- United States

- /

- Biotech

- /

- NasdaqGM:KOD

Kodiak Sciences (KOD) Is Up 13.6% After Strong Phase 3 Results for KSI-101 in Uveitic Macular Edema

Reviewed by Sasha Jovanovic

- Kodiak Sciences announced new Phase 3 clinical trial data at the American Academy of Ophthalmology meetings showing that intraocular interleukin-6 inhibition with KSI-101 led to meaningful improvements in vision and anatomy for patients with uveitic macular edema, and was well tolerated across all dose levels.

- An especially rapid onset of action, with most of the drying effect seen by Week 1, sets KSI-101 apart in retinal disease treatment research.

- We’ll examine how positive late-stage trial results and analyst upgrades for KSI-101 could shift Kodiak Sciences’ investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Kodiak Sciences' Investment Narrative?

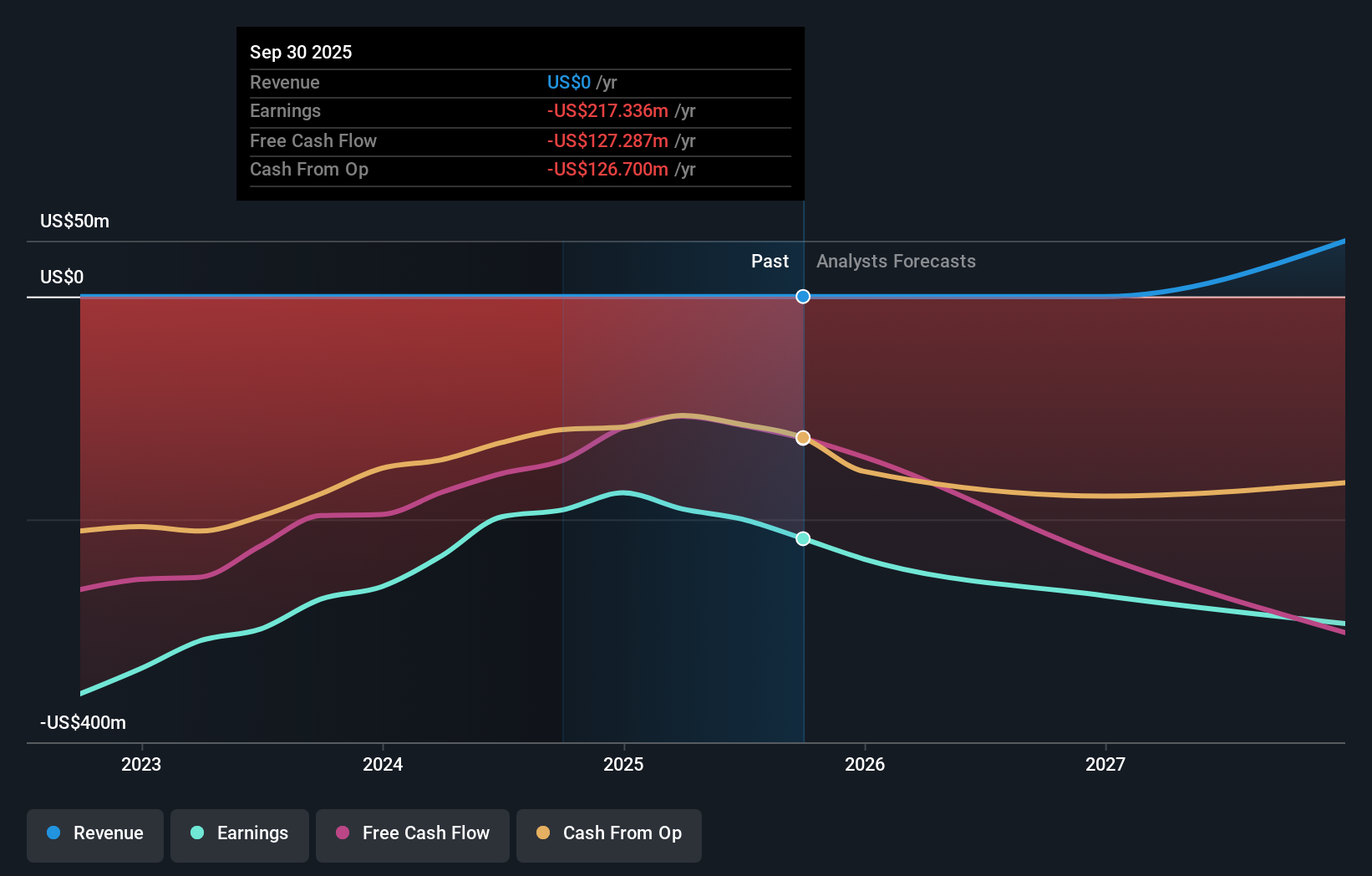

To be comfortable holding Kodiak Sciences stock, an investor needs to believe not only in the continued progress of the company’s late-stage pipeline, but also in its ability to overcome near-term risks surrounding financial viability. The recent Phase 3 data release for KSI-101 is a genuine game-changer for Kodiak in the short term, serving as both a validation of its clinical approach and a potential inflection point that could ease long-standing market skepticism. News of rapid efficacy and strong tolerability has already sparked upgrades from major analysts, suggesting a real shift in sentiment that may boost confidence in both ongoing trial recruitment and Kodiak’s access to capital. Still, auditors’ concerns about Kodiak’s cash runway have not disappeared, and despite optimism around KSI-101, the company remains unprofitable with high expenses and zero revenue. The next major milestones to watch are further clinical readouts, any funding announcements, and signals on the company’s ability to sustain operations until commercialization. On the flip side, Kodiak’s limited cash runway remains a critical concern for investors.

According our valuation report, there's an indication that Kodiak Sciences' share price might be on the expensive side.Exploring Other Perspectives

Build Your Own Kodiak Sciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kodiak Sciences research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Kodiak Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kodiak Sciences' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kodiak Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:KOD

Kodiak Sciences

A clinical stage biopharmaceutical company, engages in the research, development, and commercialization of therapeutics to treat retinal diseases.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives