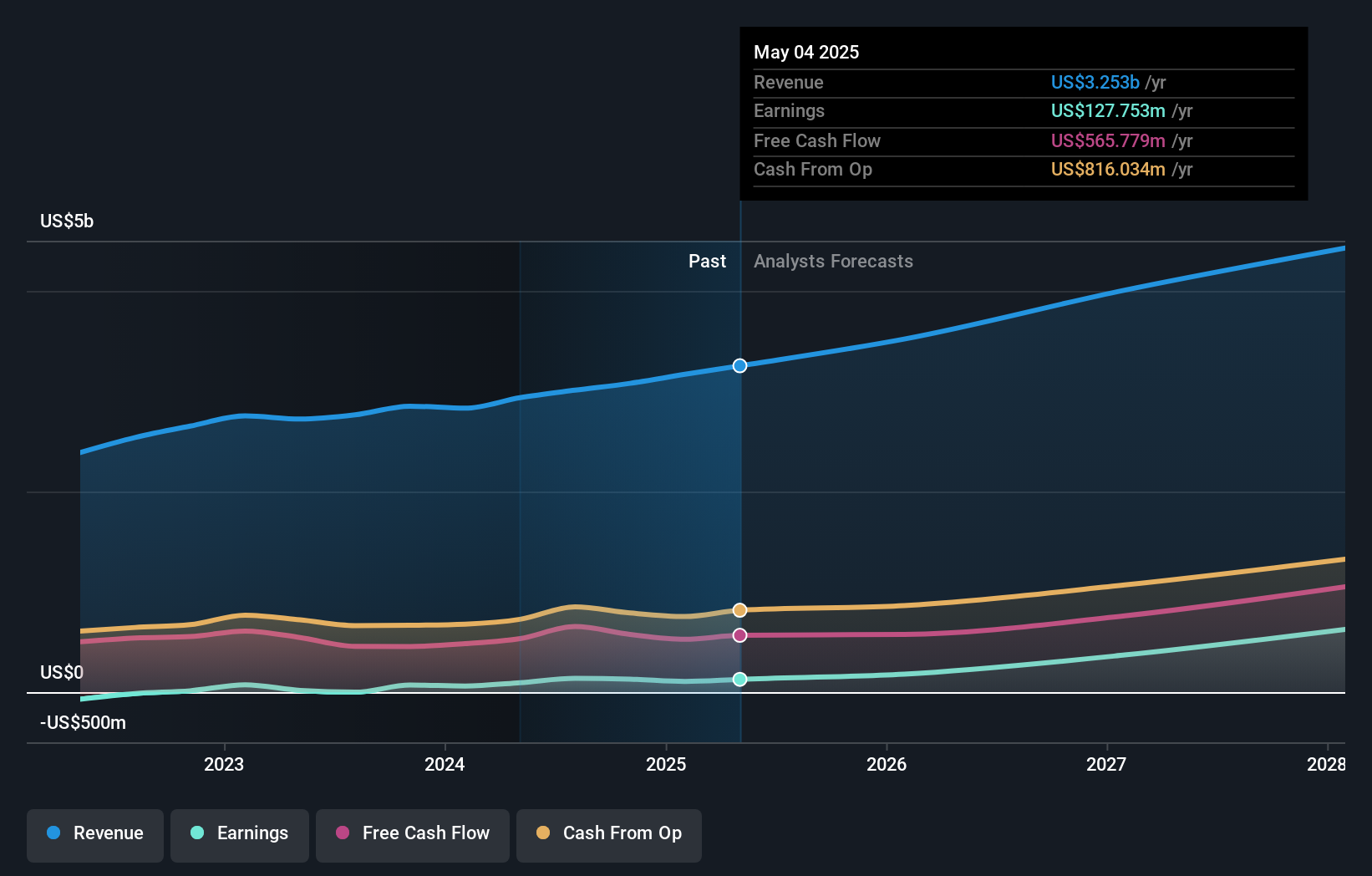

Operations: Pure Storage, Inc. generates revenue primarily from its computer storage devices segment, which accounted for $3.01 billion. The company focuses on data storage and management technologies across various regions globally.

Pure Storage's recent performance highlights its transformation, with net income reaching $35.67 million in Q2 2024 from a net loss of $7.12 million the previous year, and revenue growing to $763.77 million from $688.67 million. The company's R&D expenses reflect its commitment to innovation, crucial for maintaining competitive advantage; these expenses contributed significantly to the development of their AI-driven storage solutions like Pure Fusion™ and Evergreen//One™. With earnings expected to grow by 38% annually and revenue forecasted at an 11.3% growth rate per year, Pure Storage is well-positioned in the tech sector's dynamic landscape.

- Get an in-depth perspective on Pure Storage's performance by reading our health report here.

Review our historical performance report to gain insights into Pure Storage's's past performance.

Key Takeaways

- Access the full spectrum of 250 US High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Engages in the provision of data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.