- United States

- /

- Biotech

- /

- NasdaqGS:KPTI

Benign Growth For Karyopharm Therapeutics Inc. (NASDAQ:KPTI) Underpins Stock's 28% Plummet

Karyopharm Therapeutics Inc. (NASDAQ:KPTI) shares have retraced a considerable 28% in the last month, reversing a fair amount of their solid recent performance. For any long-term shareholders, the last month ends a year to forget by locking in a 70% share price decline.

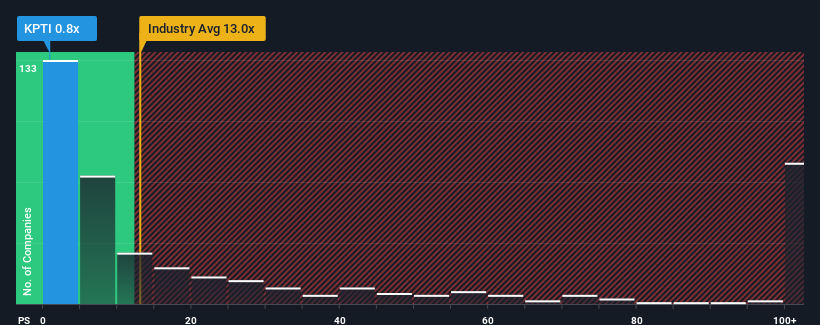

After such a large drop in price, Karyopharm Therapeutics' price-to-sales (or "P/S") ratio of 0.8x might make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 13x and even P/S above 59x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Karyopharm Therapeutics

What Does Karyopharm Therapeutics' P/S Mean For Shareholders?

Karyopharm Therapeutics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Karyopharm Therapeutics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Karyopharm Therapeutics' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 7.0% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 35% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 17% per year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 163% per year, which is noticeably more attractive.

In light of this, it's understandable that Karyopharm Therapeutics' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Having almost fallen off a cliff, Karyopharm Therapeutics' share price has pulled its P/S way down as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Karyopharm Therapeutics maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Karyopharm Therapeutics is showing 5 warning signs in our investment analysis, and 2 of those are potentially serious.

If these risks are making you reconsider your opinion on Karyopharm Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Karyopharm Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KPTI

Karyopharm Therapeutics

A commercial-stage pharmaceutical company, discovers, develops, and commercializes drugs directed against nuclear export for the treatment of cancer and other diseases in the United States.

Medium-low risk and fair value.

Similar Companies

Market Insights

Community Narratives