- United States

- /

- Biotech

- /

- NasdaqGM:JANX

Janux Therapeutics (NASDAQ:JANX) Is In A Strong Position To Grow Its Business

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. Indeed, Janux Therapeutics (NASDAQ:JANX) stock is up 378% in the last year, providing strong gains for shareholders. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

In light of its strong share price run, we think now is a good time to investigate how risky Janux Therapeutics' cash burn is. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Janux Therapeutics

How Long Is Janux Therapeutics' Cash Runway?

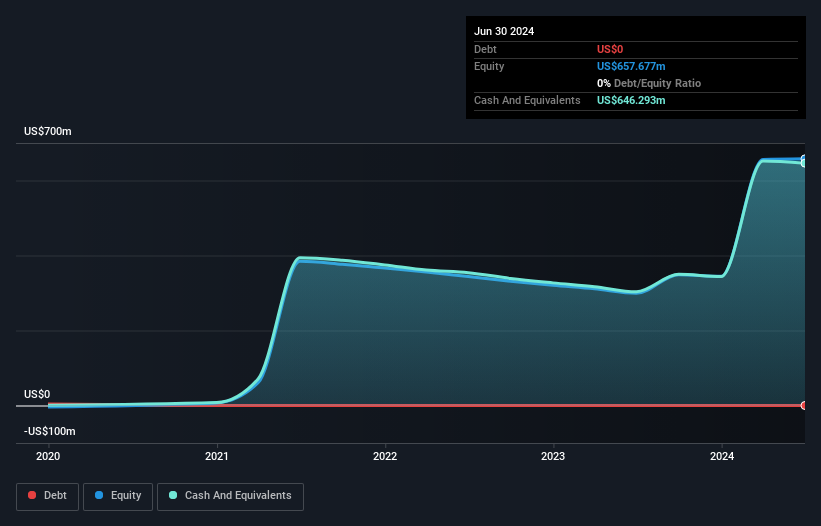

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Janux Therapeutics last reported its June 2024 balance sheet in August 2024, it had zero debt and cash worth US$646m. In the last year, its cash burn was US$48m. That means it had a cash runway of very many years as of June 2024. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. You can see how its cash balance has changed over time in the image below.

How Well Is Janux Therapeutics Growing?

It was fairly positive to see that Janux Therapeutics reduced its cash burn by 20% during the last year. And arguably the operating revenue growth of 95% was even more impressive. It seems to be growing nicely. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Janux Therapeutics Raise More Cash Easily?

There's no doubt Janux Therapeutics seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Janux Therapeutics' cash burn of US$48m is about 2.0% of its US$2.4b market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

So, Should We Worry About Janux Therapeutics' Cash Burn?

As you can probably tell by now, we're not too worried about Janux Therapeutics' cash burn. In particular, we think its revenue growth stands out as evidence that the company is well on top of its spending. Its weak point is its cash burn reduction, but even that wasn't too bad! After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. Taking a deeper dive, we've spotted 3 warning signs for Janux Therapeutics you should be aware of, and 1 of them is potentially serious.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies with significant insider holdings, and this list of stocks growth stocks (according to analyst forecasts)

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:JANX

Janux Therapeutics

A clinical stage biopharmaceutical company, develops immunotherapies based on Tumor Activated T Cell Engager (TRACTr) and Tumor Activated Immunomodulator (TRACIr) platforms technology to treat patients with cancer.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives