- United States

- /

- Biotech

- /

- NasdaqCM:KRRO

Why Korro Bio (KRRO) Is Down 80.0% After Restructuring, Clinical Trial Miss, and CMO Resignation

Reviewed by Sasha Jovanovic

- In the past week, Korro Bio announced a significant restructuring aimed at extending its cash runway, including a workforce reduction of approximately 34%, alongside an update on its Phase 1/2a REWRITE clinical trial for KRRO-110 in AATD, which showed acceptable safety but did not meet expected efficacy thresholds.

- These announcements coincide with the temporary pause of its collaboration with Novo Nordisk and the resignation of its Chief Medical Officer, highlighting a period of transition for the company.

- We'll assess how the combination of operational changes and clinical trial results may reshape Korro Bio's investment narrative moving forward.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

What Is Korro Bio's Investment Narrative?

For anyone considering Korro Bio as a potential investment, the core belief is in the company’s RNA editing platform and its ability to create meaningful therapies for tough genetic diseases, a vision now tested by recent events. The announced workforce reduction, restructuring costs and temporary pause in the Novo Nordisk partnership point to a shift in short-term catalysts, with heightened uncertainty around business development milestones and future clinical readouts. The mixed Phase 1/2a data for KRRO-110 add risk to the pipeline’s near-term value, while also pushing any hope for efficacy-driven momentum further down the road. Leadership changes, ongoing operating losses, high share price volatility and removal from Russell indexes further cloud visibility. While previous analysis flagged rapid revenue growth as a key upside, these latest developments increase the weight of execution risk in the months ahead.

But, not all investors may have factored in how a long partnership pause could impact the next phase.

Exploring Other Perspectives

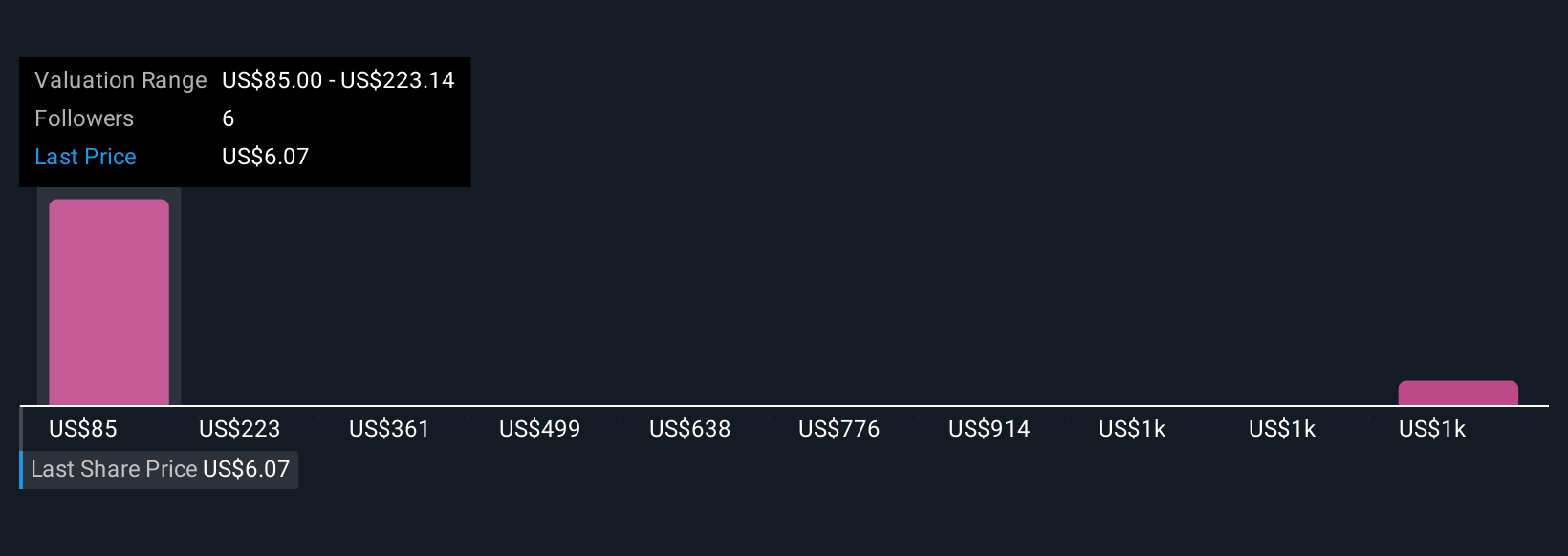

Explore 3 other fair value estimates on Korro Bio - why the stock might be worth just $85.00!

Build Your Own Korro Bio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Korro Bio research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Korro Bio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Korro Bio's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Korro Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:KRRO

Korro Bio

A biopharmaceutical company, engages in the discovering, developing, and commercializing of genetic medicines based on editing RNA for the treatment of rare and highly prevalent diseases in the United States.

Flawless balance sheet with low risk.

Market Insights

Community Narratives