- United States

- /

- Biotech

- /

- NasdaqGS:KNSA

Kiniksa Pharmaceuticals (KNSA) Profit Surge Challenges Valuation Caution as Growth Outpaces Peers

Reviewed by Simply Wall St

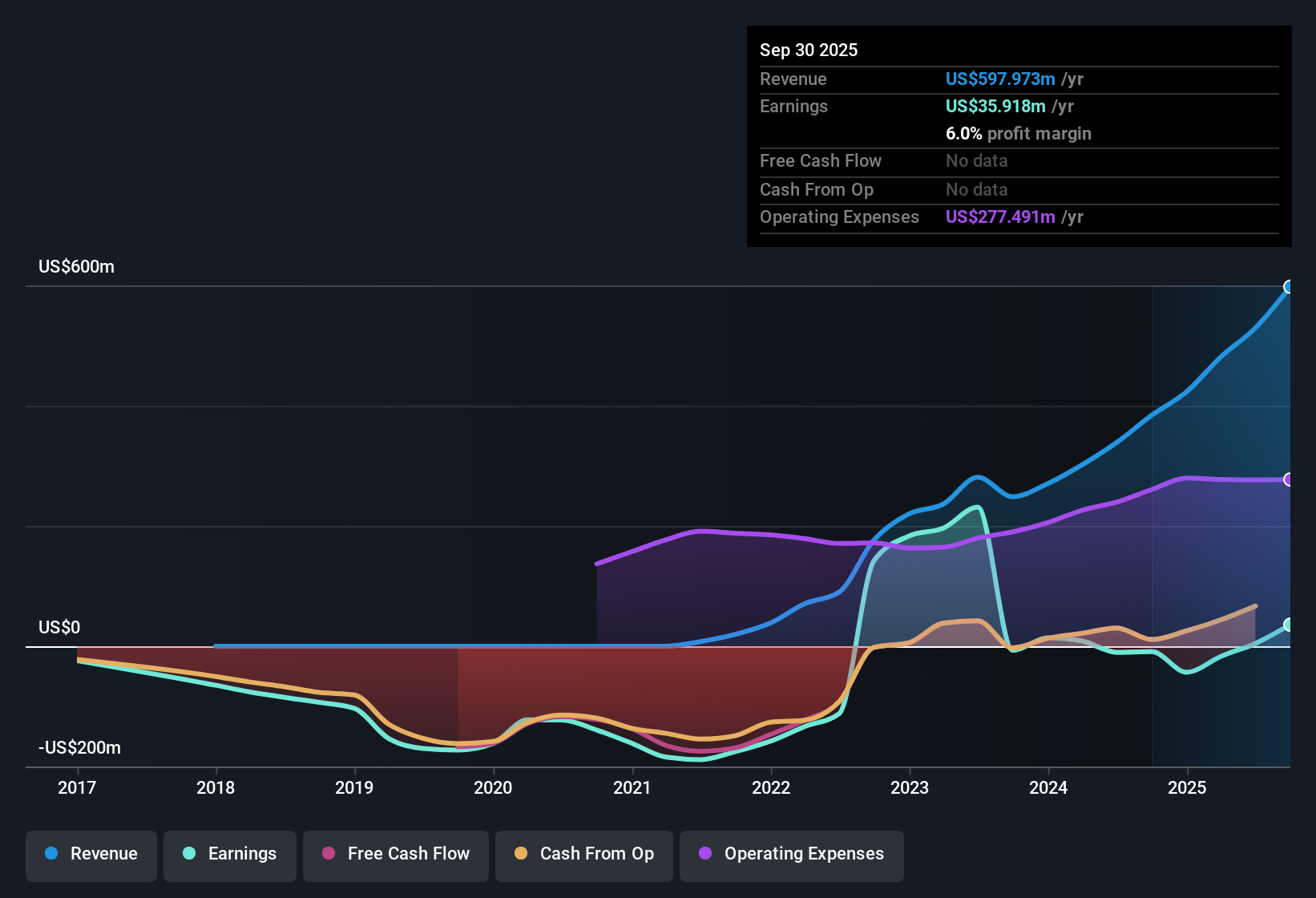

Kiniksa Pharmaceuticals International (KNSA) turned profitable in the last year, with net profit margins improving and earnings growing at a 40.7% annual rate over the past five years. Looking ahead, analysts expect earnings to climb another 33.3% per year on average for the next three years. This is notably faster than both the US market and the company’s own revenue forecast, which is set at 16.7% annual growth. These trends position the company as one with robust ongoing momentum and optimism around future profitability.

See our full analysis for Kiniksa Pharmaceuticals International.Next up, we’ll see how these results stack against the prevailing narratives. The numbers may reinforce some beliefs and challenge others.

See what the community is saying about Kiniksa Pharmaceuticals International

ARCALYST Drives Most of the Growth

- ARCALYST, Kiniksa’s lead product, currently accounts for the majority of revenue, with market penetration into the recurrent pericarditis population at just 15% and an additional 26,000 potential patients untapped.

- According to the analysts' consensus narrative, the top-line guidance is being supported by significant expansion opportunities for ARCALYST as new treatment guidelines drive earlier adoption and the addressable market ages and grows.

- Consensus narrative notes that clinical guidelines are shifting toward earlier and more frequent use of targeted biologics like ARCALYST. This trend is expected to bolster revenue momentum and help offset the risks of overreliance on a single therapy.

- Bulls and analysts alike point out that ongoing high payer coverage and robust commercial execution (over 90% approval rates) support revenue pipeline resilience, but emphasize that expansion beyond the U.S. remains limited for now.

- Consensus narrative highlights opportunity and execution risk. See what the market's saying in the full story: 📊 Read the full Kiniksa Pharmaceuticals International Consensus Narrative.

Profit Margins Set to Climb

- Analyst expectations are for net margins to rise from 0.9% today to 19.1% in 3 years, representing a meaningful shift in underlying profitability beyond headline earnings growth.

- Consensus narrative credits Kiniksa’s strong cash balance and positive cash flow generation from ARCALYST as key to funding R&D and portfolio expansion, strengthening operational leverage.

- Consensus narrative also emphasizes that as ARCALYST sales grow, increased scale and efficiency should allow for improving margins. This improvement can help offset high R&D spending and near-term risks associated with pipeline investments.

- However, the analysts acknowledge that Kiniksa’s exposure to regulatory and reimbursement shifts could create swings in gross margins, a factor worth monitoring as the earnings mix evolves.

Valuation: High PE, Deep DCF Discount

- Kiniksa’s share price trades at a PE of 77.1x, well above the biotech sector average of 17.9x and peers at 34.9x, but remains far below the DCF fair value of $135.89. This suggests a large implied long-term upside if the earnings trajectory holds.

- Consensus narrative highlights that although the valuation premium is clear by sector standards, both analysts and guidance point to ongoing profit and revenue growth as rationales for the current share price. The gap to fair value puts added weight on delivering future projections.

- Consensus narrative explicitly warns that for Kiniksa to justify both analyst price targets ($52.43) and a rerating, the company must achieve $992.0 million in revenue and $189.0 million in earnings on a much lower PE. Execution will be key to closing the value gap.

- Bears might call out the current valuation as stretched, but so far, the lack of flagged risk factors and persistent growth trends make the DCF discount equally difficult to dismiss for optimists.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Kiniksa Pharmaceuticals International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got your own take on these figures? Share your perspective in just a few minutes and shape your own narrative, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Kiniksa Pharmaceuticals International.

See What Else Is Out There

Kiniksa’s premium valuation and reliance on a single lead product expose investors to risk if growth targets or market shifts are missed.

If you’re seeking stocks with greater upside versus price paid, use our these 853 undervalued stocks based on cash flows to spot investments that offer stronger value relative to their fundamentals today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kiniksa Pharmaceuticals International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KNSA

Kiniksa Pharmaceuticals International

A biopharmaceutical company, developing and commercializing novel therapies for diseases with unmet need and focuses on cardiovascular indications worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives