- United States

- /

- Pharma

- /

- NasdaqGS:ITCI

Intra-Cellular Therapies, Inc.'s (NASDAQ:ITCI) Price Is Out Of Tune With Revenues

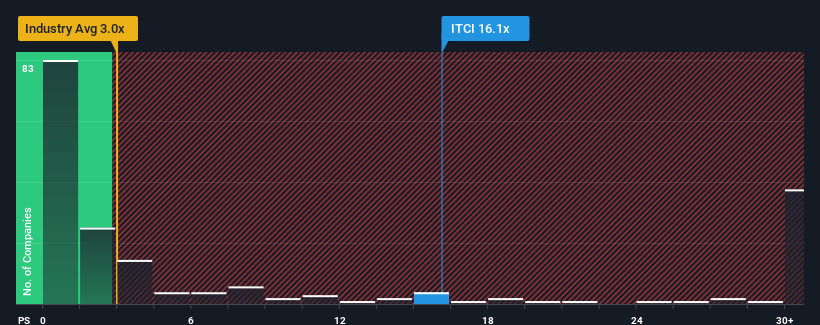

You may think that with a price-to-sales (or "P/S") ratio of 16.1x Intra-Cellular Therapies, Inc. (NASDAQ:ITCI) is a stock to avoid completely, seeing as almost half of all the Pharmaceuticals companies in the United States have P/S ratios under 3x and even P/S lower than 0.7x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Intra-Cellular Therapies

What Does Intra-Cellular Therapies' P/S Mean For Shareholders?

Recent times have been advantageous for Intra-Cellular Therapies as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Intra-Cellular Therapies' future stacks up against the industry? In that case, our free report is a great place to start.How Is Intra-Cellular Therapies' Revenue Growth Trending?

In order to justify its P/S ratio, Intra-Cellular Therapies would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 123%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 44% each year over the next three years. With the industry predicted to deliver 53% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Intra-Cellular Therapies is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Intra-Cellular Therapies' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Intra-Cellular Therapies, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Intra-Cellular Therapies, and understanding should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ITCI

Intra-Cellular Therapies

A biopharmaceutical company, focuses on the discovery, clinical development, and commercialization of small molecule drugs that address medical needs primarily in neuropsychiatric and neurological disorders by targeting intracellular signaling mechanisms in the central nervous system (CNS) in the United States.

Exceptional growth potential with excellent balance sheet.